OEMs Pulling Back from EVs?

I rewrote portions of this article and added information from my own experiences in Automotive when new technology is introduced. My experience is not as great when compared to the introduction of EVs. However, it does come close enough to understand what is going on with the industry. Anyways, onwards.

As taken from: GM Says EV Demand Is Shrinking. Data Shows a Complex Market, autoweek.com, Emmet White

Generally speaking about the market . . .

- General Motors has officially delayed the Silverado EV for another year due to shrinking demand and engineering challenges. What exactly does this signal for the EV market at large?

- It remains a complicated market in which to succeed. Automakers like Lucid and Rivian decreased production. And some manufacturers continue to reap the benefits of EV adoption trends.

- National and state-by-state figures show positive trends. Analysts warn of an impending plateau. Such an economic environment could leave automakers and their EV investments high and dry for the moment.

I do not find this confusion to be unusual for a new model and technology introduction. Front wheel became more popular in the seventies. Similar issues were experienced. I had a new front wheel drive 1975 Audi Fox. Heading out for Christmas, I bought snow tires for it and they put them on the back.

The Ford’s all-electric F-150 Lightning has been on the open road for over a year. One would think General Motors is eager to engage in an EV pickup segment competition. However, the GM competitor to the Ford F150, the Chevrolet Silverado EV is not ready yet. GM is actually pushing its launch back by a whole year.

Why is GM taking what seems like a drastic action?

A diminished demand for new EVs according to GM and also other engineering challenges. GM says demand is down, necessitating the transfer of 1000 employees to other facilitates from its Orion Assembly plant in Lake Orion, Michigan. Orion is the plant which is currently being retooled for EV production.

GM will phase out its Chevrolet Bolt production later this year at its Orion plant to take on Silverado pick-up later and after assembly lines are rearranged. The original author opines it to be surprising to see a manufacturer delay of a potential flagship EV.

I tend to agree with him. There will be a lot of work to retool the facility to manufacture the Chevrolet Silverado. It should havse started a while ago if GM was to compete with Ford. In any case, GM’s market assessment driven delay is not alone. Ford is temporarily slowing F-150 Lightning production.

Neither automaker is conceding the demand driven production problems being a result of the current United Auto Workers strike, either. Also, it is not just Ford and GM struggling with an EV market lull. Companies such as Lucid Motors produced 30% fewer models this quarter. Ford’s slow down is F-150 Lightning sales dropping 46% in the last three months.

Adjusting production to meet demand is only natural, especially in the years following multiple labor and material crises. The question remains. Is EV demand really dropping sharply? And if consumers are shying away from EVs, where does this leave automakers who are relying on EVs for their future prosperity?

AB: Perhaps automotive has changed since my departure. The car makers built to a yearly forecast, inventoried models, and expect the Tiers to stock parts to meet their orders. You certainly did not build parts far ahead of the automaker weekly or monthly orders. You might get stuck with them. They will adjust short term forecasts.

Looking for Evidence

In order to determine what exactly is going on, Autoweek began looking at state-by-state EV sales data. California is accelerating ahead (not surprising), boasting a 24.3% year-to-date zero-emissions-vehicle sales rate. This is nearly 6% higher than the overall 2022 ZEV sales rate in California. However, California is an easy EV demand target to determine. What about the other states?

A similar trend is occurring in the state of Washington Eighteen percent of new car sales for the first half of 2023 were either fully electric cars or plug-in hybrids. This according to the Seattle Times. For reference, Washington’s EV sales rate hovered around 8%-12% through the first half of 2022 before dramatically ramping up.

If these tax-credit-incentivizing, charging-infrastructure-building state statistics aren’t convincing, it is worth looking at the data on a national level, too. Data from the Department of Energy’s Argonne National Laboratory shows a fairly consistent monthly sales rate for plug-in vehicles this year, save for a small dip between June and July.

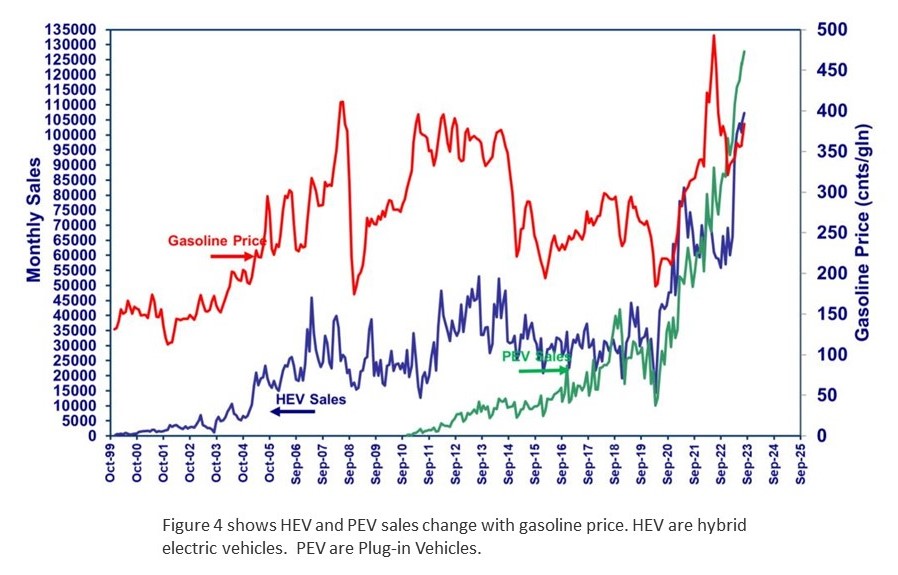

Graph pulled by myself . . .

Light Duty Electric Drive Vehicles Monthly Sales Updates | Argonne National Laboratory (anl.gov)

The graph reveals recent data. I am not certain what GM and Ford sees. There may already be reduced sales at the dealer level.

EV sales rates from manufacturers point to relatively positive trends. Ford reported a 14.8 % quarterly rise in EV sales, with the Mustang Mach-E and E-Transit posting their best sales quarter ever. That accounts for a total EV sales increase of 65% from August to September for Ford. Again, history . . .

It is not just domestic carriers seeing strong EV sales demand. Kia EV6 sales are up 45% year-over-year for the third quarter. Annual Volkswagen ID.4 sales have doubled since 2022. BMW recently set a new quarterly EV sales benchmark in the US. GM says its third-quarter EV sales are up 28% as compared to EV sales earlier this year.

If EV sales are seemingly on the rise, it begs the question of what is behind GM’s decision to take a step back from Silverado EV production. Executive analyst Karl Brauer of iSeeCars‘ sees the move as potentially prudent in the long run. This is made in spite of positive sales trends for individual vehicles and specific statewide trends. Brauer explains. . .

“There seems to be a threshold of around 7%-10% share before EV sales drastically slow down. That’s the situation in California, Oregon, and Washington, where those states have the largest EV share but also the slowest growth in EV share. We are seeing the start of an overall market pushback against electric vehicle sales now that early adopters and environmentalists have their vehicles.”

GM’s slowdown in EV production is actually indicative of caution. The company monitors demand very closely. When considering the lack of profit these vehicles offer, GM’s move actually reads as more calculated than a knee-jerk. Brauer said in an interview with Autoweek . . .

“The profit margins for EVs are much narrower or even non-existent when compared to traditional automobiles. That is when they sell for MSRP. If Ford and GM have to start cutting prices to move these vehicles, the business model rapidly deteriorates. The domestic automakers have never done well when they can’t align production with market demand.”

Of course, pricing plays a big role in the slowdown of EV sales. In fact, the average price of a new EV in the US this August was $53,376, down from $65,688 in August 2022. Factoring in federal and state incentives drops the current going rate into the $45,000 range. However, this still is not affordable for many Americans. No surprise there.

That does not mean US buyers are giving up on EV shopping entirely. Data from Recurrent shows demand for used EVs is up. The used BEV market is outpacing even the most popular new EVs, like Tesla’s Model 3. And the reason behind this is pricing. The average price for a used EV is $27,800, down 32% year-over-year.

Even so, the outlook for automakers in the near future is muddy. Stuck between impending government regulations, challenging engineering costs, and less than a third of dealers signaling confidence in EVs (according to Cox Automotive). Lying in wait may be the safest bet for OEMs. Brauer adds . . .

“There’s this widespread assumption of costs coming down, energy density will go up, and the infrastructure will come together. It paints a great picture, but having an industry move full-speed ahead under those assumptions is extremely risky. And everyone from the automakers to the government regulators knows it, even if they won’t publicly admit it.”

Guess we will have to wait for the GM EV beast to haunt the roads?

I think there should have been a greater emphasis on transitioning to PHEVs before going full EV. This would have given the industry time to solve the infrastructure, charging time, and range issues while the consumer gained confidence in electric vehicles as a commuter car but enjoyed the benefits of a gasoline engine for longer distances.

A conservative budget is unlikely to subsidize EV’s at $7,000/pop.

Tesla can manufacture an EV for $30,000 because that’s what one intelligent engineer on the payroll can do. GM has nonesuch.

Tesla tapped the early adopters and virtue signal market. The rest of the car buyers have an IQ above 70.

Here in CA I see more EVs and more brands of EV on the road almost every time I go out. I see more charging stations going in. I still want more real range before I can get one unless (until) I move closer to the big city. Maybe in 2-5 years. Range anxiety and slow charging speeds are my stumbling blocks. If the price of gas goes up again, you will get more sales for hybrids and EVs.

There is all kinds of research that “looks promising”, but nothing that has made it to commercial use yet. I keep hoping for a 400+ mile range with a 10-15 minute charge, but for that I may wait forever.

https://english.news.cn/20230816/951e8432cec64042b9161d0df9f5a318/c.html

August 16, 2023

Contemporary Amperex Technology Co., Ltd. reveals new LFP battery

Chinese battery manufacturer Contemporary Amperex Technology Co., Ltd. (CATL) revealed on Wednesday a new LFP battery * that achieves 4C superfast charging. The battery provides electric vehicles with a driving range of over 400 kilometers on a 10-minute charge. In addition, it can also deliver a range of over 700 kilometers on a single charge.

* Lithium iron phosphate

Sounds perfect, doesn’t it? Now I just need it in a small SUV bodied vehicle available in the US for under $150K. At least this is from a battery manufacturer not an academic lab. Maybe one of those breakthroughs I have been reading about for a few years will be making it to market yet.

The current Lithium-EV market, is a dead market until at least 2026, at the earliest.

You can’t force people to buy a dead horse. EV’s are totally an unviable investment as an alternative form of transportation. Free market laws always prevail..

Rex River: Duh.

[ Rather the trolling troll here; the point being always to harm. ]

@Rex,

And yet I see zombie EVs all over the place, and they are proliferating. I know some EV owners, and none of them were forced to buy them. Free market laws always prevail, it seems.

Heh.

Sure are a lot of Negative Nellies, all talking oil industry talking points

Nobody twisted my arm

Are interest rates up? That could be discouraging sales. EVs tend to sell at a premium for a variety of reasons, so higher rates could have some effect.

https://www.nytimes.com/2023/10/30/business/economy/gm-uaw-contract-deal.html

October 30, 2023

Autoworkers Score Big Wins in New Contracts With Carmakers

Tentative accords at Ford Motor, General Motors and Stellantis are the most generous in decades, raising costs as the industry shifts to electric vehicles.

By Jack Ewing and Neal E. Boudette

Government subsidy is there to force people into EVs that do nothing for the Fictisious Climate Change.

[ Same troll, trolling. Always a need to harm. ]

Maybe GM looks at Ford and thinks that they’ll keep their share of the full-sized pickup truck market completely in their most profitable configuration while Ford sacrifices profit via EV costs. The big technical challenges are hardly related to the specific vehicle, so why not work on those in less profitable segments and just keep taking the Silverado margins on gas production with no haircut for what is essentially corporate image reasons at this moment? Could be and probably will be a different situation in 3 or 4 years.

How many electric cars in China 2023?

https://www.canalys.com/newsroom/global-ev-sales-h1-2023

October 2, 2023

The first half of 2023 saw strong growth in the EV market, reflecting increasing EV popularity. Mainland China was by far the largest EV market, with 55% of global EV sales in H1 2023, a total of 3.4 million units. This represents 31% of all light vehicle shipments in the region, up from 15% in the full year 2021.

Getting my laptop fixed.

I am not surprised at this happening in China. They always seem to deliver at lower cost. Different market, government factors, and laws. Good way for the US to learn from the process used in China, improve upon, and introduce something better.

“Good way for the US to learn from the process used in China, improve upon, and introduce something better.”

Agreed, but the US is completely protecting vehicle-makers from Chinese competition. Protecting from batteries to manufacturing techniques to metals, plastics and sensors. This lack of competition means “the better” will not be coming from the US.

@ltr,

Things are not looking good for the future of entrepreneurialism in China these days.

https://www.newyorker.com/magazine/2023/10/30/chinas-age-of-malaise

Hmmm

Japanese company in the US run by Americans buying wire-harnesses for use in US by Ford, GM, Chrysler. Plants in Shantou, Tianjin, etc.

“Things are not looking good for the future of entrepreneurialism in China these days.”

Things are actually looking especially good:

https://www.nature.com/nature-index/institution-outputs/generate/all/global/all

The Nature Index

1 June 2022 – 31 May 2023 *

Rank Institution ( Count) ( Share)

1 Chinese Academy of Sciences ( 7172) ( 2168)

2 Harvard University ( 3516) ( 1100)

3 University of Science and Technology of China ( 1757) ( 655)

4 Max Planck Society ( 2438) ( 650)

5 University of Chinese Academy of Sciences ( 3006) ( 618)

6 French National Centre for Scientific Research ( 4276) ( 616)

7 Nanjing University ( 1379) ( 596)

8 Tsinghua University ( 1703) ( 587)

9 Peking University ( 2114) ( 573)

10 Zhejiang University ( 1334) ( 517)

11 Stanford University ( 1827) ( 512)

12 Helmholtz Association of German Research Centres ( 2458) ( 503)

13 Massachusetts Institute of Technology ( 1918) ( 486)

14 Sun Yat-sen University ( 1132) ( 456)

15 Fudan University ( 1235) ( 450)

16 Shanghai Jiao Tong University ( 1248) ( 427)

17 National Institutes of Health ( 1134) ( 392)

18 University of Oxford ( 1496) ( 388)

19 University of Cambridge ( 1301) ( 383)

20 University of Michigan ( 1221) ( 367)

* Annual Tables highlight the most prolific institutions and countries in high-quality research publishing for the year

@ltr,

As a published research scientist for over 40 years, I can tell you that the publications in a given year reflect the past several years. My comment was about the present and future state of China, not its past. And in the case of China, Chinese journals are notoriously problematic.

“Things are not looking good for the future of entrepreneurialism in China these days.”

Things are looking especially good in and for China:

https://fred.stlouisfed.org/graph/?g=16TkI

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16TkM

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2022

(Indexed to 1977)

@ltr,

Why are these dates “August 4, 2014?” We are in November 2022.

“Things are not looking good for the future of entrepreneurialism in China these days.”

The IMF, Goldman Sachs, JP Morgan… have Chinese GDP growth coming in at about 5.2% this year, and a 45 year record and especially high investment levels tell us there is much more important to come.

@ltr,

I guess you didn’t actually read my post or the link. My post referred to the “future” of entrepreneurialism, not the past. Those of us who understand economics and investing know that past performance is no guarantee of future results.

But I knew my comment was a guarantee of your future reaction, and you didn’t disappoint.

Chinese investment as a share of GDP is far higher than in other major economies:

https://www.imf.org/en/Publications/WEO/weo-database/2023/October/weo-report?c=924,134,534,158,111,&s=NID_NGDP,NGSD_NGDP,&sy=2000&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2023

Total Investment & Gross National Savings as a Percent of GDP for China, Germany, India, Japan and United States, 2007-2022

2022

China

Total Investment ( 43.5)

Gross National Savings ( 45.7)

@ ltr,

“Total Investment & Gross National Savings as a Percent of GDP for China, Germany, India, Japan and United States, 2007-2022″

Those data end in 2022. We are at the end of 2023. My post was about the present and future, not the past.

“The World Bank cut China’s gross domestic product (GDP) forecast for 2024 to 4.4% from 4.8% on Sunday, citing persistent domestic difficulties such as elevated debt, property weakness and an aging population.”

https://www.cnn.com/2023/10/06/economy/china-economy-real-estate-crisis-intl-hnk/index.html#:~:text=The%20World%20Bank%20cut%20China's,weakness%20and%20an%20aging%20population.

“New annual housing starts are down 57 percent, and the sector will likely remain below half of its previous size over the next decade. Nothing else in China’s economy has replaced the property sector as a driver of growth, which explains why economic growth has slowed so dramatically over the past two years.”

https://www.csis.org/analysis/experts-react-chinas-economic-slowdown-causes-and-implications#:~:text=New%20annual%20housing%20starts%20are,over%20the%20past%20two%20years.

“Sentiment on China’s economy has grown increasingly negative in the past few weeks, with public discourse variously emphasizing “structural” issues such as debt, demographics, and China’s deteriorating relationship with the West.”

https://www.csis.org/analysis/experts-react-chinas-economic-slowdown-causes-and-implications

“China’s economy is stagnating, plagued by a real-estate crisis, high unemployment, dwindling confidence among investors, and other setbacks.

“Some may be surprised at the severity of these challenges, but MIT Sloan professor isn’t one of them. In writing his new book, “The Rise and Fall of the EAST: How Exams, Autocracy, Stability, and Technology Brought China Success, and Why They Might Lead to Its Decline,” Huang anticipated that China’s economy would falter.

“We are basically seeing a repeat of Chinese history, when the Chinese state previously restricted economic and political freedom,” Huang said. “And with that comes economic stagnation.”

https://mitsloan.mit.edu/ideas-made-to-matter/new-book-details-chinas-economic-rise-and-now-its-fall

ltr:

China’s economy is still state manipulated. This not to be compared to US freedom for silliness in manufacturing. To which, I can vouch for both. Labor is still the lowest percentage in either country.

In 2008 Union leader Gettelfinger testified to Congress it was t he smallest percentage of cost in manufacturing. This is similar to the experiences I had in consulting while at Ingersoll Engineers and in management. Much more cost can be found in materials, overhead, and in this case transportation. The difference is minimal. It is not worth it.

i think the OEMS are ignoring that their ICE vehicles are piling up on their dealers lots. in fact some of their vehicles have 200 or more days (up to 2 years) at current sales rate. and non evs vehicles are piling up on dealers lots. some of this is because of dealer business practices (lots of addons, market adjustment some as high as $100000 , ordering only high trim with higher prices vehicles, among others), some of its the OEMS increasing prices and restricting the low price prices, and of course interest rates, and the anger in the those buy the vehicles is pretty high at dealers and OEMS, plus they arent as well as they used to be (or they think this)