Higher new home sales, with lower prices in May: good!

Higher new home sales, with lower prices in May: good!

– by New Deal democrat

Let me start with my usual caveat about new home sales: while they are the most leading of all housing metrics, they are very noisy and heavily revised.

With that out of the way, the bottom line is that they offered pretty definitive evidence that sales have bottomed, while prices are still declining, at least on a YoY basis. Which makes sense, because as I always sale, prices follow sales.

First, here are seasonally adjusted new home sales (blue, left scale) compared with the less leading, but much less noisy single family permits (red, right scale):

Both now show a significant and apparently sustained rebound from their respective lows last summer and winter. Unless the Fed jacks up rates further enough to drive mortgage rates well over 7%, the bottom certainly appears to be in.

Nevertheless, a longer term view shows that even with this rebound, new single family houses are being built and are for sale at no more than a moderate pace compared with the last 30 years:

Note that neither of these metrics include multi-family units, which as I discussed last week, are being built at an all-time record.

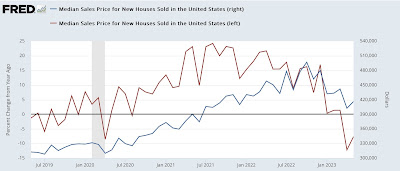

Turning to prices, which follow sales with a lag, there was a non-seasonally adjusted increase of 3.5% for the month (blue, right scale below), while on a YoY basis, prices declined -7.6% (red, left scale):

This was simply a very good report for the economy: lower prices and higher sales. Good!

New home sales and prices: yet another confirmation of a bottom in sales, while prices continue to decline YoY, Angry Bear, New Deal democrat

What Is Happening in the Housing Market?

NY Times – June 26

Home construction surged in May and prices have ticked up, even with interest rates at a 15-year high. The resilience has surprised some economists.

… The Fed’s rate increases are aimed at slowing America’s economy — in part by restraining the housing market — to try to bring inflation under control. Those moves worked quickly at first to weaken interest-sensitive parts of the economy: Housing markets across the United States pulled back notably last year. But that cool-down seems to be cracking.

Home prices fell nationally in late 2022, but they have begun to rebound in recent months, a resurgence that has come as the market has proved especially strong in Southern cities including Miami, Tampa and Charlotte. Fresh data set for release on Tuesday will show whether that trend has continued. Figures out last week showed that national housing starts unexpectedly surged in May, jumping by the most since 2016, as applications to build homes also increased.

Housing seems to be finding a burst of renewed momentum. Climbing home prices will not prop up official inflation figures — those are based on rental rather than purchased housing costs. But the revival is a sign of how difficult it is proving for the Fed to curb momentum in the economy at a time when the labor market remains strong and consumer balance sheets are generally healthier than before the pandemic. …

Sales in the tract going in behind us picked up substantially after they dropped their price about $50K on all the models, and a bit more on the more expensive ones. And they are starting actual construction on some of the lots that had been just sitting. Maybe that was the plan, but it is a very very very slow buildout for a tract in our area. It is a small tract to begin with, maybe 35-40 homes total and it must be at least 9 months already if not more.