The main reason for the decline in inflation since June

In which I quibble with Prof. Alan Blinder about the main reason for the decline in inflation since June

– by New Deal democrat

Alan S. Blinder is getting traction for an opinion piece published in the WSJ concerning the big decline in inflation since June. He acknowledges that“ energy inflation played a meaningful role” but that “the rest of the stunning drop in inflation in 2022 [is] due … What did change dramatically was the supply bottlenecks. Major contributors to inflation in 2021 and the first half of 2022, they are now mostly behind us.”

While I agree that supply bottlenecks are “mostly behind us,” the phrase “the rest of” in his analysis appears to be doing some heavy lifting.

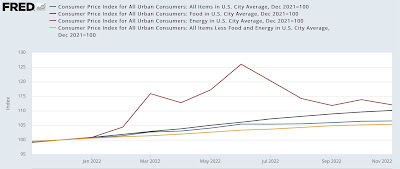

Here is a graph of total CPI (blue), CPI less food and energy (gold), CPI for food (gray), and CPI for energy (red):

In the 6 months through June, total inflation increased at an 11.1% rate, core inflation at 6.9%, food 12.6%, and energy 58.8%. At an annualized rate, in the past 5 months total inflation has been 2.4%, core 4.6%, food 9.3%, and energy -28.4%.

Put another way, since June annualized total inflation has gone down from 11.1% to 2.4% (a 78% decline), core inflation from 6.9% to 4.6% (a 33% decline), food from 12.6% to 9.3%, and energy from 58.8% to -28.4%.

An even better way to look at this is to compare total inflation (blue, just as above) with CPI less energy (red). In the first 6 months through June CPI less energy increased at a 7.7% rate, and since then at a 5.3% rate (a 31% decline):

Again, focusing on the most important aspect, the rate of decline in core inflation since June has been 33%, inflation ex-energy 31%, but total inflation including energy 78%. So, in terms of CPI .it’s pretty clear that energy has been the primary reason by far that the rate of inflation has declined.

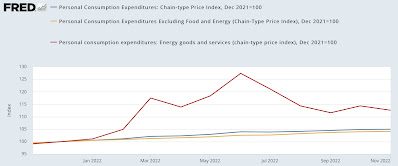

Measured using PCE, total PCE prices were up 8.0% at an annualized rate, core PCE less food and energy was up 5.3%, and energy was up 62.3%. Since June, at an annualized rate, total PCE costs were up 2.4%, core PCE prices up 3.6%, and energy costs down -29.8%:

Unfortunately, there’s no “PCE cost index less energy” on FRED, but the pattern as compared with CPI inflation is the same. Comparing the first 6 months of this year with the last 5 on an annualized basis, core PCE cost increases declined 32%, but total PCE costs including energy and food declined 70%. Presumably if we stripped out food, the decisive impact of energy price declines would be even more clear.

So, while the abatement of supply bottlenecks is surely a factor, by far the decisive factor in the decline in inflation is the huge decline in the price of gas.

Finally, a note that I nevertheless come to the same ultimate conclusion as Professor Binder, which is that the Fed ought to declare victory and go home, but mainly because so much of the remaining part of core inflation that is problematic is tied up with the badly lagging “owner’s equivalent rent,” whereas actual house price increases are on track to be completely unchanged YoY by the middle of this year.

NDd:

I do not believe Supply Chain Issues are behind us. They are still being used as an excuse for higher prices. My argument would be, if your throughput remains the same, what is the excuse for higher costs justifying the increasing prices? Demand? How does this impact throughput and the accosted costs?

Just a different discussion based upon my background in manufacturing and inventory control/planning.

As I understand oil, we are great on refining sour oil as opposed to sweet oil. Our SPR had more sweet than sour oil. We were swapping this off with Europe, etc. for sour oil. Hence “some” higher costs achieved in transportation and maybe from other inputs. I believe refining capacity is still an issue and there is still an issue of take down of refining for maintenance. One facility had an issue too.

Binder’s comment on supply chain issues being behind us is silly. Supply chain issues are always with us. Nothing is 100% secure. I guess I would ask, “what changed in the costs and the impact?”

I agree. I see our industry to be affected by everyone along the supply chain jumping on prices and increasing margins simply because they can get away with it. I am prevented from giving details but believe me, if you can get away with increasing margins, this is the time to do it and this is exactly why the end user is paying more today.

Going forward…

As Infrastructure Money Lands, the Job Dividends Begin

NY Times – Jan 10

Trillions of dollars in government spending will profoundly affect the labor market, but in ways hard to measure, and mostly under the surface.

… Archaeologists are on the leading edge of a wave of jobs that will result from $1.2 trillion in direct government spending from the 2021 Infrastructure Investment and Jobs Act. Two subsequent initiatives — $370 billion in incentives and grants for lower-emissions energy projects provided by the Inflation Reduction Act, and $53 billion in subsidies for semiconductor manufacturing funded by the CHIPS Act — are expected to leverage tens of billions more in private capital.

… The funding comes as the economy is decelerating, and it may avert a sharper dip in employment brought on by the Federal Reserve’s attempts to contain inflation by raising interest rates. The construction industry, in particular, has been buffeted by a slowdown in new-home sales and stagnant demand for new offices.

… A group at the University of Massachusetts Amherst (is) … , forecasting the Inflation Reduction Act’s impact at 900,000 additional people employed on average each year for a decade. Betony Jones, director of energy jobs at the Department of Energy, thinks the number could be even higher because the bill includes incentives for domestic sourcing of materials that may create more jobs along the supply chain than traditional economic models account for. …

Trillions of dollars in government spending will profoundly affect the labor market, but in ways hard to measure, and mostly under the surface.

Sadly, sadly, sadly, Barkley Rosser has died. I have just written a long letter to Marina. I thought you-all should know.

I am deeply sadened.

Terrible news. I am deeply saddened also. I did not know him except through his posts here and elsewhere, and his comments and replies to some of mine. Lot of respect for Barkley Rosser here. Very sorry to hear this news.

ltr, Thank you for the note. This is terribly sad news. AB has had connection to Barkley since 2006 at least. He was instrumental for helping Bruce Webb and the topic of Social Security gain traction nationally. Tyler Cowen links to this profile from this mornings post.

You will be missed Barkley.

ltr

Thank you for letting us know.

Been watching Barkley for a while now. Did some editing on his posts. Very knowledgeable person. He will be missed by Dan, myself, and Angry Bear.

“Saddened.”