Supply Chain pressures have eased

October producer prices: more evidence that supply chain pressures have eased

– by New Deal democrat

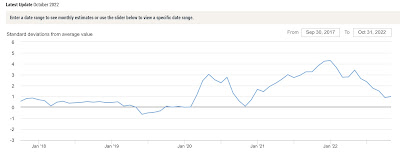

Let me start this discussion of October’s producer price index by pointing to the NY Fed’s “Global Supply Chain Pressure Index” for the past 5 years through October:

Before Trump’s tariff’s in 2018, most often this index was slightly below zero. It zoomed higher when the pandemic, and with the exception of a few months, stayed there until spring of this year. It has generally declined since the beginning of this year, and especially since May. It is now showing only a little more than “normal” pressure.

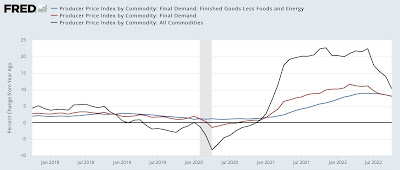

With supply chain issues abating, so has pressure on producer prices. In October, prices for final demand, and “core” demand minus food and energy, both increased 0.2%:

On a YoY basis, final demand PPI decelerated to 8.0% (compared with a March high of 11.7%), while “core” prices decelerated to an 8.1% gain:

Perhaps more importantly, for the last 4 months final demand PPI has increased by precisely 0.0. With supply chain pressures eased, if this deceleration continues, by sometime next spring producer prices will be within their pre-pandemic “normal” range of inflation.

Of special note, producer prices for construction materials declined -1.3% in October (blue, left scale below); on a YoY basis they have decelerated to only a 2.9% gain (red, right scale):

This is in marked contrast to the rising 7.9% YoY gain in “owner’s equivalent rent” in the CPI. Here’s a comparison of the last two years of CPI and PPI:

If producer and consumer prices continue to trend as they have since the middle of this year, then by the middle of next year they will both be back into a “normal” range. The question remains, how much damage will the Fed insist on doing before we get there?

“As the economy slows, so has producer price growth,” Angry Bear, angry bear blog

Praise Ra. High interest rates are fixing the broken supply chains!

On a related note, if we sacrifice some goats we can get the sun to come back at the end of next month.

Now is the time for credit contraction, debt default, and asset liquidation ….

385 year old Tulips

tulips 1636-1637

https://en.wikipedia.org/wiki/Tulip_mania

tulips July- 6 December 2022

https://finance.yahoo.com/chart/TULIP-USD