Real aggregate payrolls rise to new high as CPI ex-shelter continues somnolent

Real aggregate payrolls rise to new high as CPI ex-shelter continues somnolent

– by New Deal democrat

With few exceptions, the November CPI report once again demonstrated how important fictitious shelter is to its calculation, as well as how important the inflection point of $5 gas in June 2022 has been.

Headline inflation rose only 0.1% in November, and is up 3.1% YoY. Core inflation less food and energy increased 0.3%, and is up 4.0% YoY.

Shelter, which is 1/3rd of the headline index, and 40% of core, increased 0.4% for the month and was up 6.5% YoY. Perhaps more importantly, CPI ex-shelter was *down* -0.1% for the month, and up only 1.5% YoY.

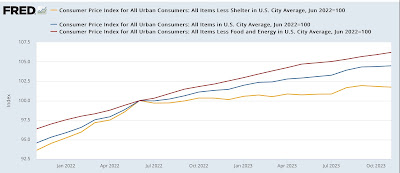

Per the above, below I show headline (blue), core (red), and CPI less shelter (gold) all normed to 100 as of June 2022:

Ex-shelter, in the past 16 months prices have risen only 1.7%, while headline inflation has risen 4.5%, and core inflation has risen 6.5%.

In other words, take out shelter and inflation is a non-issue.

The former problem areas of new and used vehicles continue to cool, with new car prices declining -0.1% in November, while used car prices increased 1.0%. YoY new car prices are up only 1.3%, while used car prices are up 3.8%.:

But for several reasons, including that people are holding on to their older vehicles longer, which means they need more repairs, as well as the fact that insurance has had to keep pace with both the prices of new cars as well as the increased costs of repairs, the “transportation services” subset of CPI increased another 1.1% for the month, and is up 10.1% YoY:

The other current problem children are food away from home (restaurants), up 0.4% m/m and 5.5% YoY, and medical care commodities, up 0.5% m/m and 5.0% YoY. But these make up relatively small weights in the index, and are not nearly the problem that shelter continues to be.

As to shelter, here’s the update of Owners’ Equivalent Rent YoY compared with the Case Shiller index (recall that the former has a history of lagging the latter by 12 or more months):

As has been the ongoing case, YoY shelter rose more gradually than house prices, and is falling more gradually, but it is continuing to fall. At its current pace of decline, it will take another 12 months or more to be back into the Fed’s comfort zone.

Finally, we can also update real aggregate payrolls. These rose nominally by 0.9% in November, so after inflation they rose 0.8% to a new all-time high:

This means that in the aggregate average working and middle class Americans have more buying power now than ever before, and is a very potent positive for the economy over the next few months.

Scenes from the employment report: an important trend in self-employment; and real aggregate payrolls, Angry Bear, New Deal democrat

November CPI report once again demonstrated how important fictitious shelter is to its calculation…

[ This is incorrect and the language is unfortunate. The costs of shelter is altogether real and altogether important for many, many families:

https://www.nytimes.com/2023/12/11/us/politics/rent-burdens-low-income-life.html

December 11, 2023

Record Rent Burdens Batter Low-Income Life

More tenants than ever spend half or more of their income for shelter, leaving less for everything else, taking an emotional toll and leaving some without a place to call their own.

By Jason DeParle

The federal government deems shelter affordable if it takes 30 percent or less of household income, a goal that only about half of the nation’s 44 million renter households meet….

https://fred.stlouisfed.org/graph/?g=HKys

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2023

(Indexed to 2020)

https://www.nytimes.com/2023/12/11/us/politics/rent-burdens-low-income-life.html

December 11, 2023

Record Rent Burdens Batter Low-Income Life

More tenants than ever spend half or more of their income for shelter, leaving less for everything else, taking an emotional toll and leaving some without a place to call their own.

By Jason DeParle

Unaffordable rents are changing low-income life, blighting the prospects of not only the poor but also growing shares of the lower middle class after decades in which rent increases have outpaced income growth.

Nearly two-thirds of households in the bottom 20 percent of incomes face “severe cost burdens,” meaning they pay more than half of their income for rent and utilities, according to the Harvard Joint Center for Housing Studies.

Among working-class renters — the 20 percent of people in the next level up the income scale — the share with severe burdens has nearly tripled in two decades to 17 percent.

For both groups, the proportion with severe cost burdens has reached record highs.

“More people, higher up the ladder, are facing impossible trade-offs,” said Whitney Airgood-Obrycki, a researcher at the Harvard Center.

The federal government deems shelter affordable if it takes 30 percent or less of household income, a goal that only about half of the nation’s 44 million renter households meet.

In consuming half or more of a family’s income, severe rent burdens steal from essential needs like food and medicine. They destroy the ability to save. They force frequent, destabilizing moves, unsettling parents at work and children in school. They flood fragile households with stress.

“Housing insecurity ripples through every domain of family life,” said Stefanie DeLuca, a sociologist at Johns Hopkins University. “It’s this constant mental and emotional tax.” …