Financial markets in past fiscal crises; the “gold standard” of employment reports . . . big deceleration in Q4 of last year

Financial markets in past fiscal crises; the “gold standard” of employment reports shows big deceleration in Q4 of last year

– by New Deal democrat

I have a post up at Seeking Alpha on how stocks, bonds, and consumers behaved during the 3 fiscal crises of the last decade. Hint: recessions are always disinflationary.

Also of interest: the “gold standard” of employment data is the Quarterly County Employment and Wages report, which is not a sample, but the full census of 95% of all establishments. Unfortunately, it has two drawbacks: (1) it does not get reported until almost 6 months later, and (2) it can be revised for a full year or more afterward.

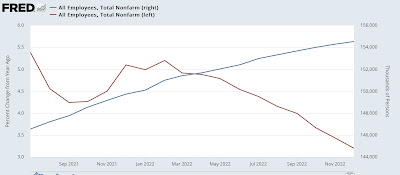

With those caveats, YoY employment through December of last year decelerated from 4.3% at the end of Q3 to +2.6%, and a total of 152,318,000 jobs:

This compares with the monthly jobs report which was up +3.2% YoY (red, left scale) at 154,535,000 jobs (blue, right scale):

We had a similar disconnect for Q2 data, which subsequently got revised away.

Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow, Angry Bear, New Deal democrat