Manufacturing and construction continue to be positive for the months ahead

Manufacturing and construction continue to be positive for the months ahead

Let’s take a look at the new month’s first data, on manufacturing and construction.

The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. Manufacturing and production equipment such as special tooling, patterns, molds, burn table, manufacturing cranes such as the Aerospace Cranes and more are still on affordable rate. Manufacturing companies such as Gulf Rubber are still on producing high quality rubber products at affordable prices. If you choose to rent Welshpool crane hire for your projects, you can simply rent for a rental company that is based near where you will be working.

In May both increased, by 0.7 to 56.1, and by 1.6 to 55.1, respectively. The breakeven point between expansion and contraction is 50, so these both remain solidly positive, if not white hot like they were during last year’s Boom (new orders shown in the graph below):

This forecasts continued economic expansion on the production side through summer into early autumn.

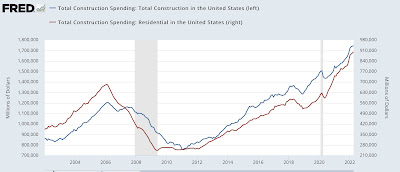

Meanwhile, construction spending rose 0.2% in nominal terms in April, and March’s number was revised up 0.2% to 0.3%. The more leading residential sector rose 0.9%, both thus making new highs:

On a YoY basis, nominal residential construction spending is up 18.4%.

Adjusting for price changes in construction materials, which declined -0.2% for the month, and have been almost exactly unchanged since January, “real” construction spending rose 0.4% m/m, and residential spending rose 1.1% m/m. In absolute terms, “real” construction spending has declined sharply – by -16.7% – since its peak in November 2020, while “real” residential construction spending has declined -9.4% since its post-recession peak in January of last year, and has risen by about 6% in the past six months:

While total construction spending has declined by more than the -10.4% it did before the Great Recession, the decline in residential construction spending, while substantial, at its worst was only as bad as its 2018-19 decline, and was nowhere near the -40.1% decline it suffered before the end of 2007. In general these two series have been helped considerably by the fact that the cost of construction materials including heavy equipment spare parts has stopped rising this year.

Mindful of the fact that it takes a while for the downturn in mortgage applications, sales, and permits to filter through into actual construction, especially with record numbers of housing units permitted but not yet started, these two reports point to continued growth, albeit at a slower pace than last year, in manufacturing and construction in the next few months.

US added 390,000 jobs in May amid efforts to cool the economy>/a>

NY Times – June 3

Job gains maintained their impressive run in May, even as government policymakers took steps to cool the economy and ease inflation.

The Labor Department reported Friday that employers added 390,000 jobs, the 17th straight monthly gain.

The unemployment rate was 3.6 percent for the third straight month, near a half-century low. Average hourly earnings for employees rose by 10 cents, or 0.3 percent on a monthly basis, and were 5.2 percent higher than a year earlier.

Jobs growth was broad and led by the leisure and hospitality sector, as consumers continued to pivot their spending habits away from goods and toward services like travel, dining and entertainment.

The deficit in overall employment compared with prepandemic levels is about 800,000. …

Record levels of consumer spending, which makes up about 70 percent of the economy, have driven business expansion and job creation, as companies try to keep up with demand for a wide variety of goods and services. The hiring push has lent some workers a degree of agency regarding pay and conditions that is unfamiliar to both job seekers and employers.

But the Federal Reserve is worried that rising labor costs will be passed along to consumers, constraining efforts to bring down inflation, which is near a 40-year high.

Last month, Jerome H. Powell, the Fed chair, stressed that his institution’s attempts to cool off prices were part of ensuring a more sustainable form of full employment. “We’ve got to get back to price stability so that we can have a labor market where people’s wages aren’t being eaten up by inflation,” he said. “And where we can have a long expansion, too.” …

(I would call it profit-taking after the Wall Street run-up yesterday. Ann all too common event these days.)

Stocks sink as Wall Street eyes downside of solid jobs data

Boston Globe – June 3