Unlike homeowners, home builders can alter their product and pricing point

Unlike homeowners, home builders can alter their product and (much more flexibly) their price point

– by News Deal democrat

Yesterday I noted that home builders, unlike existing homeowners trying to sell their existing house, have flexibility in the size and amenities of the house they will build, as well as the price they are willing to set, based on commodity costs and profit margins.

Today’s new home sales report for July confirmed that, as sales rose to 714,000 annualized, the highest level since February 2022 on a seasonally adjusted basis. As I have frequently pointed out, new home sales are the most leading of any housing metric, but they do have the drawback of being very noisy and heavily revised. Below I compare them (blue) with single family permits (red, right scale) which are much less noisy:

I suspect that level will not survive the increase in mortgage rates to over 7.25% in the past week, the highest rate inn over 20 years.

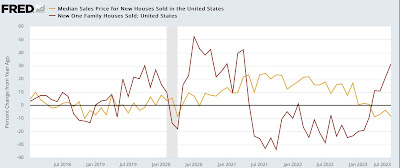

The report does not seasonally adjust prices, so the best way to look is YoY. Below I compare those (gold) with the YoY% change in sales (red):

The median price of new homes has declined -8.7% over the past 12 months, vs. existing homes, which as we saw yesterday, are actually *higher* YoY.

This dynamic cannot last beyond the short term. I suspect it will change as soon as commodity prices for home building materials (chiefly lumber) have unequivocally stopped declining, and homeowners feel a profit squeeze.

House prices stabilize (or even increase!) for existing homes, while prices have been slashed for new homes. What’s going on? Angry Bear, New Deal democrat

Row houses. The same houses side-by-side just turned around and fitted out with varying amenities. Albion’s Seed was/is a good study of those building styles dating back (at least) a couple hundred years. Really interesting to remodel, especially the ones that have been remodeled

My son just got back from three years framing the same seven houses in Minnesota, sixty-six total. Interesting that you brought this up as one of the last houses he framed out was so readily fitted out as a duplex to be obvious it was a contingency from the start. We laughed

Too bad they were all built out in the middle of what was once farmland …