July mfg. and June constr. spending: leading components of both are negative

Quick note; “ISM metric strongly suggests that it is likely that the economy will enter recession no later than Q1 of next year, and possibly much sooner (but probably not now). more detail below

July manufacturing and June construction spending: leading components of both are negative

– by New Deal democrat

As usual, the new month’s first data is for manufacturing and construction. Here’s a look at each.

The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. In July, for the second month in a row, the leading new orders index showed slight contraction, declining -1.2 from 49.2 to 48.0. The overall index – and all the other components, such as supplier deliveries, continued to show expansion, but also declined from 53.0 to 52.8:

This index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three cases did not actually cross the line until the first month of the recession itself – although the recession did not begin until after the total index fell below 50, and in fact usually below 48.

In other words, this metric strongly suggests that it is likely that the economy will enter recession no later than Q1 of next year, and possibly much sooner (but probably not now).

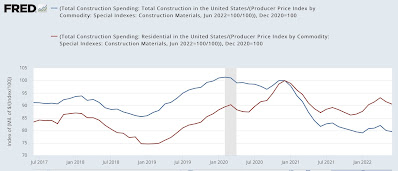

Meanwhile, construction spending declined – 1.1% in nominal terms in June, while May was revised up slightly to +0.1%. The more leading residential sector declined -1.6%, although May was revised sharply higher, from -0.1% to +0.8%:

YoY nominally total construction is up +8.3% (down from +11.7% in February of this year) and residential construction is up +15.4% (down from +34% one year ago).

Adjusting for price changes in construction materials, which declined -0.6% for the month, “real” construction spending declined -0.5% m/m, and residential spending fell -1.0% m/m. Thus in absolute terms, since December 2020, “real” construction spending has declined by -20.4%, while “real” residential construction spending has declined -9.5%:

The decline in residential construction spending, while substantial, is less than its 2018-19 decline, and was nowhere near the -40.1% decline it suffered before the end of 2007.

For the past few months I have been making the point that “it takes awhile for the downturn in mortgage applications, sales, and permits to filter through into actual construction, especially with record numbers of housing units permitted but not yet started.” In the past two months, it appears that has happened.

In sum, both reports – for manufacturing and construction – are negatives going forward.

i wonder just how much the supply chain crash has impacted this. and given the standard manufacturing process today, which is designed to only have on hand enough parts on hand for a day’s production (as an ideal), if some parts are short, production is impacted, new orders will also be impacted. its a wonder that any data regarding manufacturing hasnt been negative for months on end