Real wage growth leads spending; meaning spending seems likely to stall after an increase over the next few months

Real wage growth leads spending; meaning spending seems likely to stall after an increase over the next few months

– by New Deal democrat

No big economic news today, so I wanted to pick up on a subject I began a week ago Monday; namely, taking a detailed look at personal spending, i.e., consumption. To put it in more socially relevant terms, what allows average American households to spend more, or to cut back? And what are its ramifications for the economy as a whole?

Last week I discussed how real personal spending is a coincident indicator, but real spending on services almost never declined, even during recessions. Rather, it simply increased at a decelerated pace. Personal spending on goods, on the other hand, has been a legitimate if weak short leading indicator. And personal spending on goods, over time, has closely tracked with retail sales. The difference between the “real” measures of the two has boiled down to different inflation measures.

Many times in the past 15 years I’ve repeated the mantra that consumption leads hiring, not visa versa. It is the increase or decrease in demand that causes companies to add or lay off staff. But the reverse is not true. This week I want to focus on, “what leads consumption?” Particularly as it relates to the leading measure of spending on consumer goods.

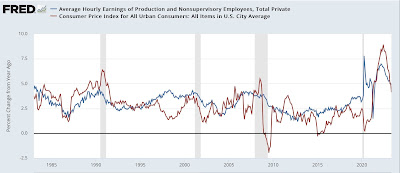

The beginning point is that prices are more volatile than wages. To put it another way, as some economists do, wages are “stickier.” Here’s a long term graph of the YoY% change in consumer prices (red) vs. wages for nonsupervisory workers (blue) over the past 40 years:

In the 35+ years between the onset of the more modern economic era in 1983 and the pandemic, YoY prices varied between a peak of +6.4% in 1990 and a low of -2.0% at the end of the Great Recession. By contrast, wages were much less volatile, varying between a peak of +4.8% at the beginning of 1983 and a low of +1.9% in 1987. Incidentally, the same volatility holds true since the beginning of the wage series in 1964 through 1982, shown below:

In general, expansions start when inflation is significantly less than wage gains (and interest rates are generally lower). The vast mass of people who are still employed find that their money goes further. There are some compellling bargains for purchases they would like to make. This generates more demand, and so more production and more hiring. The expansion is underway.

Later, the increase in demand causes commodity, producer, and consumer prices to increase at an increasing rate, usually outpacing wage gains. Typically interest rates have also increased. Consumers cut back, and as this is noticed by producers, production and employment follow down as well. A recession begins, prices retreat, and we back to the beginning of a new cycle.

The two exceptions (the mid-1980s and right after the pandemic) were the times that a lag in wage growth was swamped by a big increase in the labor force, i..e, household earnings grew. In the former, it was women joining the workforce; in the latter, it was the opening of leisure and hospitality establishments after pandemic closures.

Which leads us to the most important leading indicator for consumption I have found: in general, real wages lead real spending on goods. Over the 50+ years leading up to the pandemic, an increase in real hourly wages (i.e., adjusted for inflation) leads to an increase a few months later in real spending on goods. Similarly, a decrease in real hourly wages has led to a decrease in real spending on goods with several months’ delay:

Not perfect (see, e.g., the early 2000s), but generally the direction (and frequently but definitely not always a similar amplitude) of real spending on consumer goods has followed the direction of real wages with some months’ delay.

Here is the same data since July 2021 (avoiding the lockdown and stimulus distortions):

In other words, we should expect YoY improvement to continue in real spending on goods over the next few months. Here’s what the absolute level of such spending looks like:

Beyond that, I am not sure at all that the increase continues. That’s because, as the superheated jobs market has cooled, average hourly wage growth has decelerated, and that can be expected to continue. But once we get past June, inflation will be measured against the steep decline in energy prices of the 2nd half of 2022:

As shown above, since the peak in energy prices last June, energy has been a bigger determinant of the direction of monthly inflation vs. shelter. If it continues to be the case, then gradually increasing energy prices are likely to at least be an equal determinant to the badly lagging almost certain deceleration in shelter prices. Stabilizing inflation vs. decelerating wage increases would mean decelerating or even declining real wages. Which, per the above, will lead to stalling or declining real spending on consumer goods; and in turn, further deceleration to, and maybe a complete stall in hiring.

The un(der)employment rate leads wage growth: 2023 update, Angry Bear, New Deal democrat

It’s sort of amazing that economics has to jump through hoops to come up with the obvious. Yes, people have to have more money to spend more. Yes, businesses have to be making more money to justify hiring more people.