Arab Oil embargo 50 years ago weaponized oil to inflict economic trauma

I thought this article was a solid rehash of what took place in the early seventies when we were driving the inefficient monsters Detroit was manufacturing. It was only a short time earlier, smaller and more efficient foreign cars arrived in the US from places such as Japan. I was fortunate to snag a Datsun 510 shortly before the oil embargo. Some information on this article, where it came from, and the authors.

The Conversation allows republishing of articles as long as it is properly attributed. The article was submitted to The Conversation by both Jim Krane and Mark Finley of Rice University.

Jim Krane, Fellow in Energy Studies, Baker Institute for Public Policy; Lecturer, Rice University and Mark Finley, Fellow in Energy and Global Oil, Baker Institute for Public Policy, Rice University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Rising oil prices, surging inflation: The Arab embargo 50 years ago weaponized oil to inflict economic trauma – sound familiar?

Jim Krane, Rice University and Mark Finley, Rice University

Fifty years ago, a secret deal among Arab governments triggered one of the most traumatic economic crises to afflict the United States and other big oil importers.

Saudi King Faisal and other Arab leaders launched an oil embargo on Oct. 17, 1973, as payback for Washington siding with Israel in its war with neighboring Egypt and Syria.

The oil market hostilities arose from a pact between Faisal and the leaders of Egypt and Syria, whose armies planned surprise drives to retake their territory under Israeli occupation. If the United States intervened to assist Israel, Faisal and other Arab producers agreed to retaliate with the “oil weapon.”

When Washington airlifted in U.S. weapons that helped Israel thwart Arab gains, Faisal and OPEC’s Arab members retaliated. They increased oil prices, banned oil shipments to the United States and cut production by 5% per month.

The ensuing economic and political carnage is legendary. The embargo catalyzed a long period of upheaval in global oil markets and pain at the gasoline pump for Americans and consumers globally. Oil prices quadrupled nearly overnight and remained high for over a decade. Producing countries leveraged the opportunity to reclaim sovereignty over their oil reserves. By 1980, many had completed the process of kicking Western oil companies out of their territories.

Oil’s global regime change

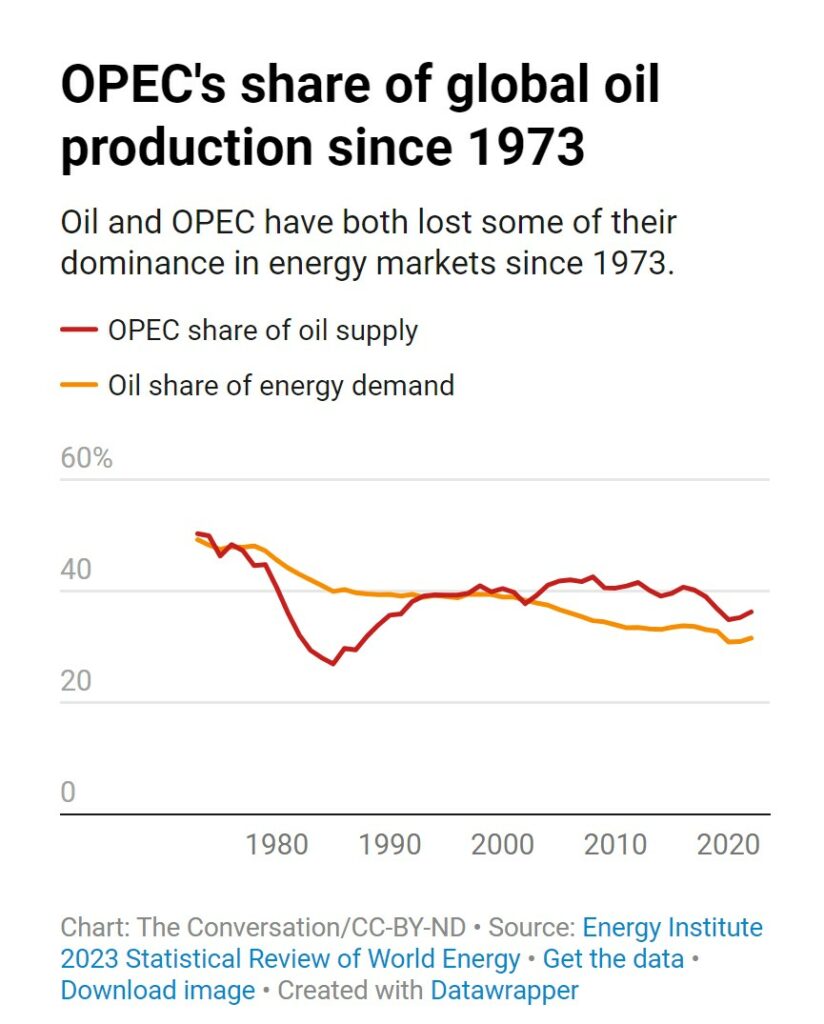

The embargo’s disruptive power was due to two key factors: OPEC’s dominance of world oil supply, and oil’s supremacy in the global energy mix.

Prior to the embargo, oil fueled almost half of total energy consumption in the United States (47.5%) and worldwide (49%). While OPEC countries produced more than half (53%) of global oil, the concessions were operated by Western oil majors.

After the embargo, producer states took over. Control of global oil production passed from Western oil giants like Shell and Exxon to newly formed national oil companies.

As a result, a torrent of cash from oil sales poured into Middle Eastern countries where rudimentary services like electricity were still being built out. Oil revenues in Saudi Arabia jumped fortyfold between 1965 and 1975, from US$655 million to $26.7 billion. These countries also amassed new geopolitical power.

How the oil price spike played out in the West

In the West, price increases wreaked havoc on economies and transport systems that were far less efficient than today. Inflation soon boiled over into “stagflation,” a combination of economic stagnation and high inflation. Misguided policies, including gasoline price controls and rationing, exacerbated shortages, creating long lines at service stations and emboldening gasoline thieves. https://www.youtube.com/embed/ra9Ep6jEcLA?wmode=transparent&start=0 A look back at the 1970s oil crisis.

America saw a pell-mell downsizing of gas-guzzling vehicles and a simultaneous ramping up of imports of fuel-efficient Japanese cars. Drivers obsessed over miles per gallon, and the U.S. government imposed corporate average fuel economy, or CAFE, standards, aimed at saving fuel by requiring automakers to sell more fuel-efficient cars.

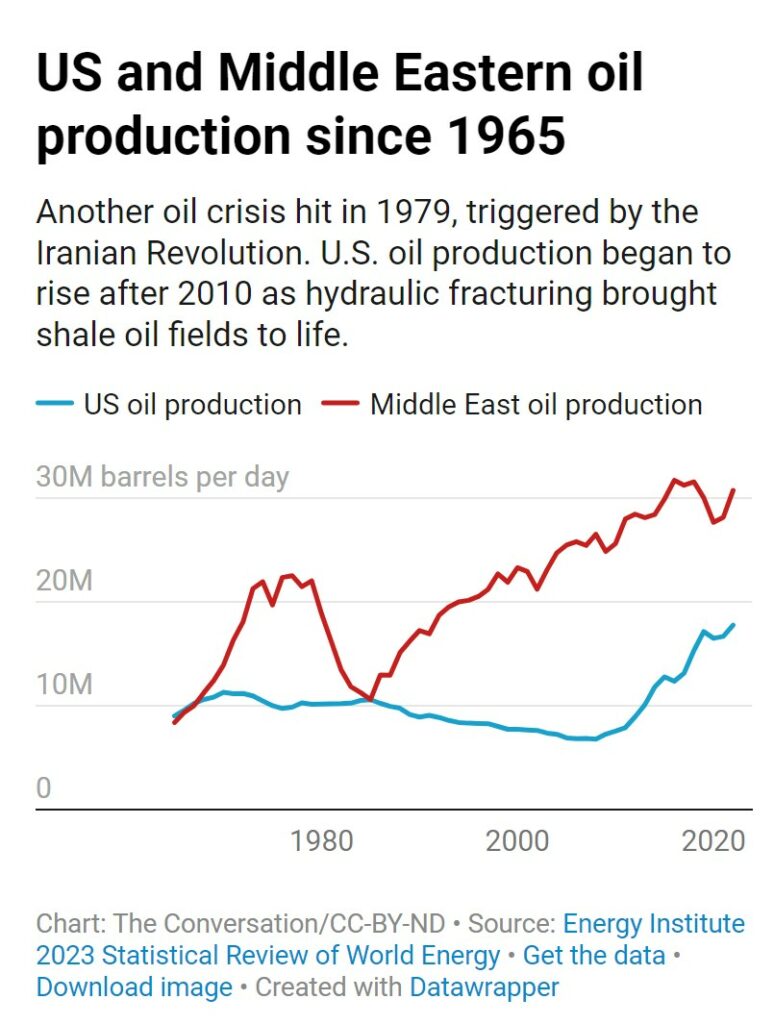

Western oil companies, kicked out of the Middle East and other oil regions, pivoted to more difficult terrain: the offshore Gulf of Mexico and North Sea, and the Arctic regions of northern Alaska.

As scholars of energy policy, we have long studied the embargo’s spillover effects on the global economy and political systems. These outcomes are a central theme in Jim Krane’s 2019 book “Energy Kingdoms.” On the embargo’s 50th anniversary, Oct. 17, 2023, King Faisal’s son, the former Saudi Ambassador to Washington Prince Turki Al Faisal, is joining us for a conference at Rice University’s Baker Institute to discuss the still-valid lessons of the Arab oil embargo.

50 years later, new pressures

Fifty years on, markets have changed. But oil continues to be the world’s dominant energy source.

On one hand, crude oil use has grown dramatically. Global supply has risen from less than 60 million barrels per day in 1973 to nearly 94 million barrels per day in 2022. Motor fuel prices are still a critical input to inflation; we calculate that the increase in gasoline prices in 2022 cost the average American household roughly $1,000.

On the other hand, OPEC’s importance – and oil’s share of the global energy mix – has declined. OPEC’s 13 members account for just 36% of global oil production today. The high oil prices caused by the 1973 embargo created incentives for oil drillers to diversify toward new sources of oil and develop substitute fuels to replace oil.

Within 15 years of the embargo, production outside OPEC increased by a massive 14 million barrels per day. Oil from Alaska and the Gulf of Mexico helped stabilize U.S. production. Later, the shale revolution turned the United States into the world’s largest producer and a net exporter of oil, capping a 50-year quest.

The world has also become much more efficient, reducing the amount of oil needed to maintain the same activity. Global per-capita oil use per dollar of gross domestic product has fallen by a massive 60% since 1973, our calculations show.

But, as in 1973, energy security concerns are back at the top of national agendas.

Russia’s 2022 invasion of Ukraine reprised the risks of energy “weaponization.” Europe, in particular, has been hurt by overdependence on Russian natural gas and has raced to shift its energy sources. The Israel-Hamas war that began on Oct. 8, 2023, has not yet ignited retaliatory responses from Arab governments, and the initial impact on oil has been minimal, but geopolitical effects from such a large event could still roil markets.

Energy security itself is also being altered. The transition to renewable energy sources like wind and solar insulates consumers from most supply chain risks. Electric vehicles likewise protect owners from swinging oil prices. So, while crucial materials can still be manipulated by governments, shortages and price spikes mainly affect component manufacturers and their investors. If supplies are bottlenecked long enough, the energy transition could be delayed.

Like the embargo 50 years ago, today’s crises have rendered the future of energy massively uncertain. Changes in the global energy mix, especially the rapid growth of electric vehicles, could weaken the importance of oil and the cartel that oversees it.

As former Saudi oil minister Ahmed Zaki Yamani was reported to have said a quarter-century ago:

“The Stone Age did not end for lack of stone, and the oil age will end long before the world runs out of oil.”

Jim Krane, Fellow in Energy Studies, Baker Institute for Public Policy; Lecturer, Rice University and Mark Finley, Fellow in Energy and Global Oil, Baker Institute for Public Policy, Rice University

Speaking of Datsuns, one recalls their 240Z model. Now there was a car.

Throughout the 70’s I was driving a VW bug. I much preferred driving a small car over a larger one. When I travelled for business, when it was to Canada, I was always provided with a rental Datsun. Certainly not a 240Z, always a terrible little ‘compact’ model. Barely like my beloved bug at all.

Eventually, I replaced the bug with a Chevy Camaro LT. Now there was a car. It was actually pretty scary to drive, had some serious defects, was hugely overpowered, got absolutely terrible gas mileage, Mrs Fred was actually afraid to drive it, but it was a lovely car.

It got replaced after only a few years, with a practical little Toyota Corolla fastback SRT, that lasted much longer, and was still kind of sporty, got great gas mileage. Only a few defects.

I had several bugs in my youth, and two buses, all well used and lots of self repairs. Fun to drive in traffic.

I was “rich” when oil lines were the rage owned a Roadrunner 383. The last V8 in my corrale

Funny how the Austin America I was driving fifty years ago doesn’t look all that different from the Mini Cooper I’m driving today. Same paint job even

I’ve had a handful of Volkswagons down through the years, though it was more of a Oregon logger/hippie/biker thing, and they’re fun to work on: 3 bugs, 2 busses (one a panel van the other with the little windows around the top), an early Fox and a later early 4 door sedan. Had an Opal Cadet too, a Buick Volkswagon; fine little sedan, I wonder what the first ex-wife did with that

Had a couple Pintos too; fine cars, buddy of mine still got the one I sold him …