What to look for in tomorrow’s CPI and Friday’s PPI

What to look for in tomorrow’s CPI and Friday’s PPI

– by New Deal democrat

We’re still in the post-jobs report lull in economic news today. That will end tomorrow with initial jobless claims, and also CPI and PPI tomorrow and Friday respectively.

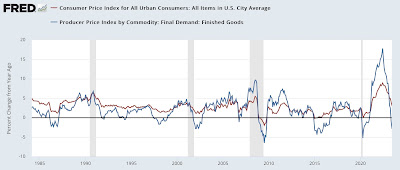

I always watch CPI, but I believe the PPI is uniquely important at present as well. To show you why, let me show you the YoY relationship between PPI and CPI for the past 75 years in two graphs below:

I’d like to focus your attention on those times when (1) both PPI and CPI were decelerating or declining YoY, and (2) PPI was decelerating or declining at a faster pace than CPI.

Until recently, this relationship typically has occurred either in the latter part of recessions, or else early in recoveries just after the end of recessions. That’s because recessions kill demand, and since producer prices are more volatile than consumer prices, producer prices go down faster. Which lays the groundwork for the next expansion, as producers can produce goods more cheaply, enabling consumers to get a good deal – thus stimulating demand again.

But the relationship also has happened repeatedly in the middle of expansions in the past 40 years. Not always, but some of the time that has been not because of a decrease in demand, but rather an increase in the supply of commodities, chiefly but not necessarily limited to gas and oil. In those cases, consumers have just motored right through what otherwise would have looked like recessions.

Now cast your eyes to the far right. In the past year, commodity prices have declined almost 10% – one of the steepest declines ever. And that has *not* been because of a massive killing of demand, but rather because supply chain bottlenecks created by the pandemic have unspooled dramatically.

At present the YoY% change in PPI prices are running -12.6% below that for the CPI, the highest in the entire 75 year period except for the very bottom of the Great Recession:

I am increasingly of the opinion that this amounts to a hurricane force tailwind behind the economy.

So tomorrow and Friday I will be looking to see if this trend continues, or if there are signs of a reversal. Tomorrow that may be evident in CPI ex-fictitious shelter, and on Friday we may see the first increase in PPI for raw commodities since January and only the second in the past year. If the downward trend continues, the tailwind is continuing. If the downward spiral breaks, then as the tailwind abates the lagged effects of Fed rate hikes will likely come to the fore.

Real hourly and aggregate wages update; plus further comments on consumer and producer inflation, Angry Bear, New Deal democrat

Seems like good news, maybe. AP via Boston Globe – just in …

Everyone wants to work at UPS after union scores $170,000 driver pay

Bloomberg via Boston Globe – just in

unions (and Joe Biden) may just save the middle class after all

The Teamsters Union pulled this off.

Fortune – August 11 – behind a paywall

The Teamsters Union …

Looks like both ticked up. I don’t put much stock in one month’s data but definitely worth watching.

Also of note was the jump in rents. Real estate investments are typically leveraged. With the Fed increasing interest rates the cost of servicing the loans goes up. These costs are passed on to the renters especially in a tight market. The same in true in the energy sector. New investment in increased production is financed and those higher costs are passed onto consumers. Energy is starting to creep back up.

I mentioned in the comments several weeks ago about my concerns of the Fed actually causing more inflation by raising interest rates. Like I said, one month of data is hard to make a conclusion. But in the infamous words of Han Solo: I got a bad feeling about this.

Mark:

What, no more fixed interest rates for apartments once built? My past knowledge being a higher rate while building? Maybe things have changed.

If you are getting the one-year builders loan with a range, I guess you could pass on an increase, keep it, and add it to what the market will bear even when rates decrease and yours follows. If true, it sounds like an excellent game. Tight markets guarantee renters. The market right now is rushing to accommodate it. I am sitting in the midst of it. The sloppy builder’s practices are allowed by local governments who acquire the least knowledgeable of citizens to sit on their boards. Huge rubber stamp. The local gov. will pay the price now and also later and place blame elsewhere.

NDd follows the market and offers up commentary governing the changes occurring in the market. I link his posts to the most recent one from the past. Those links are at the bottom of his posts. There may be a time spread between each commentary and I may miss a link. In that respect, your comment would be correct. Are you asking him to do charts of each of his findings or speculation? Marvelous idea; I think we would have to pay him.

Each Friday NDd offers up a lengthy review of what is happening. He does this at Seeking Alpha. I read his reports there also and it does relate to time. Sometime SA will not allow me access. The fee is too high to get into there.

Powell is attempting to kill the steely beast of Labor with his knife of increasing Fed Rates. With each stab of his increase, costs do increase. Yet Labor still goes onward as long as there is not enough of it and increased demand for product. The results of Powell’s actions with rates have been slowing the need of Labor and product. The cost? Attorney Powell wanting to be another Volcker. His actions to date revealed banks being on the edge again. Maybe moving them from the $50 billion limit was not so great an idea? Which is the greater threat> Labor or Banks? And yes, you are correct on Powell.

I get a bad feeling too and the Fed will be the cause of a reaction. The detail is in NDd posts if you follow them. They are linked by topic.

From my past experiences in manufacturing, companies are slow to react, too stupid to react, or are manipulating the market by limiting production. It is great to be in demand and a king. Companies do not necessarily manufacture to a maximum output. So there is slack in manufacturing capacity. Some critical items do not require much labor input. so, what gives? Supply Chain is a real issue. It is an under rated issue and it is being manipulated the same as it was after the 2008 blowup. Did Biden really have to tell Long Beach and LA to increase shifts at the docks?

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2023

(Percent change)