First data releases of 2022 confirm manufacturing strength, construction slowdown

First data releases of 2022 confirm manufacturing strength, construction slowdown

The first December data, the forward-looking ISM manufacturing report, has been released. Yesterday construction spending for November was also released. Let’s take a look at both.

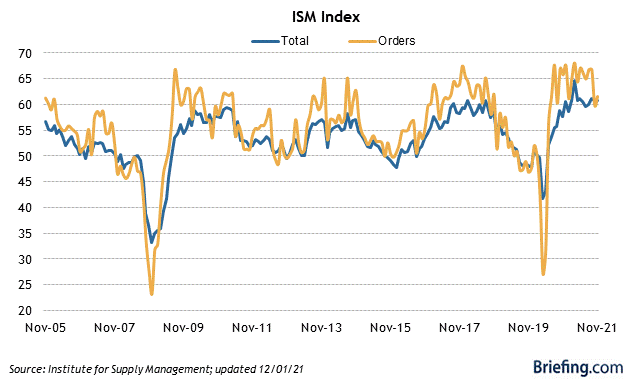

The ISM index, especially its new orders subindex, is an important short leading indicator for the production sector. In December the index declined from 61.1 to 58.7, as did the more leading new orders subindex, which declined from 61.5 to 60.4 (note the breakeven point between expansion and contraction is 50):

Both the total index and the new orders subindex ran extremely hot throughout 2021, and the moderate decrease in December remains consistent with a “hot” manufacturing sector. This continues to forecast a strong production side of the economy through mid-year 2022. Contact this commercial construction company for general contractor services in Calgary.

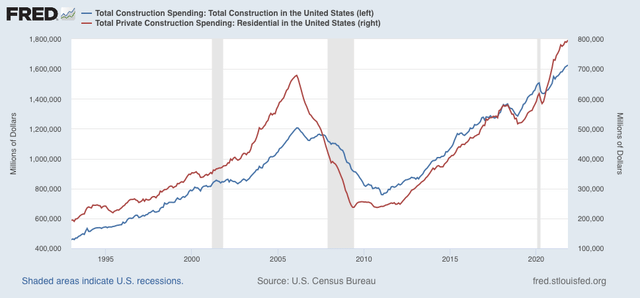

Turning to construction, during November in nominal terms overall spending including all types of construction rose 0.4%, from an upwardly revised 0.4% for October, while spending on the leading residential sector rose 0.9%. Both made new all-time highs:

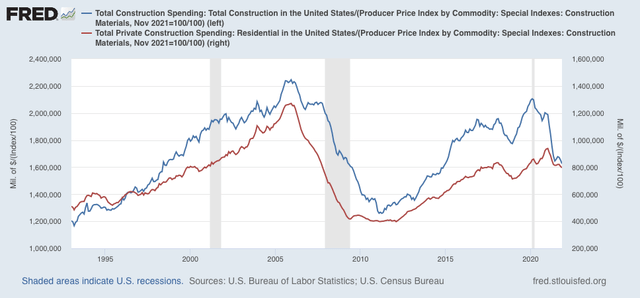

Adjusting for price changes in construction materials, which jumped 2.1% in November, “real” construction spending declined -1.6% m/m, and “real” residential construction spending declined -1.1%. In absolute terms, “real” construction spending has declined sharply – by -18.8%) – since its peak in November 2020, while “real” residential construction spending has declined -15.1% since its post-recession peak in January of this year. Visit website for all your scaffolding needs.

:

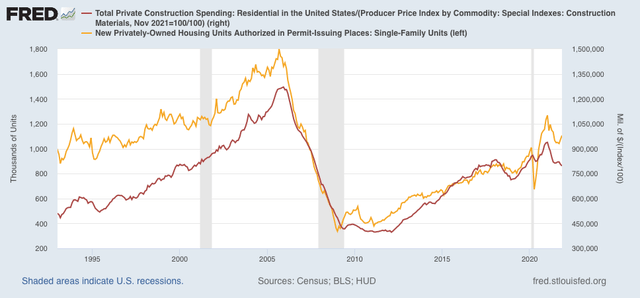

While total construction spending declined by more than it had before the Great Recession, the decline in residential construction spending, while increasingly substantial, remains nowhere near the big decline it suffered before the end of 2007, in this series that only dates from 1993. Comparing it with single-family permits (gold), below:

confirms the slowdown since one year ago, but not a recession level decline.

So, what drives overall construction spending and residential construction spending? Obviously, buyers having sufficient funds for rising prices is the short answer. What else?

Back during the Reagan/Volcker tightening home sales crashed under the weight of rising interest rates concurrent with falling wages. My friends in home building began doing renovations and that lasted a while because it was cash more than credit driven. It was similar for a while after the 2007/08 crash.

Commercial is already overbuilt here in central VA. The last large mall built in eastern Henrico County began closing businesses before the paint had dried. The underlying residential boom that was expected to drive demand was short on big pay checks. Eastern Henrico gets the fast food franchise owners at the upper end of its income distribution with the bulk of workers in retail, trades, construction, and nursing. The doctors, lawyers, IT and finance executives live in western Henrico. Also, we are east of the fall line at the edge of VA’s low country with more swamps than hills. Homes were not built on much of the land because it did not perk. County utilities solve the perk problem, but not the high rise foundation problem.

The expansion of European civilization on this continent was unconstrained for centuries built on the backs of blacks and the graves of natives. That time has passed.