Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow

Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow

– by New Deal democrat

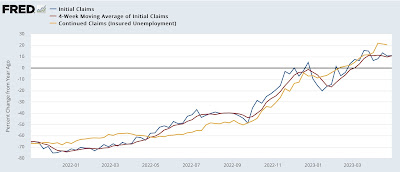

Initial jobless claims rose 13,000 to 242,000 last week, while the 4 week average rose 3,500 to 239,250. Continuing claims, with a one week lag, declined -38,000 to 1.805 million:

This is right in the range of the past 2 months.

YoY initial claims are up 11.0%, the 4 week average is up 10.8%, and continuing claims are up 20.5%:

This is enough to reinstate the “yellow flag” caution, but not across the 12.5% boundary where I would begin to hoist the “red flag” recession warning.

Tomorrow morning we will get the April jobs report, and since initial claims are a leading indicator for the unemployment rate (red in the graph below), here’s what that looks like for the past 18 months:

Initial claims are clearly forecasting an increase in the unemployment rate by 0.2%-0.3% over the next few months, but whether or not there will be an increase tomorrow is impossible to know. But they do certainly suggest there will be no *decrease* in the unemployment rate.

Meanwhile, since real retail sales (showing consumption; blue in the graph below) are a leading indicator for employment (red), here’s the latest update on that comparison:

The gold line represents the quarterly change (*4 to estimate the annualized rate) in job growth.

Real retail sales are plainly forecasting continued deceleration in jobs growth. Deceleration in the YoY rate, as well as deceleration in q/q growth suggests a gain of less than 325,000 tomorrow. A negative outlier would be anything less than 200,000.

Additionally, tomorrow I’ll be looking for continued deterioration in the leading sectors of manufacturing, construction, and temporary employment, along with the manufacturing workweek and an increase in short term unemployment.

Jobless claims continue to warrant yellow caution flag – continuing claims shade closer to crimson, Angry Bear, New Deal democrat

US Job Growth Retains Vigor Despite Economic Worries

NY Times – May 5

Employers added 253,000 jobs in April and unemployment fell to 3.4 percent, but the labor market’s strength complicates the Fed’s inflation fight.

The labor market is still defying gravity — for now.

Employers added 253,000 jobs in April on a seasonally adjusted basis, the Labor Department reported Friday, in a departure from the cooling trend that had marked the first quarter and was expected to continue.

The unemployment rate was 3.4 percent, down from 3.5 percent in March, and matched the level in January, which was the lowest since 1969. Wages also popped slightly, growing 4.4 percent over the past year.

The higher-than-forecast job gain complicates the Federal Reserve’s potential shift toward a pause in interest rate increases. Jerome H. Powell, the Fed chair, said on Wednesday that the central bank might continue to raise rates if new data showed the economy wasn’t slowing enough to keep prices down.

It’s also an indication that the failure of three banks and the resulting pullback on lending, which is expected to hit smaller businesses particularly hard, hasn’t yet hamstrung job creation. …

Wages Grow Steadily, Defying Fed’s Hopes as it Fights Inflation

NY Times – May 5

Pay gains picked up last month, the opposite of what Federal Reserve officials are hoping for as they try to cool inflation.

Wage growth ticked up in April, good news for American workers but bad news for officials at the Federal Reserve, who have been hoping to see a steady moderation in pay gains as they try to wrestle inflation back under control.

Average hourly earnings climbed by 4.4 percent in the year through April. That compared with 4.3 percent in the previous month, and was more than the 4.2 percent that economists had expected.

The increase in wages compared with the previous month — at 0.5 percent — was the fastest since March 2022.

The hourly earnings measure can bounce around from month to month, so it is possible that the April increase is a blip rather than a reversal in the trend toward cooler wage gains. Even so, the data underscored that the Fed faces a bumpy road as it tries to slow the economy and bring inflation under control. …