Scenes from the August employment report – and a warning

Scenes from the August employment report – and a warning

– by New Deal democrat

The weekly lull after last Friday’s employment report will end tomorrow. In the meantime, let’s take a deeper dive into a few important trends in that report.

First, the unemployment rate rose 0.3% to 3.8% – which is totally not surprising at all.

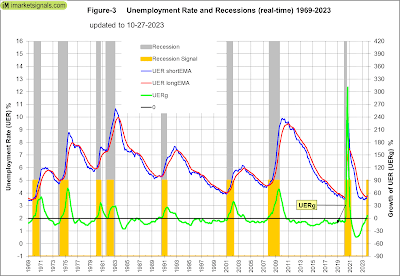

As I wrote last Thursday, initial jobless claims have a nearly flawless 60+ year record for forecasting the trend in the unemployment rate. Here’s the supporting graph:

The red line (the unemployment rate measured YoY) follows the blue line (initial jobless claims) almost like clockwork.

Here’s the past two years of the same graph:

Initial jobless claims turned higher YoY in March. The unemployment rate has followed. With jobless claims up about 10% YoY, an increase from 3.5% to 3.8% or 3.9% (i.e., 1.1*3.5%) was right in line with the forecast.

Although it would take several months of a 4.0% or higher unemployment rate to trigger the Sahm recession Rule, one similar unemployment rate-based metric has been triggered, which compares the short term monthly average of the unemployment rate with its 12 month average. If both are rising, and the former turns higher than the latter, in the past 50 years that has *always* signaled a recession, with *zero* false positives or false negatives:

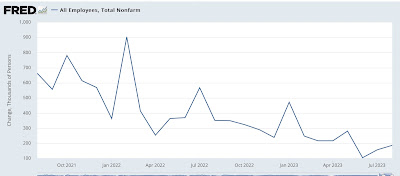

Meanwhile, the deceleration in monthly jobs gains, on average about -20,000 per month, has continued for 2 years now:

If this trend continues, we will get actual job losses in about 9 to 12 months.

In general, goods employment turns south before a recession begins, while services employment only follows later, and may never turn negative YoY. I track a variety of leading jobs sectors in my monthly blurb. Here’s what total goods employment (red) looks like compared with a number of other leading sectors, all normed to 100 as of August:

You can see that several – temporary jobs, residential construction, and trucking – have already turned down. Manufacturing jobs are flat. Only total construction jobs are still rising strongly.

Finally, as I’ve frequently noted, real aggregate payrolls are an excellent coincident recession indicator. When working and middle class households earn less money in real terms, they have always cut back spending, and this marks the onset of recessions. Here’s the long term comparison of total payrolls YoY (blue) vs. CPI YoY (red):

There are no false negatives, and only one arguable false positive (2002, a near miss) in the past 60+ years.

Here is a close-up on the last four years:

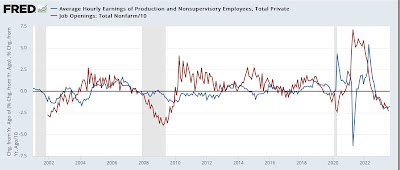

The YoY% change in wage gains is a long lagging indicator, starting up only after unemployment and underemployment decline, and also after the rate of job openings (red in the graph below) increases:

With job openings continuing to decline, the YoY% of wage gains (a component of aggregate payrolls) is likely to continue decelerating. But, as a number of writers including myself have pointed out in the past several months, gas prices have resumed increasing (spiking over $90/barrel yesterday):

making it more likely that the CPI YoY will increase.

Decelerating wage gains and increasing CPI means it is more likely that real aggregate payrolls will turn negative in the coming months, signaling recession.

And what should be of special concern is that a US recession in 2024 that causes Biden to lose and Trump to return to power is just about the #1 foreign policy priority of both Russia and Saudi Arabia, both of which have announced curtailment of their oil output in the past several weeks.

July JOLTS report: is the game of reverse musical chairs in employment ending? Angry Bear, New Deal democrat

After last Friday’s employment report, the temporary quiet period is ending soon. Let’s explore a couple of key trends from that report.

Firstly, the unemployment rate has risen by 0.3% to reach 3.8%. This isn’t unexpected.

As I mentioned in my previous article last Thursday, initial jobless claims have a remarkable track record spanning over 60 years in predicting changes in the unemployment rate

Read more

midlaj:

Do you have a better link to your article?

The labor participation rate ticked up which accounts for some of the increase in unemployment. My guess is some government benefits went away forcing more people to seek work.

The government deficit is still over $1 trillion and the debt to GDP ratio (aka private sector savings account) is still sufficiently high. The interest payments from the government due to higher interest rates is also added stimulus. This may be enough to hold off recession.

I still fear inflation will continue above the target level as the Fed’s misguided policy is actually creating inflationary pressure. And I agree the oil situation will make things worse.

Biden is between a rock and a hard place. Inflation will cause him to lose. The only thing that will curb inflation is a severe recession which will cause him to lose. While he will probably overwhelmingly win the popular vote, the election will be determined by a handful of swing voters in a handful of swing states. I am curious what the country’s reaction will be if Trump loses the popular vote by 10-20 million but wins the presidency.

Mark:

You have to have a foundation for this remark: “I am curious what the country’s reaction will be if Trump loses the popular vote by 10-20 million but wins the presidency.”

Bill,

My foundation is I think the abortion issue will bring many more voters to the polls to vote Democrat. In blue states this doesn’t matter because they already won those electoral votes. I doubt the extra turnout will be enough to flip any red states. So that leaves the 5 swing states (GA PA AZ MI WI) that Biden flipped from the 2016 election. Biden received 7 million more votes than Trump but only a combined approximately 250,000 in those 5 states. So if a mere 125,000+ switch their vote in those states, Trump wins. With the extra turnout, Biden could easily get 10 million more votes than Trump. I just wonder how the will of 85+ million voters with a margin of victory of 10 million being overridden by a couple hundred thousand votes will sit with the country.

Mark:

First thank you for the reply. I do not intend to be flippant but sometimes people do not look to the detail. 2016 was a strange year and national election.

I am in AZ now; however, Michigan has greatly changed with the redistricting. One Repub head in Livingston County openly admitted to me of packing districts around Detroit. I believe you will see Michigan a much stronger lean to Dem. I believe you will find WI will be similar and not quite as strong. Kari in AZ has been a real side show for Repubs demonizing Maricopa County for failed voting procedures. Except, Maricopa County is very strong Republican. Repubs in the county ran the elections. So keep on bashing them Kari. Can’t say much about PA, except the new senator who has issues pulled a victory off. These are observations.

I do believe much of the issue sits with the House being stuck at a fixed number of Representatives. The dynamics would change and go more towards representing the population. I got a post somewhere on Angry Bear showing the numbers if we used the least population state as the number for each representative.

Biden’s Econ policy pre and during Covid is widely recognized. He does need to jawbone with the FED. Also “believe” is a very strong word and also expresses uncertainty.

Mark:

By the way, I believe New Deal democrat is vastly under appreciated.

Mark:

This is what Digsby had to say about the issue you refer to . . .

“The cavalry is arriving extraordinarily early for President Joe Biden.

With poll after brutal poll showing the president in danger of losing a likely rematch with former President Donald Trump, his campaign is getting an unusual boost from a super PAC spending millions of dollars to resuscitate public opinion of him in major battlegrounds.

The ads are striking for both their timing and their content.

The election is still 423 days away, and Biden and an affiliate of his chief super PAC are already running TV ads in nearly every major battleground state — far earlier than normal for a presidential election. And instead of going on the attack, as super PACs usually do, the ads are trying to boost Biden’s image.”

Maybe Dems are taking notice of the issues?