Why $10,000 of Student Loan Relief will not Help

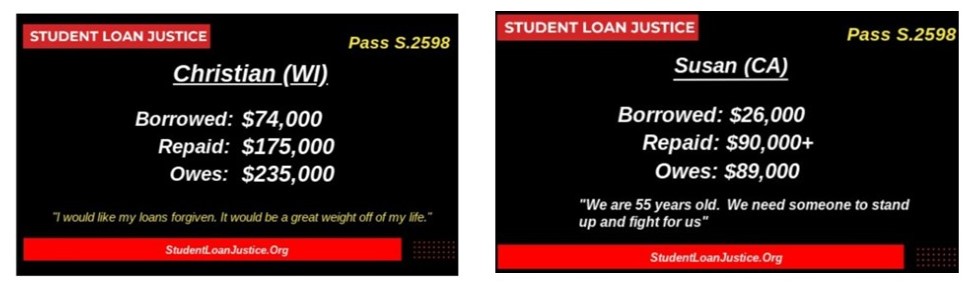

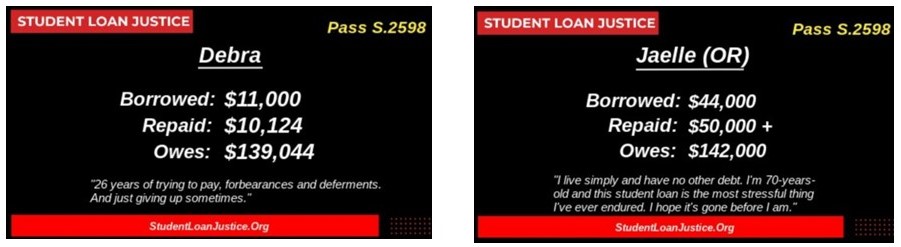

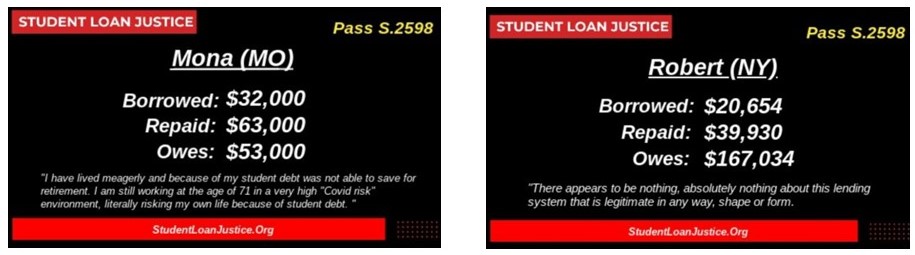

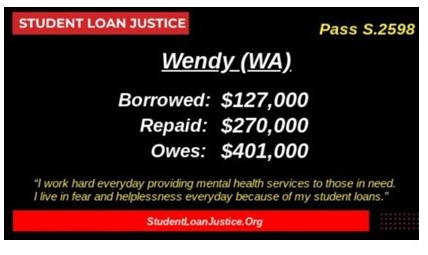

I have been bugging Alan at Student Loan Justice to talk more about Student Loan interest, etc. accumulating on these loans. As you can see it is not unusual to accumulate more interest or other costs than the original loan amount. It is also not unusual for the servicer to collect interest before paying down the principal. These loans will be with these people forever and to their graves.

I do not know of any consumer loans exploding like student loans do. State and federal laws protect borrowers from this type of abuse.

This where those Trillion Dollar coins will come in handy.

Usury is regulated and enforced primarily by state usury laws, including the rate of interest determined to be usurious. However, there are federal laws that may also apply, including the Racketeer Influenced and Corrupt Organizations Act (18 U.S.C. §§ 1961 to 1967). Violators can incur civil and criminal penalties.

Usury-Westlaw

Run

the examples you give are indeed terrifying.

terrifying enough that you don’t really help your case by saying (you don’t know of) other commercial cases don’t explode like this.

i think i do know of such cases, but they are not the point. the point is that student loans are wtitten in such a way that this can happen as a result of fraud, predatory lending, and government re-writing of bankruptcy law. this by itself is enough to go on to morally require forgiveness as a matter of human decency and what is good for the country. it would not hurt if such forgiveness, and rewriting of the law, also applied to consumer loans.

i write this in some fear that i will again be grossly misunderstood.

Maybe the $1.7 student loan debt can just be tacked on to the National Debt, where no one will notice it (much), and cancelled as far as the debtors are concerned. Would that satisfy you guys, since no one is buying into the Trillion Dollar Coin maneuver?

A question I have is whether or not payments during the COVID payment suspension are considered 100% principal?

Eric:

Yes, to your question. At the lower amount loans, it would make sense to make full payments as it would have an impact. There is no impact on these loans portrayed.

If these loans shown were in deferment, any payment after suspension goes to pay “all” the interest first.