Real consumer spending forecasts continuing jobs deceleration

What is interesting about NDd’s latest is his identifying manufacturing playing “a much smaller role in the total US economy now than it used to in the decades after WW2.” He identifies another factor occurring before the start of a recession. It has become increasingly necessary for spending on services to falter as well.

Real consumer spending forecasts continuing jobs deceleration

– by New Deal democrat

As I’ve written many times over the years, one of the best short leading indicators for the jobs market is real consumer spending. Usually I use real retail sales. In this post I’m going to expand the analysis to real personal spending as well.

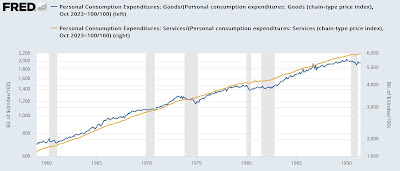

To begin with, it’s important to realize that in most recessions only real personal spending on goods (blue in the graphs below) turns down. In most recessions in the past half century, real spending on services (gold) continues to rise throughout. Here’s from 1960-1990:

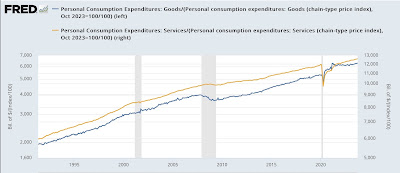

And here is 1991-present:

I’ve noted recently that manufacturing plays a much smaller role in the total US economy now than it used to in the decades after WW2. As a result, it appears that for a recession to occur, it has become increasingly necessary that spending on services falter as well. The below graph shows the same information as above, but on a YoY% lelel. Note how over time real spending on services YoY has decelerated from 3%-6% to 1%-3%:

But with just a few exceptions (1987, 2002), real spending on goods turning negative YoY has been a good indicator of recessions.

So here is what real spending on goods and services has looked like in the aftermath of the pandemic:

We had a false alarm in the first part of 2022, but this year spending on goods has recovered.

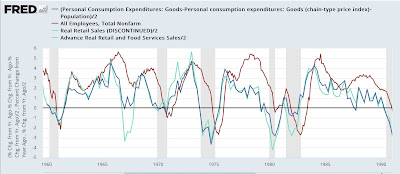

Now let’s look at real spending on goods YoY (dark blue), real retail sales (light blue) and employment (red) since 1960:

Both spending series tend to track closely to one another, although real retail sales has been more volatile, and frequently turns negative a little sooner. But note that they both have an excellent track record of leading jobs data, once they turn down (and up).

Here is the post-pandemic record:

Real retail sales is still negative YoY. And not only have both series accurately forecast a continuing deceleration in jobs gains, but they continue to forecast further deceleration.

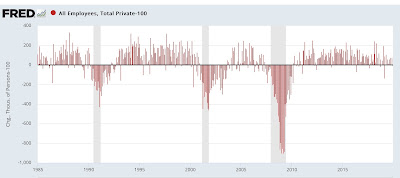

I came across a quick note earlier this week elsewhere that we might get a negative print as to private jobs this Friday. Indeed, in the past year or so not only have private jobs underperformed total employment, but they have had two readings of less thank 100,000 growth in the past five months:

Comparing this with the past forty years, even negative prints for private jobs have not necessarily forecast a recession (note below graph subtracts 100,000 so that any reading below 100,000 shows as negative). They were particularly common during the 2002-07 period, and again beginning in 2018:

Still, another print under 200,000 for total jobs (leaving aside the return of UAW workers to their jobs) looks likely, and a print under 100,000 would not be surprising at all.