August retail sales rebound slightly, argue for continued strong jobs growth in autumn

August retail sales rebound slightly, argue for continued strong jobs growth in autumn

Let’s take a look at retail sales, which are perhaps my favorite monthly economic indicator, since they tell us so much about average consumer behavior, and are also a good short leading indicator for jobs.

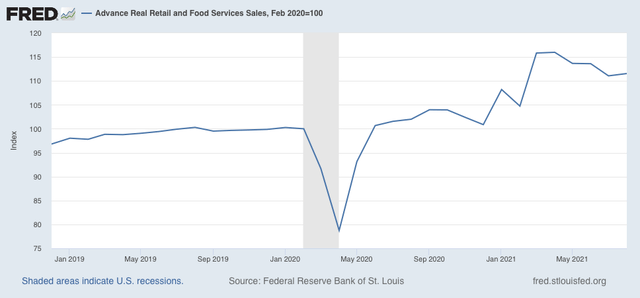

Nominally retail sales increased 0.7% for August, after a -0.6% downward revision to -1.7% for July. Since consumer prices rose 0.3% in August, real retail sales increased 0.4%. Although real retail sales are down -3.8% from their April peak, they are 11.5% higher than they were just before the pandemic hit:

While the recent decline from April is consistent with a slowing economy ahead, if sales stabilize here I don’t see this as a harbinger of an actual downturn.

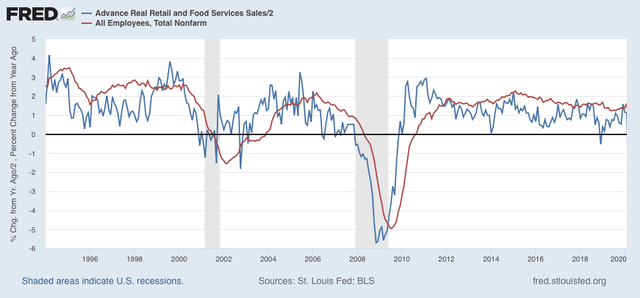

As I have written many times over the past 10+ years, real retail sales YoY/2 has a good record of leading jobs YoY with a lead time of about 3 to 6 months. That’s because demand for goods and services leads for the need to hire employees to fill that demand. The exceptions have been right after the 2001 and 2008 recessions, when it took jobs longer to catch up, as shown in the graph below, which takes us up to February 2020:

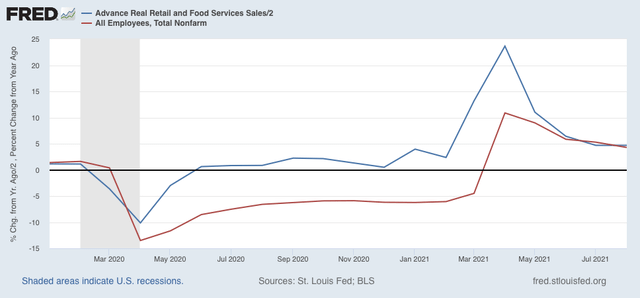

Now here is the same graph since just before the onset of the pandemic. Note the scale is much larger, given the huge changes wrought by the early lockdowns, and of course the comparative spikes from the data one year later:

As with the recoveries immediately after the two prior recessions, up until the past several months YoY job creation has been well below YoY real retail sales growth. But for the last 3 months, jobs have caught up to forecast trend.

This argues that we can expect jobs reports in the next few months to average out about even with those from one year ago, which averaged about 500,000 per month.