The Postal Service consolidates its network: Modeling five metros

Steve Hutkins and former N.C. Postmaster Mark Jamison have been following the issues with the USPS, its reorganization, and the attacks on it by politicians and commercial interests. This particular post is detailing parts of the reorganization of it. As you will read, the plan is to establish distribution centers where Mail Delivery Personnel would pickup the mail and go on their delivery routes.

The plan was developed and put into play by USPS Postmaster General Louis DeJoy. His actions have come under scrutiny by those who have far more experience in Postal Service than the logistics oriented DeJoy. As you read this detailed report by Steve, there is detailed commentary on the decisions being made and the overall plan. It is a rather lengthy report. A good read.

The Postal Service consolidates its network: Modeling five metros, Save the Post Office, Steve Hutkins.

When Congress eliminated the Postal Service’s pre-funding mandate for retiree health benefits, which had caused $50 billion in artificial debt, it required semiannual reports on the agency’s financial condition and operations. Section 207 of the Postal Service Reform Act directs the Postal Service to respond to information requests on various topics, including service performance, pricing, recruitment and retention, and facility consolidations.

The first 207 report came out a couple of weeks ago. It describes the consolidation process that’s underway in five metro areas: Charlotte, Atlanta, Indianapolis, Memphis, and Chicago. Some current and some new facilities in these regions will consolidate processing operations from other facilities, most of which will be repurposed as Sorting & Delivery Centers. These S&DCs will then consolidate delivery units from post offices — letter carriers will start and end their day at the S&DC — leaving the post office with a few clerks to manage the retail operation and a lot of empty space.

The 207 report appears to have been submitted well after it was due. The Reform Act states that “not later than 240 days after the enactment of this Act,” the Postmaster General shall submit the report to the President, Congress, and the Postal Regulatory Commission. The Act became law on April 6, 2022, so it was supposed to be submitted on December 2, 2022.

The report’s cover letter from the Postmaster General is dated December 2, and the transmittal letter from the Postal Service to the PRC shows that date as well, but the report wasn’t posted on the PRC’s website until February 10, 2023. The transmittal letter is unusual in that there’s no time stamp showing when it was received by the PRC, but the document number in the report’s URL confirms that it wasn’t received until February 10 — ten weeks late.

The report’s discussion of the consolidations is filled with repeated reassurances that the reconfigured network will provide “best-in-class processing operations” and “best-in-class delivery operations.” But the report is short on details, it’s filled with redactions on key facts — like the amount of money invested so far on overhauling the Network Distribution Centers in Atlanta and Chicago — and it fails to answer the central question: which facilities will be impacted?

There’s also the issue of how the Postal Service is going about the consolidation process. When it comes to consolidating processing facilities (as opposed to post offices), the Postal Service follows the policies set forth in Handbook PO-408, the guidelines for Area Mail Processing (AMP) studies. The consolidation process in the five metro areas appears to be well along, yet there’s been no notification of stakeholders and no public meetings, as required by the guidelines.

The report gives the impression that the consolidations are all about processing facilities, but a closer look shows that they could impact over 300 post offices, many of which could eventually be closed. One might have expected the Postal Service to inform Congress of this possibility, but the report barely even mentions post offices, and it obscures the fact that the “consolidations” include closing post offices.

When constituents start complaining about these closures, elected officials may want to remember that their support of the Delivering for America plan helped make the closings happen.

Modeling the five metros

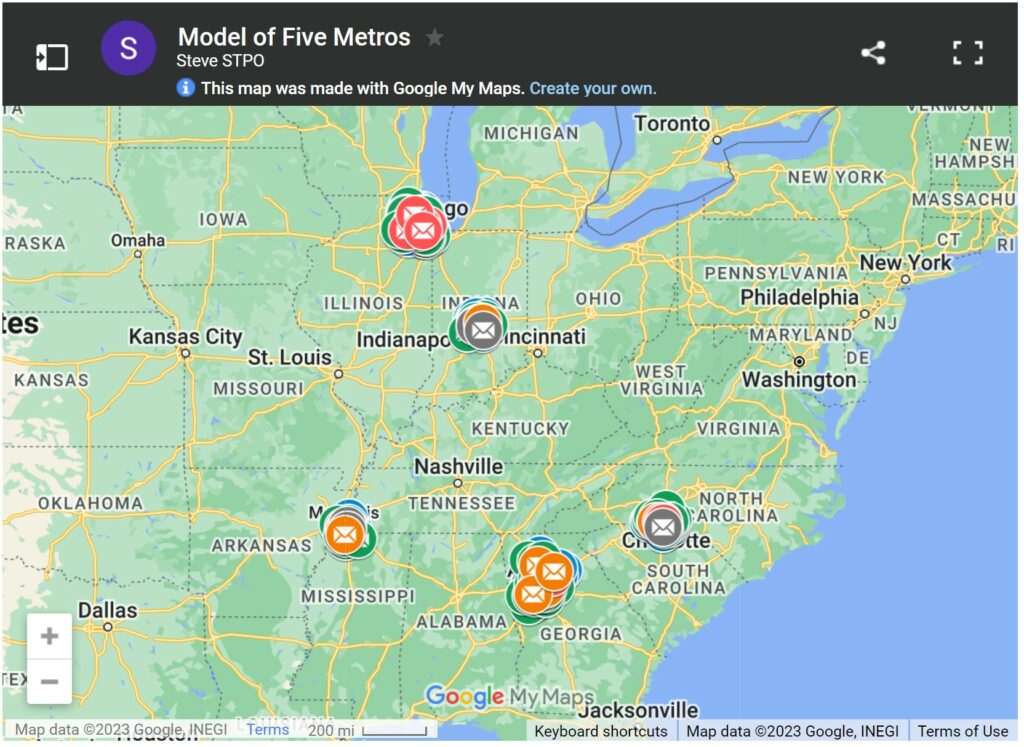

The five metro areas have 22 processing facilities, half in leased properties, half in properties owned by the Postal Service. There are also at least seven new leased facilities in the works — three large Regional Distribution Centers in Atlanta, Indianapolis, and Charlotte, three S&DCs in Atlanta, and another new facility south of Memphis, perhaps also an RDC.

In these metro areas, there are about 300 post offices with carrier operations that are within a 30-minute drive of a potential S&DC — according to the plan, the maximum “reach.”

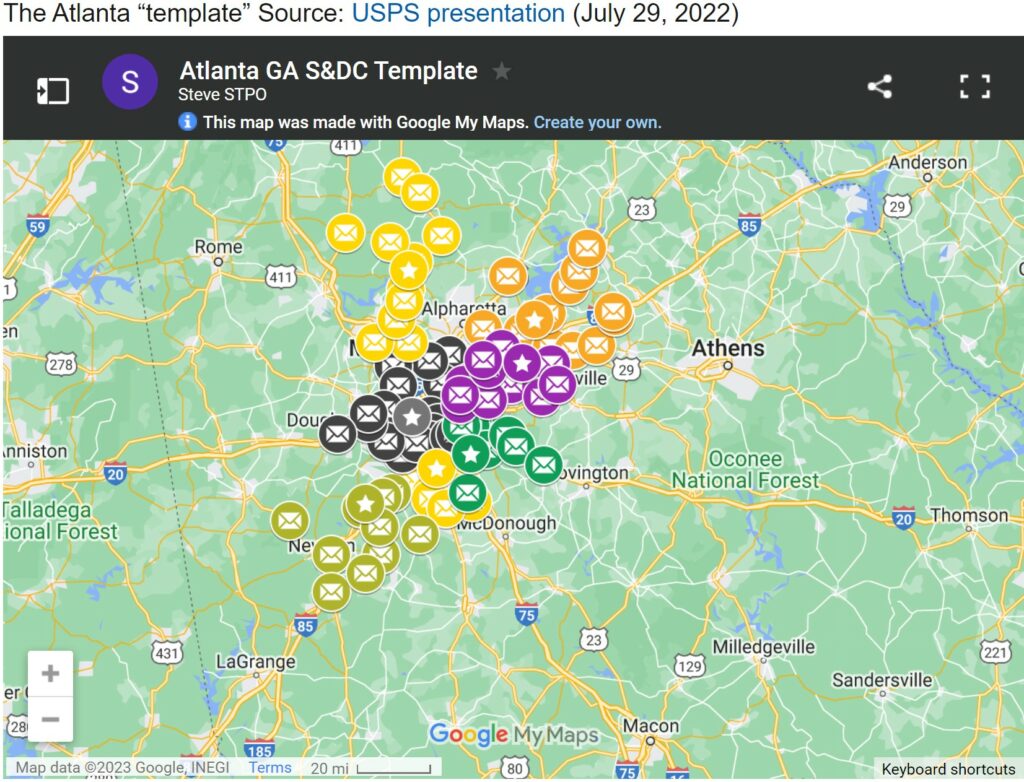

Here’s a map showing the 30 processing facilities and 305 post offices that could lose their carriers to an S&DC. The currently operating processing facilities are in red, the new or planned facilities are in purple, and the closed or possibly closing, in gray. The leased post offices are in green, the owned post offices in blue.

A list of the processing facilities is here, a list of the potential spoke post offices is here, and the Google map is here.

In some cases, as discussed below, the address of a processing facility is strictly guesswork since no specific address has yet been announced. The list and map do not include the 12,000 Remotely Operated Post Offices that are open part-time under POStPlan — they generally don’t have carrier operations and are outside of metro areas — or finance stations and finance branches – the retail-only post offices in shopping centers and store fronts.

Based on data for Atlanta and Indianapolis (provided by the Postal Service in an internal presentation dated July 29, 2022), the average post office in the metro areas has 31 routes. That’s well above the national average of about 12 routes per office, but metro area post offices are much larger than average.

The model shows that the average distance from the S&DC to the post office — which is about how much longer the routes will be in the new network — is more than 12 miles and at least a 20-minute drive.

Roughly speaking then, for the five metro areas, that’s 300 post offices with 30 routes each — about 9,000 routes and 12,000 carrier positions. The longer drive to the route will necessitate approximately 1.8 million additional work hours, which means a lot of overtime and a lot of additional routes. The Postal Service’s presentation indicates that the new system will require 5 to 10 percent more routes. For the five metros, that’s 4,500 to 9,000 more routes — and thousands more carriers and new delivery trucks.

Non-renewals of leases

The 207 report says that the Postal Service is beginning “to deploy new S&DCs in targeted regions, which will combine delivery operations from smaller delivery units into larger, standardized, optimally located delivery units.” The report doesn’t say what will happen to the post offices after the carriers are gone and more than half the floor space is empty and deemed “excess.”

The Postal Service has been claiming that when a post office loses its carriers, it will remain as is, and the retail operation won’t be affected. For example, in a statement shared with KBTX regarding the new S&DC in Bryan, Texas, which had its grand opening a few days ago, the Postal Service said, “The creation of S&DCs will not change the locations of the Postal Service’s retail units, including PO Box service.”

The 207 report suggests otherwise. The report states that through consolidating operations and combining smaller facilities into larger ones the Postal Service will be able to “reduce lease costs” in Atlanta, “see savings through the elimination of leased facilities” in Charlotte, and “realize substantial savings due to the non-renewal of leases” in Chicago.

The wording is ambiguous, perhaps intentionally so, and gives the impression that these lease savings will come from closing a few processing facilities and consolidating their operations into some larger ones. But that’s not the case.

Of the thirty processing facilities for the five metro areas, twelve are owned by the Postal Service, seven will be in new leased facilities, three currently leased facilities are package support annexes that were never intended to be permanent, and one other is an annex that closed in October. That leaves seven leased facilities that could yield savings if the leases are not renewed, but the report identifies only a couple of these for consolidation — the others may remain active as S&DCs.

The opportunities for lease savings are thus very limited and do not explain the report’s repeated references to savings on non-renewals. On the other hand, the five metro areas have about a hundred post offices in leased properties, and many of these could be closed when the lease comes up for renewal.

The AMP guidelines

The Postal Service appears to be moving forward on implementing the consolidations as quickly as possible. The Postmaster General says he’s in a “race against time.”

The leases on the RDCs in Atlanta and Charlotte were signed sometime in the spring of 2022, and probably not long after on Indianapolis. According to the 207 report, as of the end of the fiscal year (Sept. 30, 2022), the RDC projects were “at the early stages of construction (Atlanta), buildout design (Charlotte), and construction (Indianapolis). Atlanta and Charlotte will start processing in 2023 while Indianapolis will be operational in 2024.” According to a USPS presentation about the “NDC unwind,” the redevelopment of the NDCs in Chicago and Memphis began last fall.

These projects are several months farther along by now, but the Postal Service has still not initiated the public phase of the process that is supposed to occur prior to making any final decisions about consolidating facilities.

In a footnote in the 207 report, the Postal Service states: “We will fulfill all applicable internal guidelines set forth in Handbook PO-408 and comply with all other applicable regulatory or statutory requirements in connection with our consolidations in Atlanta, Charlotte, Chicago, Indianapolis and Memphis.”

Handbook PO-408 is the Area Mail Processing guide, and it contains the policies and procedures to be followed when the Postal Service is considering the consolidation of processing and distribution operations from one facility to another.

According to the guidelines, once there is a clear intent to proceed with an AMP feasibility study, the Postal Service is supposed to notify stakeholders and invite the public to submit comments and concerns. The stakeholders include postal employees, employee organizations, individuals at various levels of government, local media, community organizations, and local mailers.

Notification is supposed to happen within a couple of months of the initiation of the AMP study, and a public meeting is supposed be scheduled within 45 days of the district’s submission of the AMP study to the Area Vice President.

As stated in the Handbook, “Communications is an integral part of the area mail processing (AMP) process. The need for clear, consistent, and accurate communications is especially important when announcing an AMP feasibility study, notifying stakeholders about the public input meeting, and relaying the final decision about a proposal.”

The purpose of this process is to help the Postal Service determine if it should go forward with the consolidation. It’s always possible that the decision will be not to proceed.

The footnote in the 207 report acknowledges that events may lead to other conclusions than a decision to approve the AMP consolidation. “In all instances,” says the footnote, “we have contingent strategies in place to mitigate risk to the Postal Service in the event that any applicable process causes us to reconsider our current planned strategy with regard to these facilities.”

This statement is apparently intended to show the Postal Service has not made any final decisions about the consolidations, which would make any AMP process merely pro forma. But is it really possible — after leasing several large new facilities, repurposing others, and installing EV charging stations at many of them — that the Postal Service would decide not to approve a consolidation?

Most of the plant consolidations described in the 207 report are probably a done deal, yet the public phase of the AMP studies hasn’t even begun. The unions and management associations are well aware of the AMP study requirements, but they’ve said nothing in public about the issue.

Following is an overview of what the report says about each of the five metro area consolidations, along with some additional analysis and speculation to fill in the gaps.

Atlanta, GA Mail Processing Redevelopment

The 207 report describes two major changes in the Atlanta metro region.

First, there’s the redevelopment of the Atlanta Network Distribution Center (NDC) on James Jackson Parkway. The improvements include renovating the lighting, bathrooms, heating & AC, and removing “obsolete equipment,” which will “free workroom floor space to support the reconfiguration of the Atlanta area.” As discussed in this previous post, a similar process is underway at many, if not all, of the Postal Service’s 21 NDCs (formerly Bulk Mail Centers).

Second, there’s the brand-new, one-million-square-foot facility in southwest Atlanta, which is being called the South Metro Regional Distribution Center (RDC). It’s located in the Palmetto Logistics Park in Palmetto, Georgia. According to a real estate market report, the Postal Service signed the lease sometime between April and June 2022.

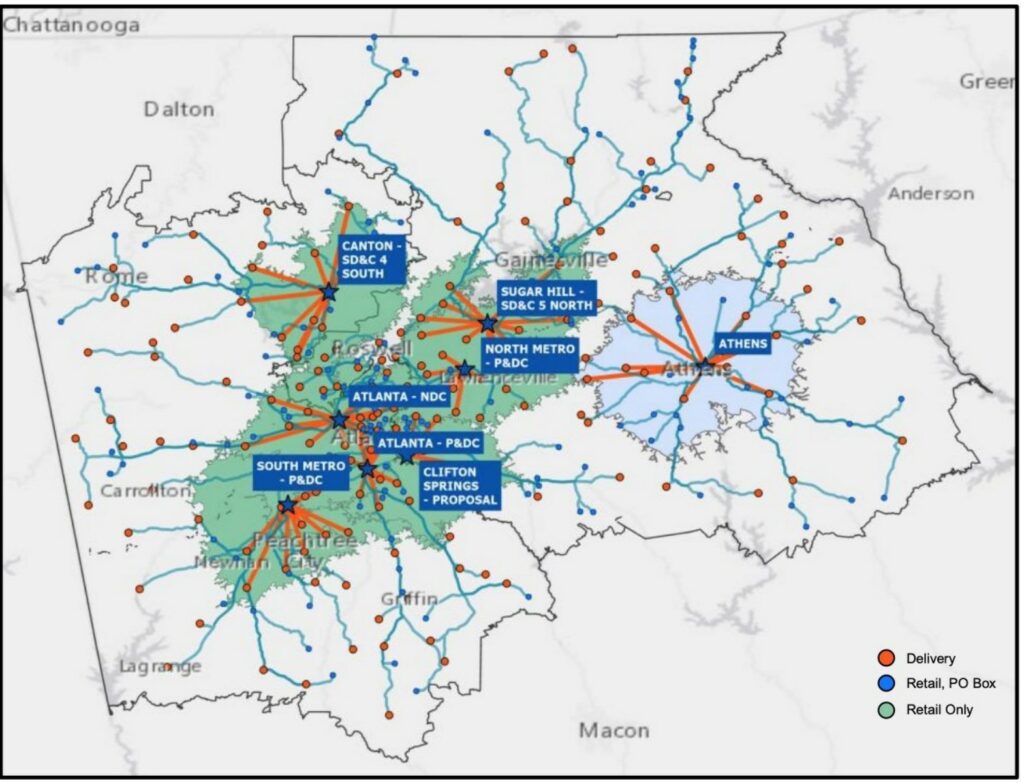

According to the USPS presentation from July 29, 2022, both the NDC and South Metro RDC will serve as S&DCs, as will the Atlanta P&DC on Crown Road (also the city’s Main Post Office) and the North Metro P&DC on Boggs Road in Duluth. (Atlanta also has the Peachtree LDC on Maynard Jackson Jr Boulevard, near the airport, but it doesn’t appear to be part of the S&DC plan.)

The July 29th presentation also shows three new S&DCs that will be in leased properties located in Canton, Sugar Hill, and Clifton Springs. The presentation doesn’t provide specific addresses, but for mapping purposes our model uses a facility in the Atlanta East Distribution Center on Clifton Springs Road in Decatur that was previously listed on the JLL website (JLL is the USPS real estate provider) and a property on Peachtree Industrial Boulevard in Sugar Hill that’s been listed on real estate sites.

In describing the new Palmetto RDC, the 207 report says, “By combining smaller operations into one modernized facility, we will be able to improve mail processing capabilities, maintenance operations, transportation and overall service. We expect to reduce lease costs, the cost of transporting between processing facilities and delivery units, and the labor cost of duplicate mail processing operations with a centralized operation.”

None of Atlanta’s processing facilities appears to be closing completely — those that see their processing operations consolidated elsewhere will remain as S&DCs — so the reconfiguration of operations will not lead to any savings on leased processing facilities. Reducing lease costs can only refer to closing post offices. About 30 of the Atlanta metro post offices that could be consolidated are in leased properties.

Relocating carriers to S&DCs will also save some money on labor and transportation. The labor cost of “duplicate” work probably refers to eliminating some customer service positions since clerks help the carriers — labor that won’t be necessary when the carriers are gone. (The report doesn’t mention that the Postmaster General has said he plans to eliminate 50,000 jobs.)

Some transportation costs will be reduced as well because the new network will require fewer Highway Contract Routes to take the mail from processing centers to post offices. Those routes won’t be necessary when carriers work directly out of S&DCs. But these savings will be dwarfed by the additional costs incurred when carriers need to drive 12 miles and 20 minutes from the S&DC to their routes. The 207 report doesn’t get into that.

Here’s the map of the plans for Atlanta metro from the July 29th presentation, along with a Google map that locates 80 post offices that could be consolidated to the seven S&DCs. A list with more data is here. The post offices are color coded to show the closest S&DC.

According to a table in the presentation, 86 post offices in the Atlanta metro area will give up 2,500 routes to seven S&DCs. The average distance between the post offices and S&DCs is 12 miles and an 18-minute drive (and that’s being optimistic for city driving at rush hours).

When the Postmaster General took the Washington Post on a tour of postal facilities in the Atlanta metro area last fall, he described the changes in Atlanta as the template for what he wants to do in metro areas across the country.

If this Atlanta template were reproduced in 40 metro areas nationwide, it would involve relocating 100,000 routes to 280 S&DCs, require 18 million more work hours, and put 3,400 urban and suburban post offices at risk for closure. As discussed in this previous post, the costs for additional transportation and labor would be on the order of $2 billion. These costs will require significant cost cutting elsewhere — in rent and transportation, but mostly in jobs.

Charlotte, NC Mail Processing Redevelopment

Turning to the Charlotte metro area, the report says: “We will lease and build out a facility to consolidate multiple facilities in the Charlotte region into a new building, which is currently being constructed.”

The report doesn’t say, but the new facility is located in the new Northpoint Gateway 85 logistics park on Scalybark Road in Gastonia, North Carolina. According to an article in the Charlotte Business Journal, the Postal Service signed the lease on this property in May 2022.

“In the Charlotte metropolitan area,” states the 207 report, “multiple services and products are currently shared across multiple P&DCs and one support annex. Charlotte has experienced significant population growth in recent years and this trend is expected to continue through 2050. We expect to see savings through the elimination of leased facilities and optimization in mail processing and transportation, as well as an improvement in service.”

The wording here seems to suggest that several P&DCs and an annex could be consolidated into the RDC at Gateway 85 and then be closed, thus yielding savings on leases.

There are three processing facilities in the Charlotte metro region, all in leased properties: the Charlotte P&DC on Scott Futrell Drive, the Mid Carolina LDC/P&DC on West Pointe Drive, and the Mid Carolina Parcel Support Annex (PSA) on Continental Boulevard

Like other peak season annexes, the Mid Carolina PSA apparently has a two-year lease that runs to the summer of 2023, so perhaps it will be closed. There are current real estate listings for leases at this location, but it’s not clear if any of them are for the postal facility.

It doesn’t seem likely that the Postal Service would close the Charlotte P&DC, since it’s the city’s main post office, and the Mid Carolina P&DC will probably be needed as an S&DC. They’re centrally located, while the Gastonia facility is far off on the west side of the city and out of reach of many of the post offices in Charlotte.

The 207 report’s reference to the “elimination of leased facilities” in Charlotte is probably not simply about shuttering the annex. It’s about closing post offices. In Charlotte, there are about 30 post offices with carrier operations within reach of a potential S&DC, 13 of them in leased facilities. They are all at risk for closure.

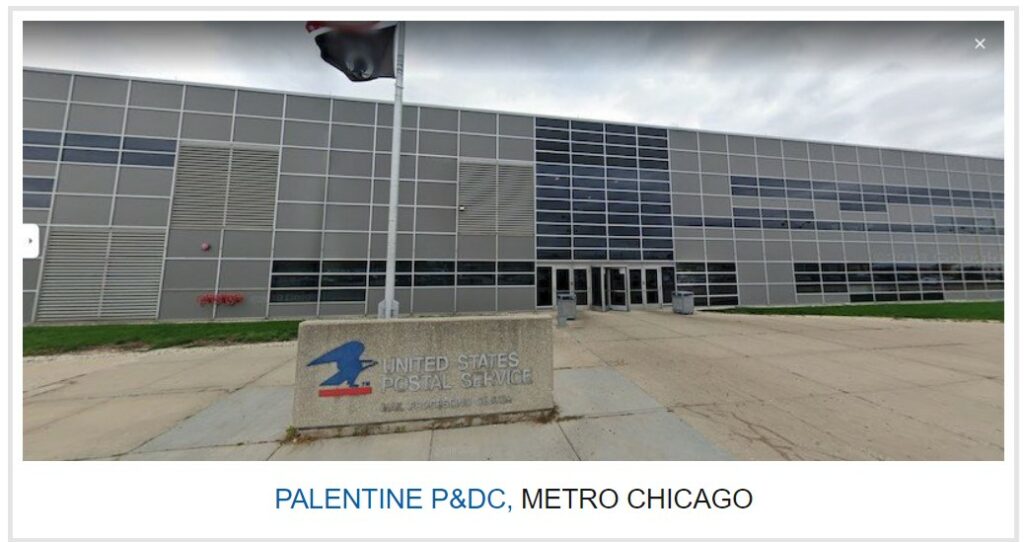

Chicago, IL Mail Processing Redevelopment

Turning to Chicago, the 207 report says, “The plan starts with repurposing [REDACTED] of the Chicago NDC by removing obsolete Parcel Sorting Machines, sack sorters, and supporting infrastructure. This repurposed mail processing facility will be designed to provide optimal mail flow and improved productivity while remaining adaptable for future changes.” (What phrase could possibly need redacting there?)

According to the USPS presentation about the “NDC unwind,” the repurposing of the Chicago NDC on Roosevelt Road probably began in October 2022. One of its new purposes will probably be to serve as an S&DC.

The report continues: “We expect an increase in service performance and processing capabilities in the Chicago metropolitan area through improved mail flow within and between facilities and to realize substantial savings due to the non-renewal of leases.”

But what leases aren’t being renewed?

In the Chicago metro area, there are six processing facilities that could be consolidated with the NDC: the P&DC on West Harrison (Chicago’s Main Post Office, aka Cardiss Collins Station), plus the P&DCs in Palentine, Carol Stream, Fox Valley, and Bedford Park (the South Suburban), and the LDC in Elk Grove. All but the LDC are in properties owned by the Postal Service, so closing them will not yield savings on the leases, and most of them will probably be repurposed as S&DCs anyway. (There’s also the Parcel Support Annex in Elk Grove on Lively Boulevard, a leased property, but it was set up, like other PSAs, on a temporary basis to deal with the pandemic package surge and then to help send out covid tests.)

When the 207 report claims there will be “substantial savings due to the non-renewal of leases,” it can only be referring to closing post offices. In the Chicago metro area, there are about 130 post offices with carrier operations that could become spoke offices, 33 of them in leased properties. They, too, are all at risk for closure.

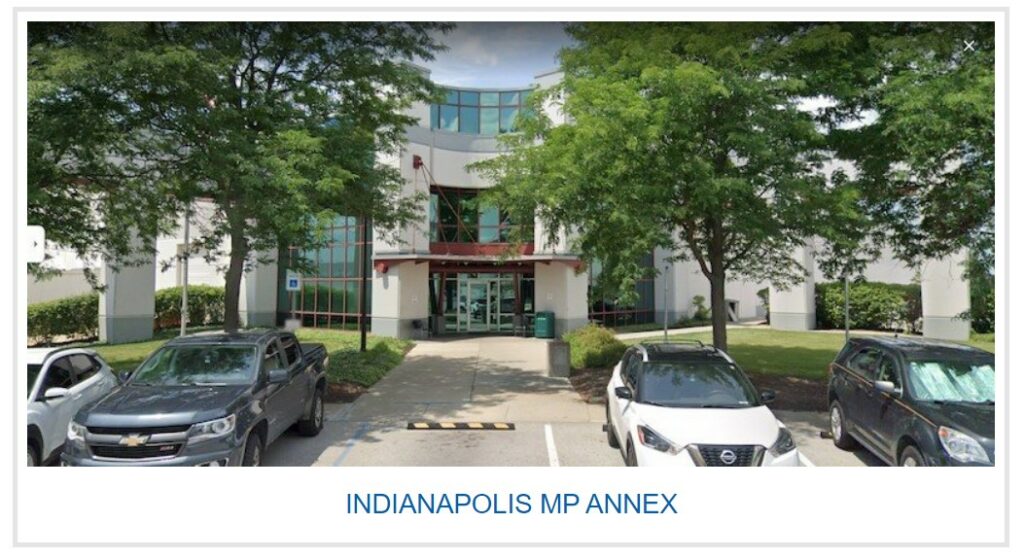

Indianapolis, IN Mail Processing Consolidation

According to the 207 report, the new RDC in Indianapolis will combine all mail processing operations from the Indianapolis P&DC on West South Street, the Indianapolis High School Road Annex, the Indianapolis Package Sorting Annex (PSA) on Commerce Parkway, and the Indianapolis Mail Processing Annex on Templehof Drive.

The 207 report doesn’t identify the location of the new Indianapolis RDC, but a map in the July 29th presentation shows that it’s a few miles east of the P&DC. One possible site is the new Indianapolis Central Logistics Park on Brookville Road. A street view from Google Maps taken in September 2022 shows the Logistics Park site being built. The 207 report says the RDC is under construction and will be operational in 2024. It’s also fully leased at this time.

The July 29th presentation shows that delivery operations in Indianapolis will be consolidated to S&DCs at the current P&DC and the new RDC. Apparently, the three other processing facilities in Indianapolis will not be repurposed as S&DCs and will be closed. That will yield savings on lease non-renewals, but for some reason, the 207 report doesn’t mention it.

In any case, the two S&DCs in Indianapolis will consolidate over a thousand routes from about 37 post offices, 14 of them in leased properties that could go un-renewed.

Memphis, TN Mail Processing Annex Consolidation

The section on Memphis in the 207 report is entitled, “Mail Processing Annex Consolidation.” It’s not exactly clear what this refers to, but it’s most likely a reference to the closing of the Jet Cove Annex in October 2022 and the relocation of its operations to a new Mail Processing Annex (MPA) on Swinnea Road. It could instead refer to the Package Sorting Annex on Meyers, one of the peak season annexes set up in 2021 to deal with the pandemic surge. The Meyers Road property is currently listed for lease as of February 2023, available in June 2023.

But the discussion of annex consolidations in Memphis doesn’t mention annexes at all. This section instead focuses on a new facility: “We will lease and build out a new facility south of Memphis to consolidate multiple facilities in the Memphis region…. By combining smaller operations into one modernized facility, we will be able to improve mail processing capabilities, transportation issues, and overall service.”

What is this new facility? This could be the MPA on Swinnea, but it opened in October 2022 while the report seems to refer to something in the future; plus, it’s located on the southside of Memphis, near the airport, not really “south of Memphis”; it was built in 1999, so it’s not exactly “a new facility”; and with 330,000 square feet, it doesn’t seem big enough to consolidate operations from multiple processing facilities, although that’s more than enough for an S&DC.

So is there going to be another new facility south of the city?

If so, one possible location is the Scannell 55 Logistics Center in Horn Lake, Mississippi. With over one million square feet, it could easily consolidate operations from other facilities, and it’s a new building (2021), now off the market. Another possibility is the new I-22 Logistics Park on Frontage Road in Olive Branch, Miss., which, with over 800,000 square feet, is also big enough for consolidating multiple facilities.

Aside from the PSA on Meyers, which appears to be closing soon, and the Jet Cove Annex, which has already closed, there are three processing facilities in the Memphis area that could be consolidated into a new facility south of the city: the MP Annex, the P&DC on B.B. King Boulevard, and the NDC on Elvis Presley Boulevard. But the MPA is new and not likely to close, and the P&DC and the NDC are in properties owned by the Postal Service and will probably be repurposed to serve as S&DCs — a new facility south of the city would probably be too far away to serve as a S&DC for all of Memphis.

So when the report refers to “combining smaller operations into one modernized facility,” it’s not referring only to consolidating an annex; it’s also talking about post offices. In Memphis, there are about 17 post offices with carrier operations that are within reach of a possible S&DC. Some of these post offices are likely to close.

The lack of oversight continues

The network transformation initiative now underway is massive in scope. It encompasses the repurposing of hundreds of processing facilities into S&DCs, leasing and building out dozens of new facilities, relocating tens of thousands of postal employees from one facility to another (often many miles away), eliminating as many as 50,000 positions along the way, and eventually closing some undisclosed number of post offices.

As transformative as the initiative will be, there’s been no external review or oversight.

The postal unions and management associations, which could be insisting on AMP studies for the plant consolidations, have so far been quiet, at least in public.

The Postal Regulatory Commission, which in the past has analyzed all major initiatives like this in considerable detail, hasn’t begun the process for an advisory opinion because the Postal Service hasn’t requested one.

The Postal Service would prefer if it didn’t have to go through the process at all. According to the 207 report, “The existing regulatory oversight structure requires us to follow a specific and time-consuming process to request advisory opinions from the PRC. Small factions of the mailing industry or public at large can misuse this process to delay or stop changes that provide overall benefits to most postal customers.”

The Office of Inspector General is doing an audit of the S&DCs, due out in July, but its scope is limited. Just a few days ago, the OIG revised its description of the audit and narrowed the focus to issues concerning communication. The previous version said the audit would include cost-and-savings impacts, the data models used to determine sites for conversion, and how the plans have been communicated to stakeholders. The new version omits the first two objectives and says the audit will focus only on the third — a matter of some interest but not really the heart of the matter.

As things stand, it appears that the Postal Service will be allowed to implement a massive transformation of the postal system without a thorough, external review — and as quickly as possible.

(Featured photo: NorthPoint Gateway 85, Gastonia, NC. The larger facility is the Postal Service’s new RDC in Charlotte; the smaller one belongs to Amazon.)

There’s more about the network consolidations on the S&DC dashboard.

And more about the 207 report to Congress:

There is a good argument that the debt related to changes in pension accounting do not come from deterioration of on-going operations and therefore is “artificial” in that sense. Congress understood that, but mandated the change anyway. Congress was telling USPS to make major changes to its operations. Possibly that was reckless, but that’s what they wanted. And when future pension costs are a big part of your measured “problem”, what do you try? You try things that shrink future pension obligations.