Where housing affordability is worst and costs are highest in the U.S.

– By Jasmine Cui and Matthew Danbury

NBC News

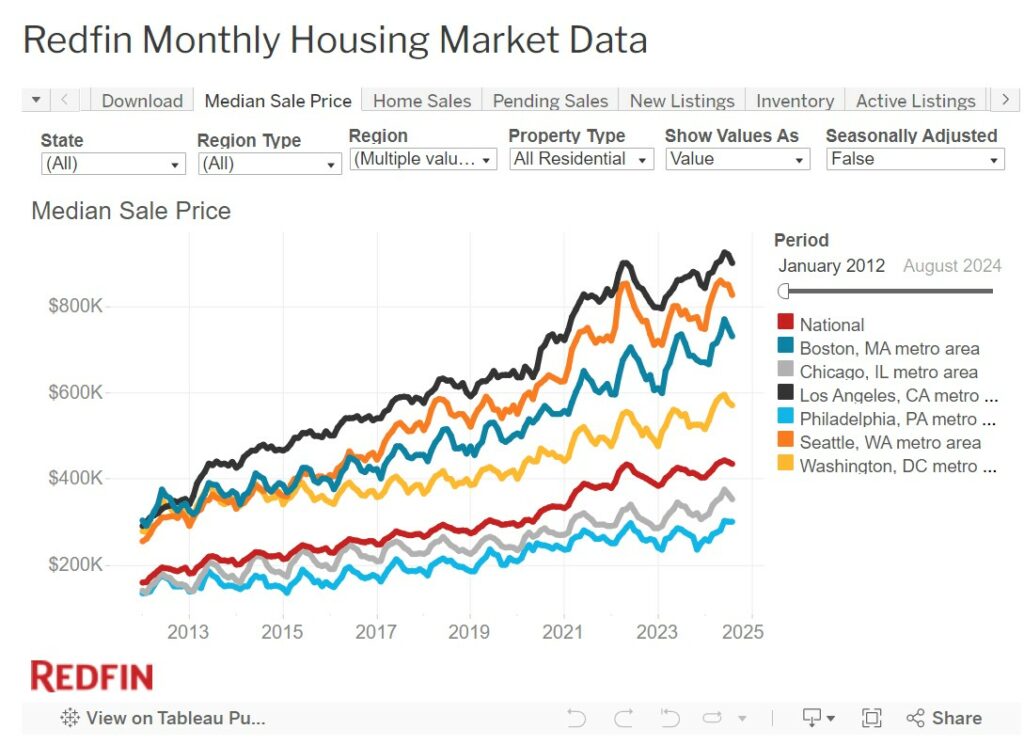

Across the country, the prospect of home ownership is slipping out of reach for the ordinary buyer.

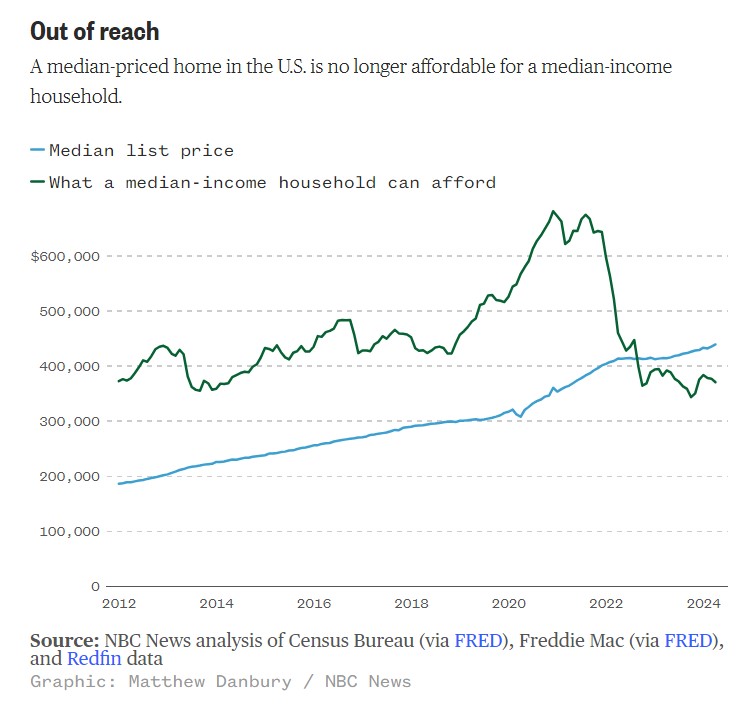

The affordability gap — an estimate of the difference between an area’s median household income and how much income is necessary to afford payments on a median-priced home in that area — is near a 10-year high in the U.S., according to an NBC News analysis of housing data. The analysis and the latest numbers from the NBC News Home Buyer Index show what experts say is a housing market inaccessible to a growing number of people.

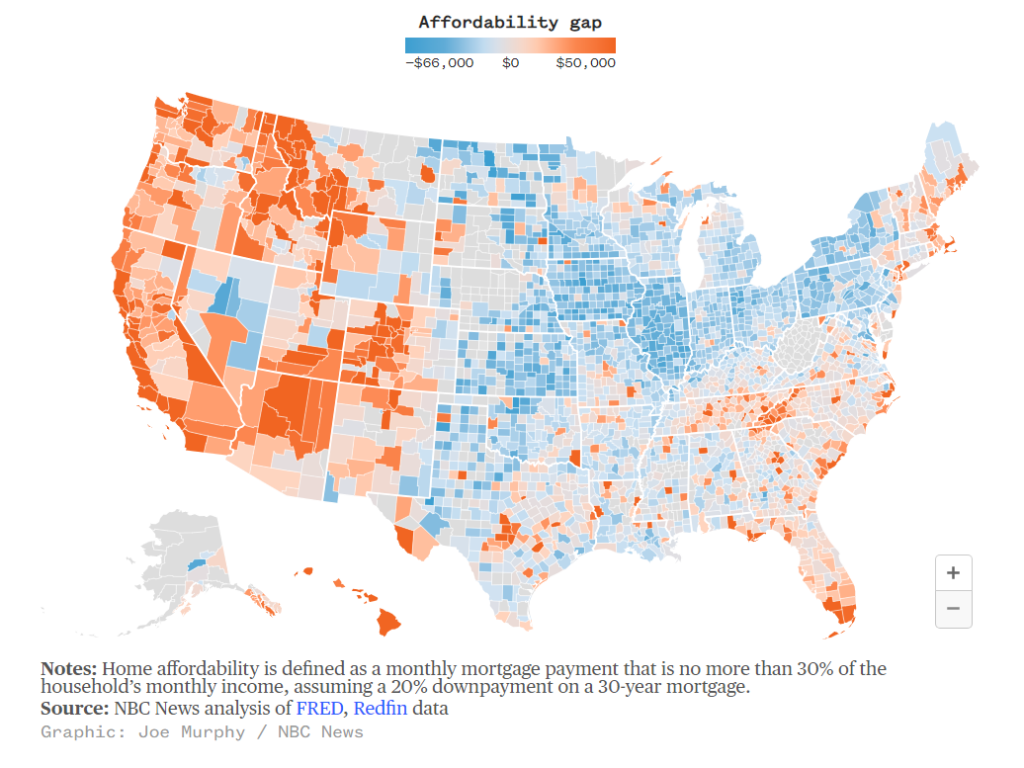

NBC News’ analysis shows:A household earning the local median income would be able to afford a home in more than 60% of counties nationwide. Five years ago, it would have been able to afford a home in just over 90%.

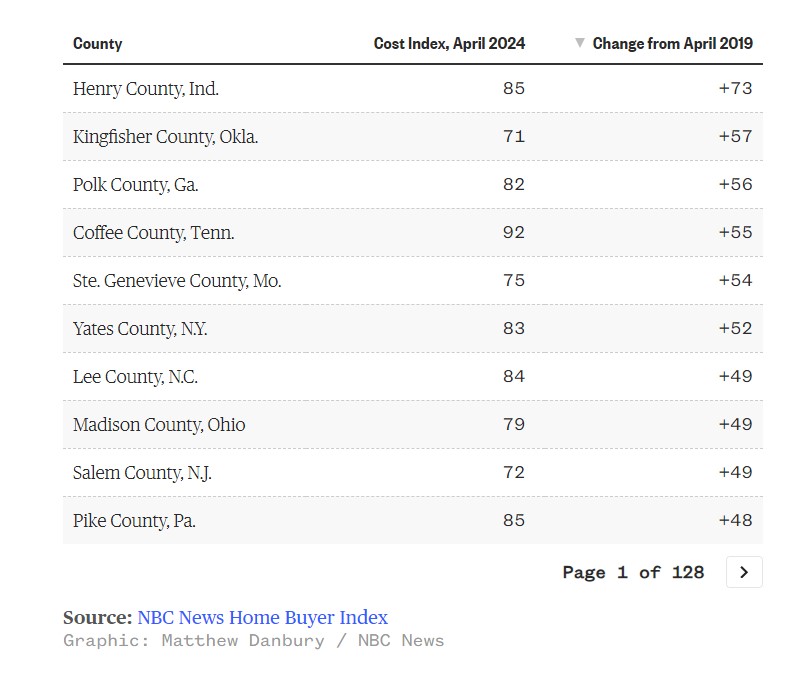

Affordability is dropping even in counties with lower-priced homes.

NBC News’ Home Buyer Cost Index — which measures how prices, mortgage rates and incomes affect home searches — is approaching highs last seen during a historically frenzied 2022 market.

The Cost Index has increased in 89% of U.S. counties over the past five years as high interest rates and low construction have driven up prices.

The median home sells for nearly $70,000 more than the average household can afford, pinching some buyers’ household budgets.

It’s the third-worst the affordability gap has been in the 10-plus years of data.

Out of reach

A median-priced home in the U.S. is no longer affordable for a median-income household.

“It’s pretty much an impossible market, even for middle-income households,” said Alexander Hermann, a senior research associate at Harvard’s Joint Center for Housing Studies. From April 2019 to April 2024 in counties where data is available, the median list price rose 55% to $102,850, according to an NBC News analysis of Redfin data.

Hermann attributes the persistent price pressure to supply shortages. Nationwide, according to Redfin data, inventory has decreased more than 30% since 2019, and has declined in 7 out of every 10 of the counties measured.

Many financial advisers consider a home affordable if mortgage payments, taxes and insurance costs don’t exceed 30% of a household’s monthly budget. In 2019, a household earning the local median income could afford to buy the median-priced home in 94% of U.S. counties. Today, that can be said of only 63% of counties.

The conservative estimate assumes a 20% down payment on a 30-year mortgage in which each monthly payment is no more than 30% of the household’s monthly pretax income.

The gap between income and home price is particularly pronounced in the West.

It’s worse out West

The gap between a county’s median income and the income needed to afford the median home price there is largest in the West, where the median income is often less than the income needed.

In the San Francisco Bay Area county of Alameda, which includes the cities of Oakland and Alameda, the gap between what buyers can afford and what homes sell for is nearly $73,000. Alan Teague, who lived in the Bay Area for nearly 40 years and was on the city of Alameda’s planning board, said some of the region’s affordability gap can be blamed on a lack of available homes, as the pace of building is far below demand.

“The sheer cost of houses has gone up, you know, an order of magnitude in the time that I’ve been here,” Teague said. “The supply has not kept up.”

New construction would help ease the gap, Teague said, but he added that the price of building in the region remains high. “We were being told that an affordable unit costs a million dollars per unit or more,” Teague said. “That’s mind-boggling.”

Even in counties that, by the numbers, look affordable, things are shifting

Where changes in ownership costs are affecting homebuying difficulty

The Home Buyer Cost Index measures buying difficulty due to mortgage rates, insurance costs, and list prices that are high relative to local median incomes. Greater values indicate greater difficulty.

More pages to the above can be found at this link: NBC News Home Buyer Index

In Henry County, Indiana, east of Indianapolis, the median list price is $190,000, less than half the national median. But prices in Henry have more than doubled since 2019 — taking the county from being one of the most affordable places to buy to one where homes are edging out of reach for locals. Reflecting that, the county’s Home Buyer Cost Index increased more from 2019 to 2024 than that of any other county NBC News measured.Hart Summeier, owner of Level Up Real Estate Group, said the buyers in Henry County who are feeling squeezed the most are first-time buyers and those on fixed incomes, like the elderly. In response, Summeier said, buyers have started “biting the bullet” and accepting homes with trade-offs they wouldn’t have accepted in previous years.

“OK, I will drive 40 minutes to work each day each way to not have to pay another $1,000 more monthly to be close to my job,” he said.

Sydney Personett experienced that squeeze firsthand trying to buy a home in 2024. At the time, Personett, 24, and her husband, Tucker, were trying to buy a home somewhere east or northeast of Indianapolis. Hamilton County was “extremely expensive,” she said, which left Henry County and Hancock County.

The couple found themselves thwarted in Henry by a lack of supply, and they eventually stomached higher home payments and bought in Hancock.

“We both made a lot of sacrifices in college, kind of preparing ourselves, you know, doordashing on the side just to get in some extra cash,” Personett said. “We both knew that our end goal was to buy a home together and kind of build this life for each other.”