The collapse of the existing home market continues in September

The collapse of the existing home market continues in September

– by New Deal democrat

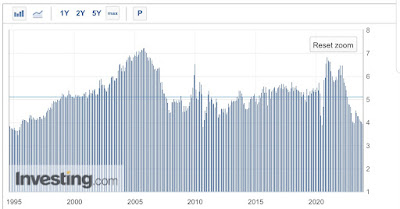

September was yet another month in the ongoing collapse of existing home sales. To wit, sales declined another -8,000 on an annualized basis to 3.960 million. This is the lowest number since August 2010. And aside from that one singular month, it is the lowest since 1995! [Note that this is similar to the collapse in purchase mortgage applications, also at the lowest level since 1995]:

The reason for the collapse, as I have noted before, is that existing homeowners are essentially locked in place by their 3% original or refinanced mortgages. They’re not selling, and they’re not going anywhere in the foreseeable future. Such houses as are on the market are disproportionately from people who have no mortgages, and so are insensitive to those rates.

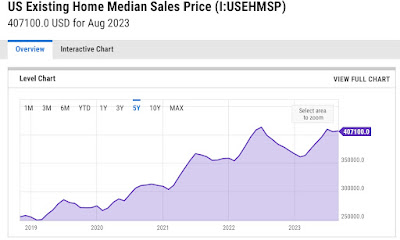

And just as was the case for the past few months, with inventory so restricted, prices have held firm, and have even increased. In September, the median price was $394,300 (not seasonally adjusted), and is up YoY for the third month in a row, at +2.8% [note: current month’s data not included in the below graph]:

This is similar to what we saw with the FHFA and Case Shiller repeat sales indexes several weeks ago.

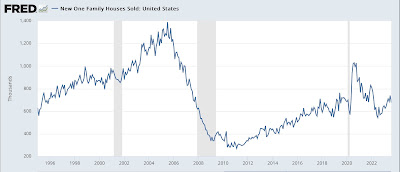

The result of the collapse of the existing home market is that more and more people have been driven to the new home market. Here are new home sales since 1995, to compare with the existing home sales graph above:

Even with their recent decline, new home sales are at a level equivalent to their level in 2019 just before the pandemic – which was itself a 10 year+ high. Although I won’t show the graph, recall that the prices of new homes have declined -10% or more on average, and less expensive multi-unit building is at an all time high compared with the construction of single family homes.

Finally, remember that it is new home building which is by far the most economically important data, because of the all the economic activity which goes into building the house, and then landscaping it from scratch, plus additional furnishings inside. This is an important reason why no recession occurred in the past 12 months. As I reported yesterday, now that new home construction has quite likely peaked as well, the odds of a recession in the next 12 months have increased substantially.

As long as the existing homes are not collapsing, then I am OK. What market conditions might be like in seven or eight years when I might be ready to sell is anyone’s guess. Only current buyers and sellers should be worried about current market conditions.

The developer that owns the 12 acres surrounding my home is moving ahead, but his PM told me it is a seven year project. All that is done so far is clearing some of the right-of-way for the underground power lines and bringing in a huge bundle of cables to the pole at the north end. When completed then I will have dozens of families for neighbors and two fast food joints within short walking distance. The county is opening a new hundred acre public park only 0.2 miles from my house next summer.

The Fed giveth and the Fed taketh away. As long as we are only in a self-imposed downturn, then in the long run everything will be good again. If something external happens, then we can start worrying.

Clever analysis:

“The Fed giveth and the Fed taketh away. As long as we are only in a self-imposed downturn, then in the long run everything will be good again. If something external happens, then we can start worrying.”

G’da would’ve muttered something about barn doors and horses

Is this the result of uncertainty in the insurance industry?

I wonder what are the prospects for real estate markets with floating interest rates predominantly, such as Sweden, where prices of both new and existing homes went down by 15%. There, i believe the interest rates are priced, however, I wonder what would happen in the event of a global collapse… I would assume spillover effects, which could drive prices in those markets to ridiculous prices.

Hi Eric:

I did a small bit of editing to your comment. Minor corrections. Thank you for your comment.