Public funding for bringing transformative drugs to market

AB: It is a government policy to turn the fruits of its research over to private industry without any strings attached. The 1980 Bayh-Dole Act allows the National Institutes of Health (NIH) and universities housing government-funded scientists to patent and transfer (for royalties, of course) their scientific discoveries, research tools, and drug candidates to private developers. Smaller entities are created to do the research and development of new cures of diseases. Once a cure is created, close to, or approved, the larger corporations buy these companies for $billions.

The original developer walks away with hundreds of millions which can be used for new research and development. This occurred before sofosbuvir (Sovaldi) and after the earlier drug was approved. And yes, Gilead spent billions to acquire the company called Pharmasset. Pharmasset was a startup company which developed sofosbuvir (Sovaldi) a treatment for a particular disease.

So Gilead is on the hook for $billions in buying Pharmasset to get ownership of sofosbuvir (Sovaldi). All of which had nothing to do with the development of Sovaldi. When you get to the bottom, you will see two charts taken from a WHO Technical Report. The charts show how soon the costs of R&D are ty[ically recovered. Two to three years recovery and Gilead’s may be a bit longer. Their argument is not about R&D. It is about the Gov mingling in the drug business to bring prices down after it provides the R&D seed money.

Public funding for transformative drugs: the case of sofosbuvir, NIH, January 2021.

Authors: Rachel E. Barenie, Jerry Avorn, Frazer A. Tessema, and Aaron S. Kesselheim

The discovery of the medication ultimately marketed as sofosbuvir (Harvoni, Sovaldi, Epclusa and Vosevi) originated in several academic centers as early as the 1990s, continued at the start-up Pharmasset, and was later commercialized by Gilead Sciences. During this time, 29 directly related and 110 indirectly related awards from NIH were identified supporting key milestones in the development of sofosbuvir. This equates to a combined estimated total of at least US$60.9 million dollars of support after adjusting for inflation.

Research during Period I (before 1998) was focusing heavily on virology related to HIV/AIDS. Whereas the research in Period II (after 1998) was focusing more specifically on HCV, including both understanding the disease and possible drug therapies. The awards identified were crucial to the development of sofosbuvir.

For example, Rice and Sofia were awarded the Lasker-DeBakey Clinical Research Award in 2016, sometimes referred to as ‘America’s Nobel Prize’, for their work in replicating HCV and developing drugs to target it. Both were key milestones in the development of sofosbuvir. Even though, none of the academic researchers are listed on any of the key drug patents and neither could we identify licensing agreements or royalties received by any institution attributable to sofosbuvir specifically.

Publicly funded research underlays the development of sofosbuvir as it has with other transformative drugs.

Links to last sentence: (The roles of academia, rare diseases, and repurposing in the development of the most transformative drugs, Contribution of NIH funding to new drug approvals 2010-2016, Public section financial support for late stage discovery of new drugs in the United States: cohort study. BMJ. 2019.)

There is a widespread belief that the pharmaceutical industry is the most important source of innovation leading to the development of prescription drugs. This being a perception effectively disseminated by the industry and used to justify high US drug prices. A US Government investigation found that Pharmasset spent US$62.4 million (US$70 million inflation adjusted) developing sofosbuvir. Although most of these funds originated from early-phase private investors, the start-up also received direct support from the Federal Government. Six highly related awards were directed to Pharmasset between 2002 and 2006, including four R01 awards and two R43 awards. The NIH estimates it has invested > US$1 billion dollars in small businesses (e.g., R43 awards), including Pharmasset, to commercialize research. This policy has been criticized as NIH’s ‘socialization of risk with privatization of gains’ in drug development.”

AB: Ok so you read what money came out of NIH for sofosbuvir, the basis for a Hepatis C treatment. Lets take another look at funding for sofosbuvir. Again, the next section is a part of the complete article. I subscribe to Goozner’s writings.

Medicine at the Mercy of Wall Street, Washington Monthly, Merrill Goozner, January 2023

Capitalizing a Cure. Roy’s doctoral thesis at the University of Cambridge conducts a deep dive into the development and marketing of Gilead Sciences’ Sovaldi, the hepatitis C drug whose $84,000 price tag for a 12-week course sent shock waves through patients, payers, the press, and the public after it was approved by the FDA in late 2013.

Roy convincingly shows through this example how venture capital, Wall Street, and the industry’s top executives turned small biotechnology firms and Big Pharma corporations into vehicles for extracting wealth from the health care system. This is coming even as these ostensibly health-promoting companies deny access to millions of needy people at home and abroad and undermine the financial well-being of patients and payers.

Roy begins his story with a familiar tale: how government-funded academic researchers were largely responsible for the development of the drug sofosbuvir, which Gilead later named Sovaldi. (I say familiar because I published a book on this subject in 2004 that covered medical innovation in the last quarter of the 20th century, which, full disclosure, Roy generously credits.) This government-to-industry development path is, if anything, even more central to the drug development process today than it was two decades ago. Government-funded research lies behind the development of the COVID-19 vaccines; the latest cancer therapeutics, like CAR-T; and new drugs for treating many rare diseases.

Roy reminds readers at the dawn of the neoliberal era, it was deliberate government policy to turn the fruits of its research over to private industry without any strings attached. The Bayh-Dole Act of 1980 allowed the National Institutes of Health and universities housing government-funded scientists to patent and transfer (for royalties, of course) their scientific discoveries, research tools, and drug candidates to private developers.

The 1982 Small Business Innovation Development Act accelerated the process by creating small business innovation research (SBIR) grants, which primarily went to biotech start-ups to develop these new tools and drugs. The new laws weren’t limited to biomedicine. The surveys of university technology managers show that four out of every five transferred patents and SBIR grants involve medical technologies. Not surprising, given the NIH’s budget of$45 billion in 2022 consistently weighs in at about five times the size of the National Science Foundation, which funds all other sciences.

Emory University’s Ray Schinazi, who in 1996 created a biotech company called Triangle Pharmaceuticals to develop an AIDS drug discovered in his university lab called emtricitabine. Emtricitabine was showing great promise in clinical trials. Schinazi and his partners sold Triangle to Gilead Sciences for $464 million, laying the foundation for Gilead to become the leading purveyor of AIDS antivirals.

Capital from the sell was used to launch Pharmasset, to develop drugs for other viral diseases, including a candidate for treating hepatitis C, which had been developed with government grants. As Roy points out, the company’s name embodied its business strategy. The idea was to develop intangible financial assets or patents on promising drug candidates. Such could be sold to Big Pharma. Less than a decade later, Schinazi became a repeat winner in the biotech sweepstakes when he sold Pharmasset to Gilead for $11 billion, from which he cleared an estimated $440 million.

AB: The clincher . . .

The drug’s eventual price had nothing to do the cost of development (Roy estimates that the government, Pharmasset, and Gilead spent less than $1 billion over the decade it took to develop the drug); the risks Gilead took; or the value the drug delivered to patients and the broader economy. Roy writes,

“Gilead’s senior leadership saw their company as a late-stage acquisition specialist, buying compounds in their final steps of development and thereby taking control of potential future earnings streams just as the compounds neared and then crossed the regulatory finish line …

Gilead’s approach had by then become common across the industry.“

AB: What? Didn’t the NIH article say similar about the costs of development???

You can read the rest of Merrill Goozer commentary on Washington Monthly. This gets my point across.

Here is Standish Fleming at Stat,

The outsized effect of ‘modest’ price controls on pharma innovation, statnews.com. August 2022.

Drug price controls in the U.S. Senate are being met with dire warnings, such an approach will stifle innovation, shut off the pipeline of new medicines, and cost lives down the road. Is innovation so fragile that a modest reduction in profits of global giants could seriously impact the supply of new drugs?

Small companies originate more than half of all new medicines. Yet the high-cost drugs that lawmakers would target are sold by global giants. Many of them make so much money that they return “excess” profits to shareholders through share buybacks. Congress believes that they can take a portion of those excess profits to balance the federal budget or fight global warming with little risk to productivity.

AB: Non sequitur on the Global Warming. We have already discussed where the technology comes from for development. They should take part of the proceeds from corporations who are already getting a sweet forever deal from trumps 2017 tax deal passed under reconciliation except, except for corporations.

There is more to this grousing about by Corporations, Gilead is leading the charge using Sovaldi as abais for their argument. I think we squashed it.

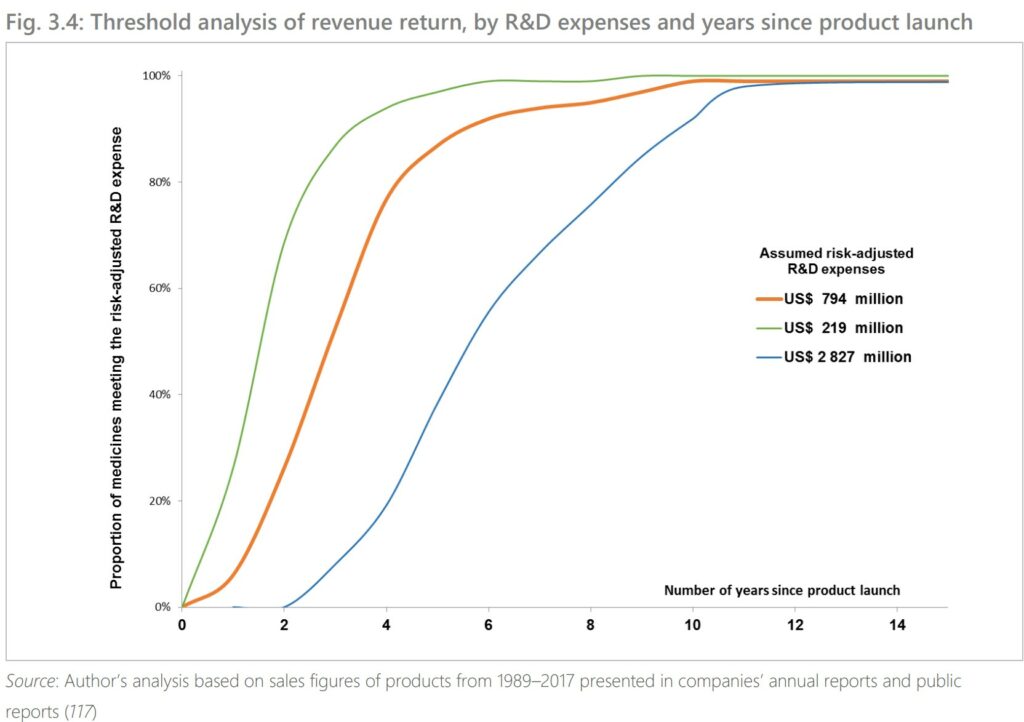

AB: So when does Pharma companies recoup costs? Gotta a chart for this.

Threshold Analysis of revenue return by R&D expenses.

What you are looking at is . . . How many years does it take to recoup R&D costs. For cancer drugs, 3 to 5 years. For Sovaldi, I would think it would be less as development costs were already less.

The median time to generate revenue to fully cover risk-adjusted R&D cost of US$794 million was 3 years (range: 2 years; 5 years, n=73). For the maximum estimated risk-adjusted cost of R&D (US$2 827million), the time to cost recovery was 5 years (range: 2 years; 10 years, n=56). A threshold analysis found that 99% of the 45 cancer drugs with sales data 10 years from their first year of launch had generated incomes sufficient to at least offset the risk-adjusted R&D costs irrespective of the assumed threshold values for R&D costs. A threshold analysis found that 99% of the 45 cancer medicines with sales data for 10 years from their first year of launch had generated incomes sufficient to at least offset the risk-adjusted R&D costs irrespective of the assumed threshold values for R&D costs (Fig. 3.4).

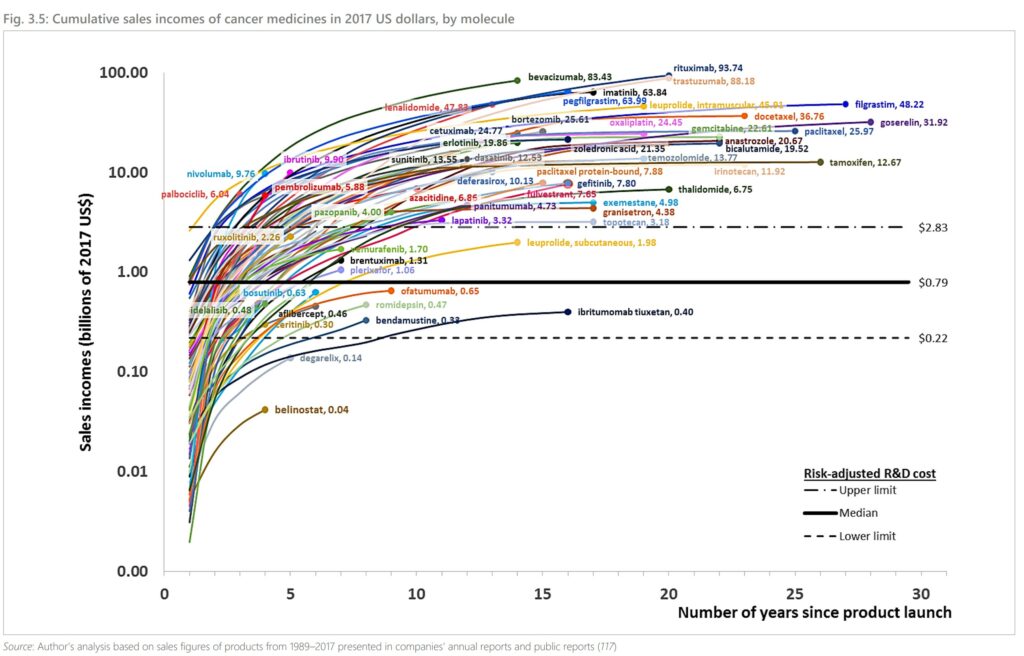

Cumulative Sales Income

Technical Report, World Health Organization; Pricing of cancer medicines and its impacts

What this is telling me, costs to bring to market are resolved in two to three years. Gilead needs no further funding. Neither can Gilead claim a need for high prices.

https://www.nytimes.com/2004/10/31/books/chapters/the-truth-about-the-drug-companies.html

October 31, 2004

‘The Truth About the Drug Companies’

By Marcia Angell

The $200 Billion Colossus

What does the eight-hundred-pound gorilla do?

Anything it wants to.

What’s true of the eight-hundred-pound gorilla is true of the colossus that is the pharmaceutical industry. It is used to doing pretty much what it wants to do. The watershed year was 1980. Before then, it was a good business, but afterward, it was a stupendous one. From 1960 to 1980, prescription drug sales were fairly static as a percent of U.S. gross domestic product, but from 1980 to 2000, they tripled. They now stand at more than $200 billion a year. Furthermore, since the early 1980s, this industry has consistently ranked as the most profitable in the United States-by a long shot. (Only in 2003 did it fall from that position to rank third among the forty-seven industries listed in the Fortune 500.) Of the many events that contributed to their sudden great and good fortune, none had to do with the quality of the drugs the companies were selling….

http://cepr.net/blogs/beat-the-press/the-best-way-to-remove-corruption-in-medicine-take-the-money-out

September 18, 2018

The Best Way to Remove Corruption in Medicine: Take the Money Out

By Dean Baker

Former New England Journal of Medicine editor Marcia Angell had a column * in the New York Times explaining how efforts to increase transparency had not ended the corrupting influence of money on medical research. Her piece describes various ways in which the researchers who get money from drug companies bend research to favor their benefactors….

* https://www.nytimes.com/2018/09/14/opinion/jose-baselga-research-disclosure-bias.html