The Budget Deficit is an absurd calculation

The budget deficit is the change in the nominal face value of public debt. It is roughly unique (as far as I know) being the change in a quantity which is not corrected for inflation. We do not usually talk about nominal GDP growth or nominal wage growth. The sustainable deficit increases one for one in debt*inflation, so the term should be removed if one is thinking of long term sustainability.

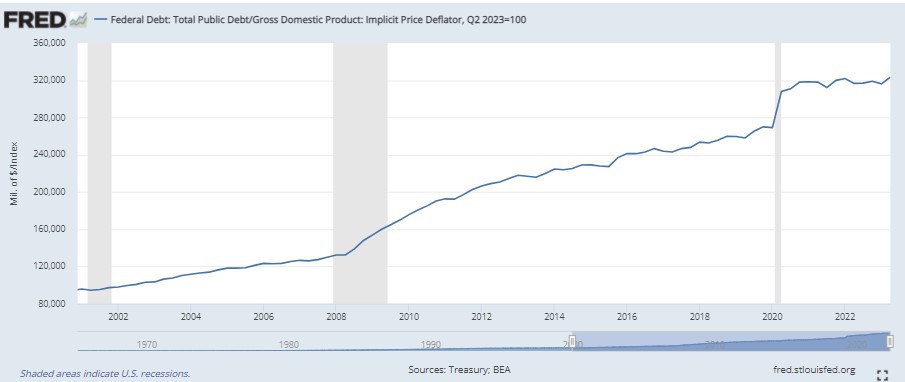

I think the reason the absurd number is used is that it is high, so deficit hawks, deficit peacocks, and very serious people like it. Here is the value of US Federal Government debt in 2nd quarter 2023 dollars (deflated with the GDP deflator)

Notice that it used to increase then ceased to increase abouit exactly when Joeseph Biden was inaugurated. This is a much more relevant series than the nominal debt (do we focus on nominal anything else — at all ?). I was surprised to see this graph. Why ?

I think one thing is that it is not at all alarming – so very serious people don’t discuss it. Even more importantly, it shows that the US Federal Government can, in fact, inflate away its debts. THere are long term Treasuries owned by private investors. An increase in inflation causes an increase in nominal interest rates, that is a decrease in the market price of those treasury bonds notes and bills. This causes a capital loss for the investors (some of which were banks which then went bankrupt). It does not affect the debt (face value of the treasury securities) or interest paid on that debt (coupons fixed in dollars).

Expected inflation is neutral (it reduces the amount the Treasury gets when it auctions bonds so the real cost of borrowing for the Treasury remains the same. Unexpected inflation is windfall for the Treasury and a loss for those who bought expecting low inflation. This fact is unmentionable — even considering the possibility of inflating away debt is an unforgivable sin in the very serious village.

I guess another explanation is politics. It doesn’t do to say that sure the deficit is high but so is inflation so it’s OK. Both budget deficits and (especially) inflation are hated. Back in the 70s when I was a kid, I didn’t understand why people hated inflation or accepted a severe recession as a cure. I still don’t (effort to understand in another post).

Here is the annual change in the real debt (in 2023 Q2 dollars deflated with the GDP deflator)

Notice it is only negative under budget bills signed by Joe Biden or Bill Clinton.

The really important (and actually often discussed) variable is the ratio of the debt to GDP. This really determines sustainability — for the taxman it doesn’t matter whether GDP increases due to inflation or real GDP growth. However, the next amazing figure is not well known either (it is available on FRED without any work required)

Note it declined when CLinton was President and when Biden was president. The recent decline from over 134.83% to less than 120.65% is basically unprecedented. It is also almost entirely unmentioned. The fact that Treasuries can inflate away their debt is unmentionable. The drop is partly due to inflation — real GDP increased a lot from the Covid trough, but the percent increase in nominal GDP was, of course, dramatically greater.

Clearly the main debt sustainability action is inflation (nominal/real) not the hugely important change in real GDP.

Now there is supposed to be a cost of inflating away debt with a surprising burst of inflation. The cost is it causes higher expected inflation which, if matched by actual inflation, provides no more help to the Treasury and is costly … for some reason which no one has ever explained to me. However, in the recent case, expected inflation remains low, so what’s the problem ? Of course investors lost (I think including me) but people who own a lot of treasuries can afford it. Some banks had to be rescued but it was not a huge problem.

So why do I hear about the deficit being a problem?

Thanks. One area to consider though is the future of energy and its impact on this. I sense a kind of double transition happening now: from carbon based energy to “clean” but also increasing discussions that energy consumption – regardless of source – needs to come down, and possibly quite a bit. There has to be some very low-hanging fruit of energy savings, but most of what green advocates think of as irresponsible still is generating GDP the same way more responsible energy use does. So what happens to GDP referenced debt levels if per capita energy moves down? I don’t know, but should be looked at.

Eric

essentially nothing. all GDP measures is the money value of what is produced. you could put a money value on chinese fortune cookies, convince people to buy a lot of them and GDP would soar. Thinking you get “rich” because GDP goes up is an illusion.

We might find it a little harder to do some things if we burn less gas or use less “clean” electricity but there is no need for our real “wealth” and personal happiness to be less.

I could have said “cocaine” instead of fortune cookies and you might understand this better.

coberly, while GDP has a nominal money value, the change in GDP which we cite every month is not a monetary value, it’s the change in the quantity of things and services our economy produced….by adjusting for inflation, we’re counting beans, not dollars..

Waldmann

I think you answered your question. Both inflation and the budget deficit/ national debt “hurt” the rich. Note “I think”, I do not know. I hope you will continue to explain this stuff to the rest of us. I don’t think it can be explained all at once. Even simple things (like Social Security) are hard to explain “at once.”

Committee For a Responsible Federal Budget (CRFB) had a paper out today, seeming to extol a proposal by “President Trump” to impose a 10% tax on all imports. I did not read it all the way through, because my experience with CRFB has lead me to expect literal nonsense or clever lies. But as far as I got i did not see any serious consideration of all the “unexpected consequences” that might follow from such a tax (unexpected because no one asked). I don’t think it matters much. No such tax will be enacted. But such papers by CRFB and others provide an opportunity for better…more honest…discussion of debt/deficit, which I hope you and others will provide.

And maybe the very serious people will take note.

“So why do I hear about the deficit being a problem?”

Mostly as a justification to cut social spending. The claim is that otherwise, the US is on the brink of hyperinflation. The US debt/GDP ratio is 123%. Japan’s debt/GDP ratio is 224%, and they don’t have hyperinflation. This isn’t about economics, this is about politics.

Joel

Thank you. I might have said that myself.

But in case there are any MMY-ers listening, MMT would not solve the problem. Under an MMT rationalization something would replace “the debt” as a excuse to not spend on social needs and not tax the rich even to pay for the benefits they get Congress to vote for…thins that make them richer.

“Japan’s debt/GDP ratio is 224%, and they don’t have hyperinflation….”

Notice though that the real value of the Yen has decreased by 54.4% since 2000:

https://fred.stlouisfed.org/graph/?g=PXdD

January 15, 2018

Real Broad Effective Exchange Rate for United Kingdom, Euro Area, United States and Japan, 2000-2023

(Indexed to 2000)

@ltr,

“Notice though that the real value of the Yen has decreased by 54.4% since 2000″

A decline of the real value of the yen by 54.4% in 23 years hardly qualifies as hyperinflation.

Notice that I didn’t say that Japan’s economy is ideal. There are many reasons for that, but the debt/GDP ratio and/or hyperinflation are not among them.

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924,134,534,158,111,&s=GGXWDG_NGDP,&sy=2000&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Government gross debt as percent of GDP for China, Germany, India, Japan and United States, 2000-2022

2000

Japan ( 136)

2022

Japan ( 261)

“Japan’s debt/GDP ratio is 224%, and they don’t have hyperinflation….”

Notice though that the real value of the Yen has decreased by 54.4% since 2000:

https://fred.stlouisfed.org/graph/?g=ouvH

January 15, 2018

Real Broad Effective Exchange Rate for Japan and United States, 2000-2023

(Indexed to 2000)

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924,134,534,158,111,&s=GGXWDG_NGDP,&sy=2000&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Government gross debt as percent of GDP for China, Germany, India, Japan and United States, 2017-2022

2017

China ( 55)

Germany ( 65)

India ( 70)

Japan ( 231)

United States ( 106)

2018

China ( 57)

Germany ( 62)

India ( 70)

Japan ( 232)

United States ( 107)

2019

China ( 60)

Germany ( 59)

India ( 75)

Japan ( 236)

United States ( 109)

2020

China ( 70)

Germany ( 68)

India ( 89)

Japan ( 259)

United States ( 133)

2021

China ( 72)

Germany ( 69)

India ( 85)

Japan ( 255)

United States ( 126)

2022

China ( 77)

Germany ( 67)

India ( 83)

Japan ( 261)

United States ( 122)

ltr:

I believe you just made one of Robert’s points.

ltr

i think you may be missing the point. the japanese people do not seem to be particularly worried about their economy…at least that was true years ago when japan went from being a model of progress for us to being a horrible example of economic mismanagement.

the value of the yen, or the dollar, is simply a number. prices adjust themselves, and i don’t think the Japanese are paticularly interested in buying American cars.

“The Japanese’s people do not seem to be particularly worried about their economy…”

Actually, the Japanese are worried about their economy and have been so. The relative lack of growth since 2000 is dramatic:

https://fred.stlouisfed.org/graph/?g=18Mc0

August 4, 2014

Real per capita Gross Domestic Product for China, India, Japan and Korea, 2000-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=18Mc6

August 4, 2014

Real per capita Gross Domestic Product for China, India, Japan and Korea, 2000-2022

(Indexed to 2000)

The deficit is only a problem when a Democrat is in office and might spend money on making things better for the average Joe as opposed to spending money on tax cuts for billionaires.

Kaleberg:

Very true!

Dems have less of a problem with deficits than the GOP does, except the GOP usually does not object to excessive defense spending, just to social spending. Now they will also be object to further aid to Ukraine, evidently.

Centrist Dems have a tendency towards ‘concern’ over deficits. More so for defnse related spending however. Tension rises from this no doubt.

The Japanese economy is kind of weird. One big difference is that real estate is a depreciable asset. I remember the 1980s when Japanese real estate prices were going insane. There was talk of multi-generation mortgages being needed to buy a home in Tokyo. I knew that the boom had ended, but there was an editorial in the New York Times (see website link) pointing out that Japan basically built its way out of it. They don’t have the same zoning laws most of the world lives with, so Tokyo has grown larger and denser. This has kept real estate prices affordable. It might cost more to live in Tokyo that some smaller city, but one can still rent an apartment on a convenience store clerk’s salary. It also means that one can start a small business and survive comfortably on relatively low volume. That’s why Tokyo and other Japanese cities are full of small businesses, not every landlord is holding out for a national chain store or a bank.

How does this affect GDP? How does this structural difference change the way real estate prices influence inflation? Japan doesn’t have a lot of control over energy prices, but it made a decision to control real estate prices and medical costs. Those are the big three drivers of consumer inflation in much of the world.

It makes one wonder whether a declining population might unleash innovative forces by lowering real estate prices. That could explain the antipathy of the wealthy for stable or falling populations.

Really interesting and helpful comment.

ltr

i will defer to Kaleberg; he knows more than I do. But I hope you realize his comment appears to be agreeing with mine. My comment that the Japanese did not seem to be especially worried about their economy remains. It is not refuted by your assertion that they are. I simply don’t know what current Japanese “experts” are worried about, but when my daughter was a student in Japan she said that the people did not seem worried. Other posters here have suggested why they might not be. I would suggest that their culture does not seem to encourage worship of “consumption” the way ours does, and if their needs are met (housing, food, health care) they don’t get hysterical about “growth,” especially not the kind of growth we have in America were millions of people live on the streets and can’t afford health care, and the rich get obscenely rich.

Toyota, a Hybrid Pioneer, Struggles to Master Electric Vehicles

NY Times – Sep 9

The world’s largest carmaker dominates the sales of hybrid cars but has been slow to sell all-electric vehicles, alienating some customers and hurting sales.

Last I heard Japan chose to not be on the electric vehicle bandwagon, or at least Toyoda did, perhaps for the same reason I got off it.

[ Please try to write with more care, since I have difficulty reading a comment otherwise.

Perhaps this is correct, but I know of no evidence that Japan has given over growth and every evidence that Japanese policy has been as self-defeating as that of Italy since 2000. ]

Toyota wants to go with hyydrogen-powered vehicles.

New Toyota CEO Still Wants To Prioritize Hydrogen Over BEVs

Toyota’s new CEO, Koji Sato, believes hydrogen is the way forward when it comes to carbon neutrality. While virtually every other automaker on the planet is focusing solely on battery electric vehicles, Sato reckons hydrogen will be the backbone of the Japanese marque’s future. …

Last I heard Japan chose to not be on the electric vehicle bandwagon, or at least Toyoda did, perhaps for the same reason I got off it.

[ I will consider this carefully from here, though I am unconvinced.

Thank you for this argument. ]

https://www.nytimes.com/2023/09/11/opinion/editorials/tokyo-housing.html

September 11, 2023

The Big City Where Housing Is Still Affordable

By Binyamin Appelbaum

Photographs by Andrew Faulk

Yuta Yamasaki and his wife moved from southern Japan to Tokyo a decade ago because job prospects were better in the big city. They now have three sons — ages 10, 8 and 6 — and they are looking for a larger place to live. But Mr. Yamasaki, who runs a gelato shop, and his wife, a child-care worker, aren’t planning to move far. They are confident they can find an affordable three-bedroom apartment in their own neighborhood.

As housing prices have soared in major cities across the United States and throughout much of the developed world, it has become normal for people to move away from the places with the strongest economies and best jobs because those places are unaffordable. Prosperous cities increasingly operate like private clubs, auctioning off a limited number of homes to the highest bidders.

Tokyo is different.

In the past half century, by investing in transit and allowing development, the city has added more housing units than the total number of units in New York City. It has remained affordable by becoming the world’s largest city. It has become the world’s largest city by remaining affordable….

https://fred.stlouisfed.org/graph/?g=oc5a

January 30, 2018

Real Residential Property Prices for Japan, 1980-2023

(Indexed to 1980)

Y’know, the spending process in the US Congress is of course highly political.

Particularly involving the House of Reps. Where spending bills must originate.

When it comes to to put up spending proposals, it’s basically ‘pork focussed’, trying to get guv’mint funding for consituents in yer district. GOP & Dem members are all-in for this, even supporting one another all too often.

But when it comes time to actually pay-up, the tune changes drastically. The majority GOP members see no reason to spend on projects that benefit the opposition Dems. Unfortunately, this makes perfect sense, to them. Even to the extent of suggesting, perhaps, if you want to actually receive funds, you’d better be electing GOP members.

Otherwise, got to get that Deficit down.

Remedy: elect lots more Dems to the House. Senate too!

Ultimately, the problem/flaw is that whichever party is in power in the House, when the time comes to pay up, the majority sees no reason to benefit the minority.

Directly related to the Toyota argument on hydrogen:

https://www.globaltimes.cn/page/202202/1252325.shtml

February 15, 2022

Beijing makes China’s hydrogen industry breakthrough: official

By Tao Mingyang and Li Xuanmin

The Beijing 2022 Winter Olympics, the largest-ever demonstration of the use of hydrogen-powered vehicles in the history of the games, marks an industrial breakthrough and scaled application of China’s hydrogen industry from one to 100, and is set to open a new chapter of development of the hydrogen industry chain in the capital city, Chinese officials said.

“The Beijing Olympics has 816 hydrogen-powered vehicles as the main force for transportation, the largest-ever in international sports events, with the most application scenarios,” Wu Zhiquan, deputy director of the Transport Department of the Beijing Municipal Bureau of Economy and Information Technology, told the Global Times on Tuesday.

While there were smallish hydrogen-powered vehicles used at that Olympics, these vehicles were grouped together and used a few fueling stations. Delivering hydrogen to a million refueling stations for general car use is not the same.

Toyota has a serious problem indeed with staying with hydrogen.

ltr

you said “[ Please try to write with more care, since I have difficulty reading a comment otherwise.”

it is diffiucult to write with more care when one does not know what difficulty you are experiencing reading the comment. i try very hard to write with attention to the difficulties of understanding what i am saying. i don’t always succeed, and sometimes i really do not care. this was not one of the latter.

i think you might consider taking about half the responsibility for difficulty in communication. usually if you ask me what i mean, i will try to find a way to explain, and then you could say “i still do not understand” and i would try again. the process of course cannot on forever, but even “please try to write with more care” sounds a bit arrogant, and assigning full reponsibility to the other guy for your understanding is not likely to succeed in improving your understanding.

i hope you can understand that i do not mean this as any kind of insult. just a suggestion from an old hand at misunderstanding.

what the japanese might be concerned about is betting on what the future market will look like. they might think that catering to a market of bigger, faster, longer range electric cars that depend on exotic materials whose price may go up unaffordable…is not the best bet.

what they might not be doing is slavishly following a market fad and “fixing” market problems with macroeconomic manipulation that produces undesirable side effects.

and..this all fails to address the question of what does the debt actually mean anyway?

or what i think may be a more fundamental question : why is a rising GDP/person necessary?

Well

understanding Japan’s problem or not-problem with debt seems to me to possibly shed light on America’s problem…or imaginary problem.

i will not partiipate in a blog where my comments are deleted.

Programming note:

This is not an open thread post. The topic of this post is the US budget deficit/national debt. Comments that use Japan’s deficit/debt as a reference point to understand the US deficit/debt are on-topic. Comments about Japan’s manufacture of EVs and hydrogen-powered cars are off-topic and will be deleted. Thank you for your attention in this matter.