While Medicaid’s enrollment purge plows on . . .

While Medicaid’s enrollment purge plows on . . . GoozNew, Merril Gooz

A few weeks ago, I critiqued the inequities that would inevitably result from a bare-bones universal insurance plan offered by two economists, which I dubbed it “Medicare-for-all lite.” There was one part of their plan that merits serious consideration: Automatic enrollment for everyone in some form of health insurance.

The idea isn’t new. But it is particularly relevant now because state Medicaid agencies across the country are purging their rolls of people who no longer qualify, either because their incomes have risen or they failed to fill out the proper paperwork. Medicaid’s annual re-enrollment process, which must be initiated by beneficiaries, was put on hold during the pandemic.

Re-enrollment resumed with the end of the medical emergency earlier this year. At least four million of the 94 million people on Medicaid have already been dropped from the program. The number could grow to 17 million by the end of the year, according to the Kaiser Family Foundation. Most will lose coverage because of paperwork snafus, not because their households surpassed the income guidelines.

Many state governments failed to gear up for the task. The Associated Press reported this week that the federal government has issued warnings to a third of state agencies whose call centers have been overwhelmed by desperate beneficiaries trying to re-enroll. Many people hung up after waiting for 45 minutes or more. How many of the working poor who rely on Medicaid because their employers do not provide coverage have an extra hour during the workday to stay on hold?

Where it’s automatic and where it’s not

As things stand now, we have automatic enrollment in just one part of the nation’s fragmented insurance system. Everyone must sign up for Medicare when they turn 65. Once you’re on, you never get thrown off.

Private insurance, either through employer-sponsored or group plans or individual plans sold on the exchanges, is almost entirely voluntary. Fully one-third of people offered health insurance at their place of work refuse to sign up for plans, according to the Bureau of Labor Statistics.

The individual mandate in the Affordable Care Act was eliminated in the 2017 Trump/Republican tax bill. Only five states and the District of Columbia subsequently enacted their own individual insurance mandates.

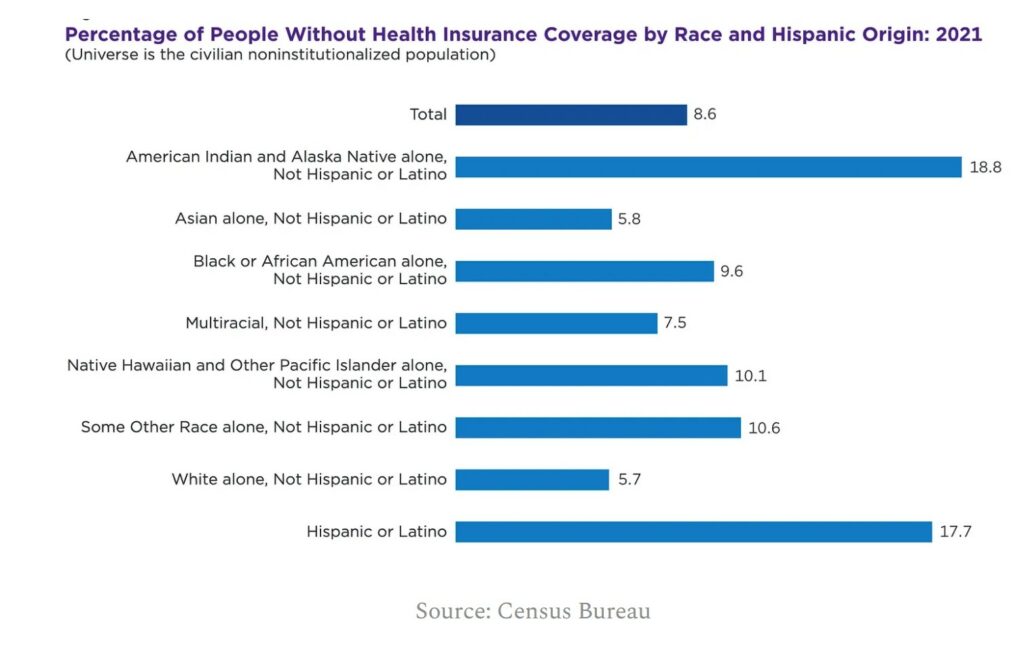

State-run Medicaid plans, which collectively are the nation’s largest insurer, are limited to the poor. Program beneficiaries must apply annually for coverage. Even before this year’s program purge, more than a quarter of the 28 million uninsured Americans who were eligible for Medicaid never applied. Another 37% of the uninsured were eligible for subsidies on the exchanges, but still decided not to buy insurance.

In other words, even under the U.S.’s existing fragmented system, near universal coverage could be achieved if everyone signed up for plans for which they are already eligible. Why haven’t people signed up? The uninsured cite cost as the number one reason for failing to enroll.

In 2020, 70% of the uninsured reported they could not afford a monthly premium above $75. The Biden new administration and Democrats in Congress tried to solve that problem with the 2021 American Rescue Plan, which expanded eligibility and raised premiums to the point where three-quarters of the uninsured could access a plan for less than $50 a month. Thanks to last year’s Inflation Reduction Act, those subsidies have now been extended through 2025. Enrollment surged, but nearly 30 million Americans still remain uninsured.

So once again we have to ask: Why don’t more people take advantage of those options. Why don’t they sign up for Medicaid when they’re eligible? Why don’t they immediately sign up for Obamacare plans when their household incomes rise to being merely poor from very poor?

Opt-out, not opt-in

One of the tried and true maxims of behavioral economics is that opt-out plans are far more efficient and effective at influencing behavior than opt-in plans. Saving for retirement at work becomes near universal when people are automatically enrolled, for instance.

Every health insurance option should adopt Medicare’s formula: People are automatically in unless they opt out. No more mandates. Let’s learn from recent history. Don’t give Republicans another opportunity to claim Democrats are “trampling on the freedoms of Americans.”

It would have to work differently for each type of plan. Employers and insurers offering group plans would have to provide full disclosure of out-of-pocket premiums and other costs for every type of plan they offer, and an easy method for employees to opt out. The carrot would be the end of the employer mandate since people working at firms that don’t provide coverage would be automatically enrolled in individual plans sold on the exchanges.

The opt-out strategy for Medicaid and the individual market would be a bit trickier since both have income limits for participation (in the case of Medicaid) and subsidies (on the exchanges). The state agencies that manage Medicaid and the exchanges that offer individual insurance plans depend on income disclosures made annually to the Internal Revenue Service.

Given today’s computer capabilities, it should be relatively easy to have individuals check a box on their income tax forms that indicates whether they have health insurance, just as they did when the individual mandate and its penalties were enforced. The IRS in turn could provide information about those who don’t have coverage to the states and exchanges, which could then automatically enroll those without coverage in the lowest cost option available. At the same time, the exchanges could give them the option of opting out or switching to a plan that better suits their needs.

Should Democrats regain control of Congress and retain the White House after the 2024 election, the timing may be right for finally achieving near-universal coverage through automatic enrollment and an opt-out option – without resorting to mandates or trampling on individual freedom.

https://www.nytimes.com/2023/08/13/us/politics/texas-medicaid-coverage-loss.html

August 13, 2023

After End of Pandemic Coverage Guarantee, Texas Is Epicenter of Medicaid Losses

Since the end of a pandemic-era policy that barred states from removing people from Medicaid, Texas has dropped over half a million people from the program, more than any other state.

By Noah Weiland

Juliette Vasquez gave birth to her daughter in June with the help of Medicaid, which she said had covered the prenatal medications and checkups that kept her pregnancy on track.

But as she cradled her daughter, Imani, in southwest Houston one afternoon this month, she described her fear of going without the health insurance that helped her deliver her baby.

This month, Ms. Vasquez, 27, joined the growing ranks of Americans whose lives have been disrupted by the unwinding of a policy that barred states from removing people from Medicaid during the coronavirus pandemic in exchange for additional federal funding.

Since the policy lifted at the beginning of April, over half a million people in Texas have been dropped from the program, more than any other state has reported removing so far, according to KFF, a health policy research organization. Health experts and state advocacy groups say that many of those in Texas who have lost coverage are young mothers like Ms. Vasquez or children who have few alternatives, if any, for obtaining affordable insurance.

Ms. Vasquez said that she needed to stay healthy while breastfeeding and be able to see a doctor if she falls ill. “When you are taking care of someone else, it’s very different,” she said of needing health insurance as a new parent.

Enrollment in Medicaid, a joint federal-state health insurance program for low-income people, soared to record levels while the pandemic-era policy was in place, and the nation’s uninsured rate fell to a record low early this year. But since the so-called unwinding began, states have reported dropping more than 4.5 million people from Medicaid, according to KFF.

That number will climb in the coming months. The Congressional Budget Office has estimated that more than 15 million people will be dropped from Medicaid over a year and a half and that more than six million of them will end up uninsured….

The proper reference link:

https://www.nytimes.com/2023/08/13/us/politics/texas-medicaid-coverage-loss.html

https://fred.stlouisfed.org/graph/?g=17GhZ

January 15, 2018

Life Expectancy at Birth for United States, China, Japan and Korea, 2017-2021

https://fred.stlouisfed.org/graph/?g=17Gij

January 30, 2018

Infant Mortality Rate for United States, China, Japan and Korea, 2017-2021

Then there is Medicare-for-some. (I am not going to hunt for some other place to put this.)

How Medicare can save $500 billion

Boston Globe – August 18

A privately managed offshoot of the government’s health insurance program appears far costlier than it needs to be.

(Mrs Fred & I are satisifed users of Blue Cross MA here in Massachusetts. Surely BC would not do anything as dastardly as those Sutter folks out in California.)

Liran Einav and Amy Finkelstein, economists at Stanford and the Massachusetts Institute of Technology, respectively (:) “We’ve Got You Covered: Rebooting American Health Care,” … the economists, who specialize in health insurance, propose the creation of a universal, government-funded health plan that covers basic services without premiums, co-pays or deductibles. … They are …

So, this would be universal, free healthcare lite. Albeit tax-payer supported, which would be good, presumably just short of what you could get at your local urgent care place.

This sounds like something that would come out of Stanford, but not necessarily out of MIT.

How Jonathan Gruber became ‘Mr. Mandate’

MIT News – Oct 29, 2012

Sort of like New Zealand maybe.

(Taxpayer supporteed ‘universal’ limited coverage. Supplemental coverage widely subscribed to if you can afford it.)

The Healthcare System in New Zealand

New Zealand’s healthcare system is a universal public system. It is one of the top 20 healthcare systems in the world, on a par with the United States and the United Kingdom. … The Act requires that all New Zealand citizens have equal access to the same standard of treatment in an integrated, preventative health care system. …

The cost of healthcare in New Zealand varies. The public healthcare system in New Zealand operates as a single-payer healthcare system. The government pays for the majority of healthcare costs using public tax money – up to 9% of New Zealand’s GDP.

Government funding means that the New Zealand healthcare system, for citizens and permanent residents, is either free or low-cost. Hospital and specialist care are covered if the patient is referred by a general practitioner (GP). Free medical services can include diagnostic tests, immunizations, cancer treatment, and appointments, and, for children, dental care and prescription medication. …

Many prescription medications are subsidized at an average cost of $5. To be subsidized, medications need to be approved by the health authority called PHARMAC. If a medication is not approved by PHARMAC, it may still be available in New Zealand, but at a much higher cost. …

Many New Zealanders Choose Private Health Insurance

Private health insurance can reduce the wait time and cost for you to see a specialist. This is a major reason why more New Zealanders are now choosing the support of a private health insurance policy.

In New Zealand, private health insurance allows patients a wide choice of specialists and the opportunity to receive treatment in private hospitals with less waiting time. Private hospitals in New Zealand provide a more private and comfortable overall experience.

Private health insurance can support a wider range of prescription medication. It often provides some coverage for medications that are not funded by PHARMAC. There may be a price cap, or the coverage may only be available when you are ill enough to be hospitalized. …

“a standard of adequacy for health-care needs”

Not a standard of sufficiency, it would seem.

That would be asking too much.

The issue remains, in the US, whether to tie medical benefits to employment or not. Looks like these two propose a compromise, which provides ‘basic’ coverage to all, guv’mint funded. ‘Deluxe’ coverage would have to be paid for by other means, apparently. That is, by the recipient. Out of pocket, or by private insurance.

This, unfortunately, will still seem ‘socialistical’ to many I bet.

Working people deserve health care, as do older folks.

Let others fend for themselves? Seems harsh perhaps.

Germany does it that way if I remember it correctly.

That sure sounds like what Obamacare was originally all about, except that it was necessary then to do this by insisting (‘mandating’) that people get insurance, which the guv’mint would pay for if necessaary (*), since shot down I guess. Somewhat self defeating, no?

* What Biden quietly told Obama, for all to hear, was ‘a big effing deal.’

Europe has several models of more universal health care to use for inspiration. Most have universal coverage for essential care and the option of supplemental care or opt-out to fully private care or both. There are articles online and in the newspapers about how easy (and inexpensive) it was to obtain care for an unplanned event while travelling there.

We need only look to Canada for a better option than what we have here.

We really need to start emphasizing Roosevelts freedom from want and freedom from fear. Universal medical care for medically essential needs is part of freedom from want.

Jane:

Having worked globally, I am aware of what other countries are offering. You are right, we should revert back to a freedom, “freedom from want and from fear.”

Thank you.

https://www.nytimes.com/2023/07/18/opinion/universal-health-care.html

July 18, 2023

We’re Already Paying for Universal Health Care. Why Don’t We Have It?

By Liran Einav and Amy Finkelstein

There is no shortage of proposals for health insurance reform, and they all miss the point. They invariably focus on the nearly 30 million Americans who lack insurance at any given time. But the coverage for the many more Americans who are fortunate enough to have insurance is deeply flawed….

The general point should always be stated, which is that healthcare outcomes in America are poorer, much poorer than in other developed countries and several developing countries. America stands alone in poor healthcare outcomes in the G7:

https://fred.stlouisfed.org/graph/?g=14GnX

January 15, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2000-2021

https://fred.stlouisfed.org/graph/?g=11RGk

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2000-2021

https://fred.stlouisfed.org/graph/?g=14GnT

January 15, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2007-2021

https://fred.stlouisfed.org/graph/?g=10Wte

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2007-2021

Celsa of the CZ Republic:

You can not post comments about solar cells in a comment section about Medicaid. Your comment does not the topic of Medicaid which is healthcare. I wanted to make sure you knew this before I delete tour comment shortly. While you may show where you blog, you can not have advertising or sales of product in your comments. Please adjust future comment to fit the topic of our commentary/posts and eliminate any advertising for products, etc.