State Taxes are Driving People to Moving to Other States?

A rewrite by me combining several articles . . .

“Go woke, go broke,” cited by one billionaire.”

The implication? The ongoing culture war and economic policies of northeastern states had facilitated the migration of wealth and economic power to the South. California has the highest marginal tax rate in the nation. California also has had the second lowest out-migration rate among households earning $200,000 or more during roughly the past decade.” As taken from:

State Taxes Have a Minimal Impact on People’s Interstate Moves, Center on Budget and Policy Priorities, Michael Mazerov.

Michael Mazerov at the Center on Budget and Policy writes, state tax levels have little effect on whether and where people move. So little effect, such movement out-of-state should not cause policymakers to enact unaffordable tax cuts to attract people. Much less, avoid enacting productive tax increases focusing on the wealthy.

Historically, U.S. residents have been moving away from the Northeast, the industrial Midwest, and the Great Plains to the Sun Belt and West for decades. The pattern of movement is substantially independent of state tax levels or the presence of an income tax. California has the highest marginal tax rate in the nation. It also has had the second lowest out-migration rate among households earning $200,000 or more during roughly the past decade. Those who are planning to move may need to hire professional movers and visit sites like https://threemovers.com/average-cost-of-movers-calculator/ to prepare a moving budget.

Job-and Family-Related Reasons Are People’s Primary Explanations for an Interstate Move, Center on Budget and Policy Priorities

People will move to other states for financial gains from employment opportunities and also for family reasons. They may also move for less expensive housing and many retirees do so for a warmer, snow-free climate. In our case, 120 degrees on a few days kept us inside. A trip to the garbage units was exhilarating warm. In the past and more recently, there has also been a trend of migration to coastal states like Maine, Oregon, and Washington in addition to states in the Rocky Mountain West like Colorado, Idaho, and Montana. Much of the later movement appears to be a desire for an outdoors-oriented lifestyle.

Policymakers in states like California, Connecticut, Illinois, Massachusetts, Minnesota, and New York should not give credence to anti-government advocates claiming state taxes cause massive “tax flight.”

Other states cutting taxes?

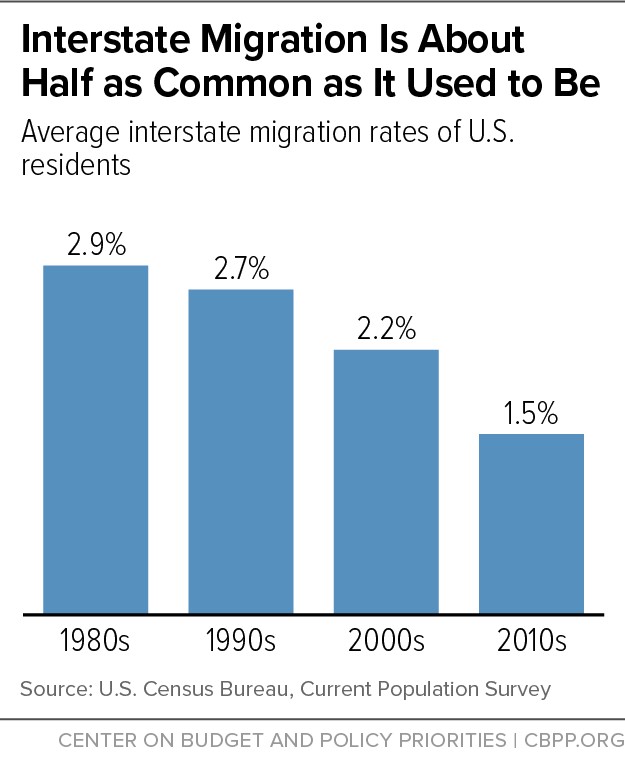

State lawmakers in Iowa, Mississippi, Nebraska, and West Virginia having recently cut income taxes may find such actions did not stem or reverse their states’ net out-migration trends. Data also shows interstate migration has been decreasing.

Job-and Family-Related Reasons Are People’s Primary Explanations for an Interstate Move, Center on Budget and Policy Priorities.

Quite the opposite can occur from deep tax cuts. If substantial deterioration in education, public safety, parks, roads, and other critical services and infrastructure occurs, states may find themselves less desirable and not a more desirable place to live, raise a family, etc.

The evidence fails to support claims of interstate migration is driven by high-income people. Or of anyone else — moving because of taxes. A careful look at Census and IRS data on interstate migration, and a review of academic studies reveals otherwise (supporting data can be found on the site recognized in the title).

Great post. That said, I’m unsurprised. I know lots of wealthy people and not a single one of them has moved because of taxes. Like me, they chose where they live based on employment and/or family reasons.

I know a couple of people who moved to Florida from Illinois for tax reasons in combination with weather. They maintain homes in both places but stay in Florida long enough for residence. I’ve also seen analysis concluding that when one combines real estate and sales taxes plus home insurance costs, the overall comparison of costs between the two states is minimal to non existent.

Thanks.

AZ is not a cheap place to live either.

(This appeared in the Boston Globe in late May, an op-ed from their crankiest conservative columnist, whom I assidously avoid reading.)

The level of out-migration from Massachusetts is the highest in 30 years.

… Massachusetts has a serious problem: Too many of its people want to leave. Year in, year out, more Massachusetts residents migrate to other states than relocate here from other states. It’s a longstanding predicament, and it’s been getting worse: Between April 2020 and July 2022, nearly 111,000 residents moved out of Massachusetts — the highest out-migration level in 30 years. Only three other states — California, New York, and Illinois — shed more residents each year than Massachusetts. …

(More recently, in the WSJ, )

The Return of Taxachusetts – October 30 – behind a pay-wall

‘Affordable housing” is a noble goal and the mother of endless dim policies. The latest counterproductive effort is a push in Massachusetts to fund home construction by taxing home sales.

Gov. Maura Healey recently gave her blessing to Bay State towns and cities that want to tax home sales. The Affordable Homes Act she announced this month would let municipalities place a 0.5% to 2% tax on the proceeds of sales above $1 million. Instead of going into a general fund, the revenue would be set aside to support housing that the state deems affordable. …

(Many homes in my town have been selling for well over $1M. We paid $80K for ours 45 years ago. It’s a relatively small house compared with the new ones going up. If we downsize & get a million for it, I’ll be happy to pay a 2% surtax.)

Also note that the MA guv’nah’s office has once again told our town officials that we need to build more housing, of the ‘affordable’ variety (I assume. That would probably be ‘under $1 million per unit’ no doubt.) Great!

As I think you’re saying: we still haven’t defined ‘affordable’

I’m still getting adjusted to this city life but what you’ve described is not unlike what I’ve watched back home, still going on mostly likely will be when I get back. Others, with more money, turned what was once an affordable place to live into someplace that is not ~ service workers, from cops to waitresses, commuting 40, 60 and 75 miles roundtrip for ‘affordable’ housing

But to this city life, my question is how many units are in all those buildings going up downtown? I only see them when we go into MGH (and across the bay) and I count upwards of forty floors in six or seven projects, and I’m sure I’m missing several counting from the ninth or fourteenth floors. What about the Ink District? How many units there?

They’re not sitting there empty …

MA is not necessarily a high-tax state, yet. The term Taxachusetts has more to do with residential property taxes. In the wealthy suburbs of Boston, these are extremely high. In most of the rest of the state, they are not. Those with incomes higher than $1M/year pay more on the portion of their income that is higher than $1M. There’s also a state sales tax of 6.25%, except on food & clothing.

AARP: Massachusetts currently has a flat income tax of 5 percent .. (with) an additional 4 percent tax on annual income above $1 million, beginning in tax year 2023. (And in 2024) taxed at 9 percent.

“According to the latest estimates, the Massachusetts population decreased by 7,716, or -0.1% over the year, from 6,989,690 on July 1, 2021 to 6,981,974 on July 1, 2022.”

-0.1%. *yawn*

https://donahue.umass.edu/business-groups/economic-public-policy-research/massachusetts-population-estimates-program/population-estimates-by-massachusetts-geography/by-state

We’ve lived in MA for over 50 years; we like the politics and the history.

And the computer industry which thrived here for several decades.

Our kids were born and raised here, although my son departed early on to NY where he had gone to college, and later to the west coast. Somewhat earlier my daughter left for the west coast as soon as she could. They left our expensive state for others even more expensive. Go figure.

Could be that if 111K left and 104K arrived, then the population would only decrease by around 7K. Or the conservative cranky columnist was ‘mistaken’?

Massachusetts population has largely been growing since the 1900s. There were dips for WW1 and WW2 and a number of relatively stagnant periods with slight declines, but overall, the story was growth.

We left Massachusetts because we hated the weather. In the 1970s, summers were short and not too awful, but by the 1990s, they were hot, humid and ran from May to November.

I have heard some of my friends bad-mouthing CA and saying they were going to move out permanently. Every one still has their CA address, whether they stay there or not.

My friends who have moved share several reasons. The top ranked is medical needs closely followed by family. Frequently both apply. Nevada is closer, and the taxes are better maybe, so they go there. I know some relatively younger people who have moved “back home” to take care of their folks, but more often the olds go to the kids. Lower down on the moving scale is a job, and more than a few have chosen to stay in CA rather than move when their jobs left.

The advantages of living in CA still outweigh the tax burdens, even assuming I could find someplace that I might care to live that has lower taxes. I know several places where we could probably live more cheaply, but I don’t want to live there for lots of other reasons. CA may have higher top marginal rates, but that is not what most people pay. By the time you get to where it makes a difference, planning, tax lawyers and accountants can save you almost as much as moving out of state.

So I “ retired” to Indiana from Wisconsin because my wife wanted to be near grandchildren and her daughter— now both daughters— and Fort Wayne was much more affordable than metro Milwaukee. Been here 8 years and can not stand it. Democrats are RINOs and the GOP— which is dominant— thinks Trump is in sufficiently MAGA. 23% of the population bothers to vote and they are the ones carrying the guns. Young people with an ounce of sense flee the state at the first opportunity and I know none of my grandchildren will ever end up here permanently. My son in laws make good money here but I believe they too will retire elsewhere. Health care is so so and the climate is only marginally better than Wisconsin but as long as my wife is alive this is where I will live😊

Terry:

We sometime rethink our move to AZ near Phoenix. Michigan school taxes were not part of Home taxes which kept it reasonable. In AZ they are. Gasoline was higher than Michigan too. The house was not less costly, The Mortgage came in at 2.6% which helps. Mostly, we are not accustomed to the area or their social graces.

Years ago I did an analysis of this using data on overall state taxation and real estate prices. You have to look at overall tax burden as a percentage of income, not one particular kind of tax. You have to consider real estate prices as the market’s way of indicating the desirability of the state and hence its tax rate. It turned out that people would pay about an extra $10K per year for a 1% higher tax rate. I thought this was odd, then I remember that realtors often point this out. The code word for a higher tax rate is “good school district”, and whether you have kids or not, that higher tax rate makes your real property more valuable.

I imagine the number are outdated these days with laughably low real estate prices, but I’m guessing that the general relationship still holds.

Every few years MA voters are asked to approve a referendum to permit state income taxes to be graduated. (The state constitution makes this a requirement.) And every few years, the voters refuse to do so. The current flat-rate tax is regressive, and many object to that, but voters here do not trust the Legislature to spend wisely or frugally, so they reject progressive income taxes, alas.

Except, as noted, a surtax on annual income over $1M is in place. It has been 4% and it’s going up to 9%. We have quite a few wealthy people here who will be subject to this.

That surtax only went into effect this year, will more than double next year, and will also apply to funds earned from selling your home, if that lifts your annual income past $1M.

Boston’s wealthy western suburbs choose by & large to operate really, really excellent public schools (‘as good as the private schools’ that are nearby) and these are very expensive, driving up property tax rates. Farther west, not so much.

Also, Bloomberg, when he was elected mayor after 9/11 remarked that he was going to increase taxes and that, while people might whine, nobody was actually going to move because of a tax increase. He was and is still running a financial information system used by professionals, so he might know something about this.

Can I be a resident of New York State if my domicile is elsewhere?

You may be subject to tax as a resident even if your domicile is not New York.

You are a New York State resident if your domicile is New York State OR:

OR

Do I need to file an income tax return?

Generally, you must file a New York State income tax return if you’re a New York State resident and are required to file a federal return. You may also have to file a New York State return if you’re a nonresident of New York and you have income from New York State sources.

(My son, who resided in NY for 15 years or so before he ‘went West’ works remotely for a company in NYC and still pays NY income taxes, as his CPA tells him he must.)

FAQ: Filing Requirements, Residency, and Telecommuting for New York State Personal Income Tax

(The state income taxes my son would pay in the high-tax state where he resides are offset by the income taxes he has to pay NY, however, as I understand it. Since his employer is in NYC, I gather he has to pay both NYC & NYS income tax.)

NY has always been very greedy in this way. Back when I was a GI, serving in MA, adjacent to NY, rarely visiting my ‘home’ state, I was expected to pay NY state income tax, and did so (on my modest GI income.) Until my final year, when I wrote them a letter to say that I was done with that, and never heard back.