Why the public still views inflation as a major problem, despite the official numbers

Why the public still views inflation as a major problem, despite the official numbers

– by New Deal democrat

This is the topic I indicated last week I wanted to write about more at length. Paul Krugman wrote last week about the disconnect between most economists, who see inflation declining, and voters, who still see inflation as a major concern. Here’s a couple of his tweets:

As I wrote last week, the “shrinkflation” in new homes is very much a part of why the public continues to believe that inflation remains a big problem. So let me elaborate a little more.

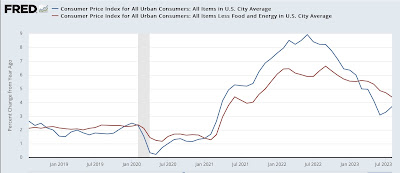

As an initial matter, Krugman is absolutely correct that the official measures of inflation are abating, as shown in the below graph of YoY headline and core inflation:

More importantly, when we eliminated fictitious shelter inflation, everything else has risen only 1.0% YoY. And measured by home prices, as we saw yesterday, shelter prices have only risen about 1% YoY as well:

So “inflation” as economists look at it, i.e., the change in prices, is clearly abating.

But consumers don’t just look at price changes like the above, or even price changes as compared with wages. Because there are at least two big expenses – houses and cars – that aren’t just purchased out of pocket, but rely on changes in wealth as well.

And that I suspect is where voters’ perceptions are coming from.

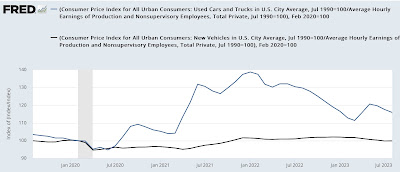

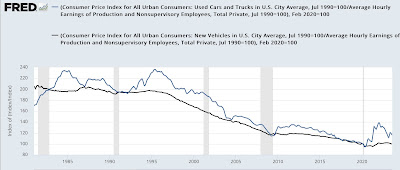

For example, when we look at the prices of new and used vehicles compared with wages, we see that new cars cost no more compared with wages than they did before the pandemic. Both have increased by about 20%; and indeed the long term view shows that new vehicles cost less than they typically did as a share of wages over the past 30 years. Used vehicles, on the other hand, still do cost about 15% more:

But most people finance their vehicle purchases. And interest rates on vehicle loans have risen from roughly 5% to 7.5%:

So the monthly payment for a new car is about 50% higher than it was before the pandemic, and for a used vehicle it’s about 80% higher (1.2*1.5). If I am calculating my monthly car payment in how I look at inflation, that’s a big increase.

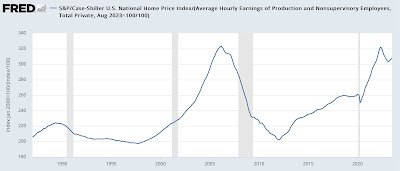

The situation is even more stark when it comes to housing. Compared with wages, house prices are still 15% higher than they were before the pandemic:

On top of that, as I wrote yesterday, mortgage rates at 7.5% are now 2.5* higher than they were at 3%. So the total monthly payment for a new house is nearly 3x as much as it was in 2019.

In other words, to summarize: the two biggest purchases made by most people have gone up about 80% and 200%, respectively. From the viewpoint of their monthly payment, inflation is a huge problem – despite officially rising less than 3%.

Big Picture Summary Inflation and Housing, Angry Bear, New Deal Democrat

That should have been completely obvious. Economic analysis seems to completely ignore the obvious in favor or obscure or irrelevant. People spend more on housing than just about anything else, so that’s going to be a big factor of their perception of inflation even if they are not at the time in the market for a new place to live. They are also going to look at the cost, as you note, including the cost of money. Most people cannot afford to buy a house in an all cash transaction.

Kaleberg:

I see much of this around Phoenix, AZ. Flashy large house and, a noisy Charger, Mustang, Challenger, or a noisy pickup truck with the big tires and the cheese grater front end. They all complain about gasoline prices and drive too fast to be efficient (if there were a chance of such.

“Vanity My Favor Sin . . .”

@Bill,

Not to mention all the folks who sit in their massive SUVs idling in the summer or winter with the heat or air conditioning on outside stores.

Joel:

The too big, too often, too fast crowd. PS: And too noisy. They are really in beed of growing up down here in AZ.

People are upset by high prices and if those prices don’t come back down to what they think of as proper then they use the word “inflation” whether or not the rate of increase slowed or stopped over a certain period, if that period is shorter than their sense of anger and alarm. The high price of crescent rolls likely will be a sore spot for a couple years, even if the huge ramp up in price ended 5 months ago. Low reported inflation, high disgust with prices.

Eric:

As I have spouted any number of times since 2008, supply chain is a critical factor to prices and somewhat to costs. The book “The Goal” is really readable for most people and it discusses what companies should be doing to meet demand. But what if they do not want to meet demand? The result is exactly what you are seeing today. Was there a lack of supply or was it contrived? In the beginning, yes. Later on, not so much. Planned inventory, restricting the amount on the market will drive pricings. We saw this in 2008 with semiconductors which take a while to manufacture.

One other issue is a pile-on. Companies have a tendency to order way more than they need in the near term. They force a priority. Manufacturer has capacity only for so many. It can go to other means to meet demand which “may” be more costly (The Goal). It makes sense to bring on more capacity even if inefficient and the costs are less than the pricing to meet demand.

Talk to the companies . . . they control supply.

It will take a while before the fact that this is the new normal sinks in. Even if the prices start going down, they have to go a long way to get back to what people remember as normal.

Jane:

I believe you are correct. Expectations are unforgiving. They also seem to forgive what 2008 was like and what could have reoccurred in 2020.

I believe the interest costs are part of the story as to the perception of inflation. Within that, so what if wages kept pace with rising costs (excluding interest), all it means is the person stayed even while hearing how good things are? If things are good, then why do I still have nothing left over? That’s I believe is part of the perception.

At the same time, the media is pushing the inflation fear/hurt button all the time. It’s all people hear especially from 1 side of the isle. Plus, they see more automation as they check out, they can’t get a real person on the phone, and they hear how wonderful the profits are for the corporations they are interacting with. They aren’t feeling the benefits of cutting labor coming back at them. All they feel is a colder interaction.

Today, listening to my local NPR, they have on a Prof Jonathan Gruber (MIT no less) said all the economist are expecting inflation to rise going forward. He expects Powell will do the right thing. That was not enough though. He then got on the national debt band wagon. It’s terrible and did you know in 75 year it will be $65 trillion! The hosts were impressed. Their response was as if they were told of a ticking time bomb, which is exactly how Gruber presented it.

What do you think all the people listening immediately thought when they heard that 75 years from now the debt will be $65 trillion? Did they think: Yeah, and how big will our economy have grown in 75 years? And how much more will this nation be worth in 75 years? The host sure didn’t. Oh, and of course Gruber said we have to cut spending.

Why do people think things are bad? Because that’s what they experience in multiple ways.

Daniel:

I have not found a link for it. There are ~ 100+ trillion dollars floating around globally amongst countries. Countries hold dollars as it is the safest currency globally. Trade globally is mostly done with US dollars. Because it is a currency held globally, we can print dollars to fund domestic needs.