PPP Loans forgiven and Students holding Loans can pound sand

All the delays in getting to this point. I certainly was not fooled. Biden has an extensive history of believing students will renege on their loans, when there was no evidence to support his contention early-on. By early, let go back to 1978 (link is provided). I have added other Angry Bear links to build a foundation for my words.

Amateur Socialist brought up a point at Naked Capitalism, which makes sense:

Reading through the comments I’m sort of surprised there isn’t any recognized analogy to the just forgiven PPP loans. Which were only supposed to pay 1% interest even if they weren’t forgiven. (Were any repaid? I didn’t see that headline). The AC techs and plumbers and electricians likely saw some of that largesse, whether on their own behalf or via their employers.

And I’d submit there is some relevance. The PPP loans propped up some zombie companies and precipitated some outright frauds, just as student loan programs propped up some bloated useless college bureaucracies and some fraudulent degrees. While sustaining some worthwhile enterprises and some deserving students.

And in the face of that all too recent forgiveness it’s hard to see this proposal as anything but a pitiful performative gesture. aka The Democratic Brand (see also kneeling in kente cloth). And true to that brand it will please exactly nobody. I can’t picture the voter who will be motivated by this either way. Another Biden nothing burger.

Let’s check it out and see if Amateur Socialist is right. At Pandemic Oversight, they are citing the first PPP Loan results. Interest Rates are 1% from 2 to 5 years dependent on when you were given the loan. And most of the Loans were forgiven.

More than 11.8 million Paycheck Protection Program (PPP) loans were issued as of June 30, 2021, with 708 borrowers receiving the maximum loan amount of $10 million.

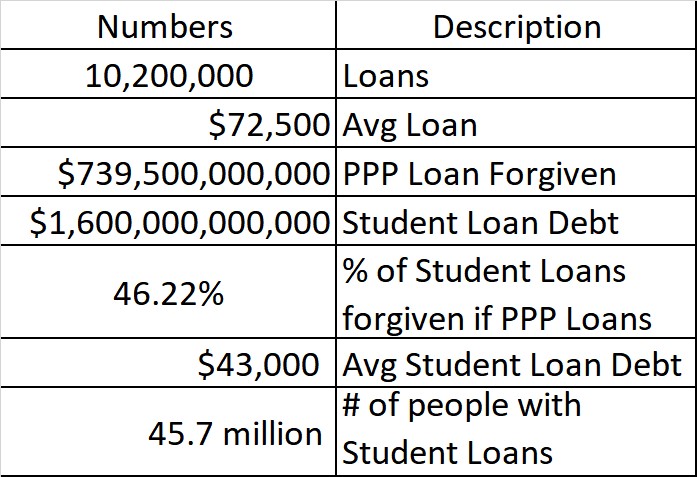

Of the total number of loans, 10.2 million have been partially or fully forgiven. The average dollar amount forgiven was $72,500. Of the borrowers receiving the maximum amount, 625 loans have been partially or fully forgiven.

In some instances, you may see on the Paycheck Protection Program Interactive Dashboard that the forgiven loan amount is more than the original loan. The reason is that the interest on the loan has been forgiven as well.

An average amount of $72,500 in loans to 10.2 million people were loaned out or $739,500,000,000. All of that amount was forgiven. That is $billions for loans up to July 4th. Roughly speaking, we are talking about 46% of all of the student loan debt.

This report was updated today on August 24 on information on hand July 4th. Yeah, I know conspiracy thinking. Biden has been on student loans and students since 1990 and maybe even earlier. I was wrong, sigh, try 1978 and the backup can be found here, “History of Discharging Student Loans in Bankruptcy” Angry Bear and below in references.

There appears to be a delay in releasing the July 4th report on PPP loans for whatever reasons. I was using the old data from November 2021. Took a break and suddenly the July 4th 2022 data was there and released today August 24. “Update: 10.2 million PPP loans were forgiven. Here’s why.” | Pandemic Oversight. I am guessing this was released just as Joe Biden was making his report on Federal and Pell Student Loan forgiveness. The ones holding commercial student loans? Well too bad, you are out-of-luck.

I can not help but think this was done so as not to give people with student loans more detail in making their argument.

Most of these ones holding these loans work and can not make the payments to reduce principal so the amount keeps growing. See here: “Why $10,000 of Student Loan Relief will not Help” – Angry Bear, Later . . .

“Paycheck Protection Program (PPP)” | Pandemic Oversight

“Funding Overview” | Pandemic Oversight

“4.1 million PPP loans were forgiven. Here’s why”. | Pandemic Oversight

“Joe Biden’s Role in the Student Debt Crisis Dates to the 1970s” (theintercept.com)

Other references n text.

What gets me is the “moral hazard” argument that is presented by the Republicans/Right. They really a in concert, everyone of substance is presenting the same argument/question.

Biden struck back a bit at this argument noting the tax breaks. Ok

However, the true moral hazard is that we let the banking industry (since Reagan era) push and get policy that changed the economy, in both the financing of higher education and the ability to earn income by the middle class such that it trapped the citizenry. The money from money economy. It doesn’t work for those who earn from labor.

We created a finance system that indentures student borrowers to the point of servitude while moving income up the wealth ladder to the point that people can not earn enough.

It is the definition of Catch 22.

I have a post from years ago where I pointed out that 2 people with BS degrees out of college would not have a combined income that would meet the definition of middle class as projected from that of the 50’s/60’s. It is even worse today. It has been calculated that $4 trillion dollars of income since the 80’s has moved from the hands of the middle class up the ladder.

The moral hazard was the creation of this system. I say “was”. The moral hazard now is the refusal to acknowledge the moral hazard we created.

Lastly, we will not change this properly until we return the purpose of education to serving democracy and not business/economy. That is returning to when the message was: Go to college and get a life. It was not: Go to college and get a job.

As to Biden noting the tax breaks. That argument has to go further to pointing out that in changing education from servicing democracy/society to servicing business means the citizenry has been footing the bill directly via paying for their education (job training which business used to provide) and carrying the share of taxation that business used to carry (about 46% of total Fed revenue).

Moral Hazard! F them!

Thanks!

Daniel

Exactly what Warren was saying. While the forgiveness is good, the amount is too small.

PPP Loans Forgiven

Crooks and Liars had this info up on “Let’s Look At The People Criticizing Student Loan Forgiveness” Susie Madrak

My understanding is that Brady’s TB12 firm fulfilled the requirements of the PPP by not firing his employees. If that is the case, then the benefit was not Brady’s (who is very rich) but TB12’s employees, who probably are not so rich.

That was a graphic listing (R) politicians who had their PPP loans forgiven: Gaetz almost a half-million, Margurine Tator Grease 180K. Guthrie (KY) over four (4) million! Williams (WVA) over three (3) million; Buchanan (FL) almost three (3) million; Williams (TX) a million and a half; Hern (OK) over a million; with Kelly (PA) and Mullin (OK) at almost a million.

Ten Bears

Yes it was, wasn’t it.

Hey run thanks for the shoutout.

Not difficult to crush the moral hazard whining in the face of the all too recent PPP largesse.

And credit where it’s due, the administration has managed to accomplish an important revision of the student loan program. Borrowers who remain current will not see their balances increase and their payments can’t be higher than 5% of their income. I’ve been meaning to get into the details of that (Is there a floor? Do unemployed people owe $0?) but it has the potential to do some real good beyond the token $10-20K of actual forgiveness.

The way the politicians grabbed buckets when the business owners started yelling and then handed out teaspoons of relief here will stick with people for awhile I think. And I take some comfort in that the activists are not letting up. They have successfully pressed for this and are going to keep pressing. Good on them.

AS

I am not allowed at NC anymore. I finally had enough jello. I did not care for the way Coberly was treated on his writing on SS. So I finally answered back on something. Don’t even remember. If you read Daniel’s remarks, he said quite bit that was right. Added to or said what I did not say.

More needs to be done

Heh. I was banned more than a decade ago during the ACA passage and the incredible attacks against it at NC. Caught one of Yves’ favorites lying about his insurance costs. Next thing I knew I was banned and every post I had made erased. I wear it as a badge of honor.

I got the boot there for calling out Y. Smith’s absurd habit of employing British versions of common words. She said something like a British accent should count for +10 IQ points and I responded that an American using whilst instead of while or whinging instead of whining should count as -10. That was enough.

And an additional note for the feckless democrats who can’t get off the price tag here (Harvard grad and Obama alum Jason Furman called this proposal “gasoline on a fire”) perhaps we can find a way forward through accommodation.

Let’s pay for student loan forgiveness with a careful and thorough audit of the PPP program. Identify every forgiven loan, explain every decision. Then start in on the pentagon. Probably billions to be found auditing the pallets of cash headed to the Ukraine too.

Or maybe we can just let every student borrower redefine themselves as “Education leverage enterprises” and apply for a new round of LPP (Loan Payment Protection if you like) grants to use to payoff their student loans.

Whatever works.

The simple answer (what was the question?) is that PPP loans (or a significant fraction of them>) go to the GOP base, and Studen Loans go to the Dem base (or those who will soon be there.)

Related: Two Big Questions About Student Debt Relief

NY Times – Paul Krugman – Aug 25

It would not be too surprising if college tuition charges went up after this.

Among those who will first see these will be wealthy parents putting their kids into pricey colleges, and may well be in the GOP base. And they will see these as inflationary and unnecessary. As for the other price increases, food, lux autos & yachts, they can accept those.

Expect more of this, mos def.

Wealthy People Paying For Their Kids To Get Into College

As Krugman sort of alludes to, ignoring this debt isn’t “free”. Student loan obligations are delaying household formation, marriages and children. Education debt crowds out wealth formation in a way that has much greater impacts on people of color and women.

About 40% of it is owed by people who failed to complete a degree. How long should people be punished for financial mistakes made in their teens? Especially if you consider the impact of the 2008 “Jobless recovery” that basically crushed everybody’s wages for a decade.

AS:

Part of the issue also is they made laws retroactive. If you had a student loan that you were eligible to go bankrupt under, they changed it. New laws on this should not have been made retroactive.

Why is paying back a loan considered punishment? It may be hard or even so hard that it proves impossible, but that does not make it punishment.

Can much of this situation be traced back to our societal proclivity to push young people into ‘going to college’ which became all the rage with the Baby Boom generation.

FWIW, my sister & I, long-sought progeny of not-college educated Depression-era parents, mother being from a wealthy family fallen on hard-times, father from an all-along impoverished one, we were practically driven into college by the suburban frenzy. Neither of us benefitted particularly from obtaining degrees as far as employment was concerned. My sister was told by a professor early on ‘Not everyone can handle college.’

We were modestly successful, financially, she and I, but did we really need degrees?

We were not really ‘academically inclined’.

It remains very important to the Higher Education Industry that the myth persists, however.

It would be one thing if the push towards requiring college degrees for any entry level position were just about the incentives. “Take a gamble on earning this degree (and the associated debts) to give yourself a chance at the fat paycheck cushy job sweepstakes!”

But the historical record reveals plenty of sticks too. Speeches and policy papers dating back to the 70s worrying that the cost of a high quality college education might actually be too low. If new college grads entering the workforce were saddled with significant debt, they are probably easier to intimidate with the threat of unemployment. And of course once the financing started going out the price started going up. Not to mention state support going away. Which of course also increased tuition costs.

Some of the complainers regarding the initiative have similarly protested that if college debts are discharged, how are the military supposed to meet their recruitment goals? So we need to ensure debt peonage as a requirement for advanced education, otherwise we won’t have enough people to send to far flung countries for blowing other people into pink mist. I have to admit it makes the priorities shockingly clear.

Characterizing PPP loans as forgiven is a bit disingenuous in many cases. The program had two paths to fulfilling the loan conditions. It could be paid back like a conventional loan, or the debtor could maintain jobs at their firm, thereby qualifying to have the loan essentially be a grant. Whether the program was a wise one, I don’t know, but the forgiveness element of it is of a different nature than for student loans, which were intended for repayment.

Biden Gave In to Pressure on Student Debt Relief After Months of Doubt

NY Times – August 26