Vehicle sales, residential, and manufacturing plant construction

Vehicle sales and residential and manufacturing plant construction continue to outweigh general manufacturing downturn

– by New Deal democrat

No important economic news today, but on Friday in addition to the employment report we did get our typical 1st of the month snapshot of manufacturing, vehicle sales, and construction, so let’s look at each.

The ISM manufacturing index has had an excellent record going all the way back to the 1940s, but it has one drawback which is that it is a diffusion index, so if 90% of manufacturing is in slight decline, but 10% is going gangbusters, it will not accurately reflect the overall situation.

And that exception is probably the case now.

For the past year, the new orders subindex has been below 50, indicating contraction. The overall index joined several months later. Last month in August, they were both still in contraction, although slightly “less worse” than in July:

The readings all this year and even at the end of last year frankly indicated recession. And yet, here we are, with no recession.

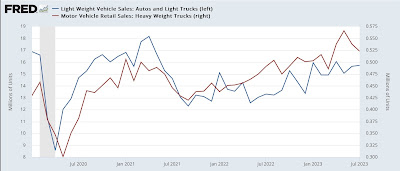

The reason why can probably be found in the next two graphs, which are light vehicle sales (blue) vs. heavy truck sales (red, right scale), which report was also released on Friday.. First, here’s the historical look:

These have always turned down in advance of recessions. In particular, heavy truck sales have turned down generally well in advance, and with much less noise.

Here is the current look:

Light vehicle sales have not turned down at all. Heavy truck sales have declined from their peak in the past two months, but are still above any other month during this expansion up until May of this year. I would need heavy truck sales to turn below 500,000 annualized (.500 on the right scale in the graph) before I would consider the downturn true signal.

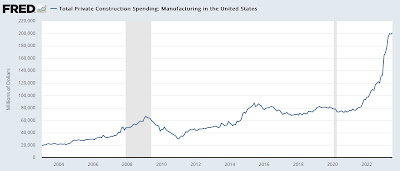

Further support for why the general downturn in manufacturing has not manifested in a recession comes from the construction spending report for July which was also released on Friday.

Construction spending on manufacturing plants, subsidized by last year’s Inflation Reduction Act, has stabilized, but at a level 50% above any previous amount before 12 months ago:

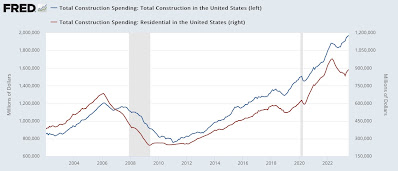

Both total construction spending and spending on construction of residences also increased nominally, the former to yet another all-time high, the latter continuing its rebound from last winter:

Deflated by the cost of construction materials, residential construction spending still rose, to about the mid-point of its post-pandemic average:

Until we see the vehicle manufacturing and residential construction sectors roll over, we almost certainly are not looking at any economic downturn.

Manufacturing and construction give very mixed signals to start Second Half 2023 data, Angry Bear, New Deal democrat

China Is Flooding the World With Cars

NY Times – September 6

Even as China’s other exports falter, its carmakers are seeing big increases in overseas sales, mainly for gasoline-powered models.