Scenes from the June employment report: consumption leads employment, goods vs. services edition

Scenes from the June employment report: consumption leads employment, goods vs. services edition

– by New Deal democrat

No big new economic news today, so let’s take a more in-depth look at some of the information from Friday’s employment report. Today I’m going to focus on the division between goods and services.

As I’ve written many times in the past, consumption leads employment. Typically I have shown that via real retail sales. The variation I am going to use today is employing real personal spending on goods vs. services, and how consumption leads employment for each.

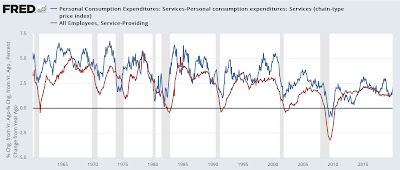

As a refresher, here is real personal spending on goods YoY (blue) vs. services (red), up until the pandemic:

Note that spending on goods is much more volatile than spending on services (in fact I’ve divided the result for goods by 1.5 so that services spending doesn’t just show up as squiggles). Most importantly, it tuns down YoY generally coincidently with the onset of recessions, whereas growth in services spending usually just decelerates. Also, while the two moved coincidently from 1960-90, since then spending on goods has usually led spending on services somewhat.

Here’s the same information since the pandemic (omitting the year of huge distortions):

Goods spending did fall below zero during much of 2022, and is only slightly above zero YoY now, while spending on services is much stronger.

Now let’s compare real spending on goods (blue) with employment in the goods sector (red) YoY, pre-pandemic:

With two exceptions (the mid 1980’s and late 1990’s) goods consumption leads goods employment. Note that this holds true even though due to globalization and offshoring, goods employment never rose nearly as much as goods consumption beginning with the 1980’s.

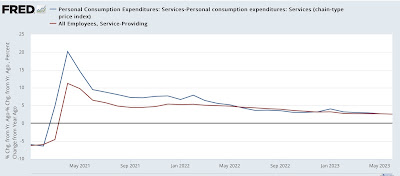

The same leading/lagging relationship holds true for consumption of services (blue) vs. employment in services (red):

Now let’s look at each post-pandemic. First, here is goods consumption vs. employment:

Goods spending recently peaked YoY in summer 2021, while as we should expect based on past history, goods employment did not peak until spring 2022. Goods spending rebounded somewhat as spending power increased with the decline in gas prices from $5 to $3/gallon in late 2022. Goods employment is still decelerating, and is only up 0.3% since February, or roughly at a 1% annual rate.

Here is services consumption vs. employment:

Both consumption and employment in the services sector have been much stronger than in the goods sector, and while both have been decelerating since the spring 2021 stimulus spree, consumption has decelerated faster compared with late 2021.

Since gas prices have been pretty stable this year, the tailwind for goods spending is subsiding. I expect goods spending to decelerate further YoY, and probably turn negative again, with goods employment following. My best guess is this will occur by the end of this year, possibly earlier.

As per past history, the deceleration in both consumption and employment in the goods sector is likely to be slower, but will follow goods spending and employment with lower growth if not an outright decline.

Real wage growth leads spending; meaning spending seems likely to stall after an increase over the next few months, Angry Bear, New Deal democrat

Totally off-topic, needs posting (IMO.)

Democrats Try a Novel Tactic to Revive the Equal Rights Amendment

NY Times – July 13

Proponents of the measure to enshrine a guarantee of sex equality into the Constitution are using a creative legal theory to try to resurrect the long-stalled amendment.

… Senator Kirsten Gillibrand of New York and Representative Cori Bush of Missouri are set to introduce a joint resolution on Thursday stating that the measure has already been ratified and is enforceable as the 28th Amendment to the Constitution. The resolution states that the national archivist, who is responsible for the certification and publication of constitutional amendments, must immediately do so.

It is a novel tactic for pursuing a measure that was first proposed in Congress 100 years ago and was approved by Congress about 50 years later but not ratified in time to be added to the Constitution. Proponents say the amendment has taken on new significance after the Supreme Court’s ruling last year in Dobbs v. Jackson Women’s Health Organization that overturned the abortion rights long guaranteed by Roe v. Wade. …

… Russ Feingold, the former Wisconsin senator who serves as president of the American Constitution Society, said he supported the Democrats’ new strategy.

“For the institution that actually put this limitation of the deadline on to say, ‘Actually, it doesn’t matter’ really is significant,” Mr. Feingold said. “The White House and members of Congress are beginning to see that credible legal scholars are saying this is already part of the Constitution.”

There is nothing straightforward or clear about the constitutional amendment process, and legal experts said that each of the Constitution’s amendments have taken a unique path to ratification. The 27th Amendment, which states that members of Congress cannot raise or lower their salaries in the middle of their terms, languished for more than 200 years before it was ratified. …

… While almost 80 percent of Americans supported adding the Equal Rights Amendment to the Constitution in a 2020 Pew Research Center poll, there is little chance that the effort will draw the 60 votes necessary to overcome a Republican filibuster in the Senate. But the Democrats’ push is their latest effort to spotlight G.O.P. opposition to social policy measures with broad voter approval, and to call attention to the party’s hostility to abortion rights, which hurt Republicans in the midterm elections.

“This is a political rather than a legal struggle,” said Laurence Tribe, the constitutional scholar and professor emeritus at Harvard Law School. “It would succeed only in a different environment than we have. It’s not going to pass. The real question is what political message is being sent. In a political environment like this, you throw at the wall whatever you can.”

This is Democrats’ second attempt this year to advance the Equal Rights Amendment; in April, Senate Republicans blocked a similar resolution that sought to remove an expired deadline for states to ratify the amendment. Only two Republican senators, Lisa Murkowski of Alaska and Susan Collins of Maine, voted for the resolution. …

… There is nothing straightforward or clear about the constitutional amendment process, and legal experts said that each of the Constitution’s amendments have taken a unique path to ratification. The 27th Amendment, which states that members of Congress cannot raise or lower their salaries in the middle of their terms, languished for more than 200 years before it was ratified. …

There are said to be 8 (or 9?) GOP senators who are women. You can suppose that would be enough to make difference, but evidently not.