September producer prices confirm economic tailwind has ended

September producer prices confirm economic tailwind has ended

– by New Deal democrat

My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. For the last several months, my focus has been whether that decline is over.

This morning’s producer price report added more evidence that indeed producer prices have bottomed.

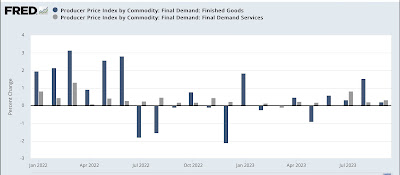

Commodity prices increased 0.5% in September:

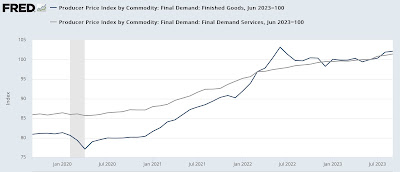

They are up 1.9% since June:

The Final demand prices for goods (blue) increased 0.2%, and final demand services prices (gray) increased 0.3% for the month:

Final demand goods prices are up 2.1% since June. Final demand prices for services are up 1.4%:

This returns to the more normal situation with producer and commodity prices. Historically, as seen in this 100-year graph of commodity prices YoY, typically there are big declines during recessions. This reflects a decline in demand:

But if you focus on more recent declines since the 1980s, you can see a number of incidents – 1986, 1997-98, and 2014-15 – where the big declines in commodity prices were dominated by declining gas prices, which put more money in consumers’ pockets to spend on other things. In all of these cases, there was no recession.

The nearly 10% decline in commodity prices between June 2022 and June 2023 was the biggest 12 month decline yet driven by lower gas prices, as well as the un-kinking of pandemic-related supply chains. Except for the very unlikely scenario that current geopolitical events drive a further decline in gas prices, that is almost certainly over.

This is probably going to be reflected in tomorrow’s report on consumer prices as well. Remember, if consumer inflation simply stops decelerating, it will lessen the gap between prices and aggregate consumer income, meaning slower economic growth at least.

Economic tailwind from falling commodity prices has likely ended, Angry Bear, New Deal democrat.

Gasoline, food drive US producer prices higher …

(BUT, ‘core inflation cools’.)

Reuters – Oct 11

Federal Reserve Officials Were Cautious in September

NY Times – Oct 11

See also…

Investors Are Calling It: The Federal Reserve May Be Done Raising Rates

NY Times – Oct 11

But wait …

September Inflation Report – Inflation Holds Steady

NY Times – just in

Consumer prices rose 3.7 percent in the year through September. There were some optimistic details in the report, but the path to fully wrangling inflation remains long and bumpy.

What was the toughest year of the US depression in 1930s?

At the height of the US Depression in 1933, 24.9% of the nation’s total work force, 12,830,000 people, were unemployed. Wage income for workers lucky enough to have kept their jobs fell 42.5% between 1929 and 1933. It was the worst economic disaster in American history.

The US equities market nadired 8 July 1932. The zero sum game then rebounded as the winners reentered the equity market. This market nadir was not the working masses’s real economic nadir which occurred the following year.

A similar market nadir prospect and later real economic nadir can be expected for the Chinese 2020’s current manufacturing behemoth, whose working population has malinvested in a collapsing real estate market worth 48 trillion in US equivalent dollars in 2020.

The current working quantitative mathematical fractal model is a final lower lower high peak on Friday 22 October 2023. This is the 2x (104th day) of a 13 March 2023 52/104 day subfractal 1 and subfractal 2 series. (See last paragraph of the 2005 main page of The Economic Fractalist). This is day 3 of a 3 October 2023 4/9/3 of 8 day ::x/2-2.5x/2x decays series.

Black Monday would occur on 25 October 2023 with a final interim low on day 130 of the 13 March 2023 x/2.5x :: 52/130 day series.

A 13 March 2023 52/130/130/78 day :: x/2.5x/2.5x/1.5x fractal series could be the equivalent of the 8 July 1932 DJIA nadir.

The quantum fractal blow-off peak valuation, as described in The Economic Fractalist posted 8 October 2023, for US long term sovereign interest rates occurring on 6 October 2023 remains intact.

Urban Survival

Gary:

Are you George or are you Gary? I have to take exception to this method of replying. You may link to a source of your comment if it is a copy and paste. No problem there. The way you had it, I have an issue with doing it in this manner.

Thank you . . .

NDd:

If anything, I would keep gasoline prices high. I still do not see people driving slower or less than they need to. It is still a free-for-all on US highways. If we lower it too much, it becomes a greater impact. Use the excess prices increases to fill the salt mine reserves.

the producer prices report from the Bureau of Labor Statistics differs significantly from what the FRED graphs show.

for instance, prices for “Unprocessed goods for intermediate demand”, which includes wheat, corn, crude oil, iron ore, and other commodities, were up 4.0% in September after rising 2.1% in August and 2.4% in July…

most other metrics are quite different as well..

here’s the bls report: https://www.bls.gov/news.release/ppi.nr0.htm

also access the links at the bottom of the release for more details..

as you know, i have also covered this report for years, & i haven’t been able to figure out what those FRED graphs are actually showing..