June’s JOLTS report: slow progress towards a new equilibrium

June’s JOLTS report: slow progress towards a new equilibrium

– by New Deal democrat

Yesterday’s JOLTS report for June captured a labor market that continues to move towards a new equilibrium, mainly via a gradual decline in job openings compared with labor availability. In other words, for the umpteenth time, “deceleration.”

Job openings and actual hires both declined to new 2+ year lows, and voluntary quits also declined to just above a 2+ year low:

For comparison, just before the pandemic, shown at far left, all three metrics were close to or at all time highs.

Hires on a monthly basis are already back to pre-pandemic levels, and voluntary quits are about 80% back to pre-pandemic levels from their post-pandemic highs. Job openings, which unlike hires and quits, is a “soft” rather than a “hard” metric, because it can be inflated by, e.g., permanent or sham listings, have now retreated by slightly more than 50% to their pre-pandemic levels.

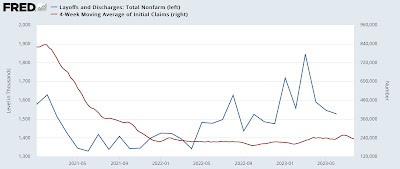

By contrast, layoffs and discharges bucked the trend of softness and declined to a 6 month low (blue):

Their pre-pandemic range was about 1700-1900. Their 1527 level in June was far below that. Note that layoffs and discharges tend to lead initial jobless claims (red, right scale), which have also declined significantly in the past few weeks.

Given all the other information we have, the downturn in layoffs looks like a counter-trend move compared with the past year.

For the past 18 months, I’ve likened the job market to a game of reverse musical chairs, where there are more chairs put out by potential employers than there are job applicants willing to fill them. June’s JOLTS report continued the trend we’ve seen for the past 15 months of a jobs market slowly returning towards a convergence of the number of chairs and players. It is likely that Friday’s employment report will show more of the same as well.

May JOLTS report: continued decelerating trend, but still extremely positive, Angry Bear, New DEal democrat

Is Good News Finally Good News Again?

NY Times – August 3

Economists had been wary of strong economic data, worried that it meant inflation might stay high. Now they are starting to embrace it.

Good news is bad news: It had been the mantra in economic circles ever since inflation took off in early 2021. A strong job market and rapid consumer spending risked fueling further price increases and evoking a more aggressive response from the Federal Reserve. So every positive report was widely interpreted as a negative development.

But suddenly, good news is starting to feel good again.

Inflation has finally begun to moderate in earnest, even as economic growth has remained positive and the labor market has continued to chug along. But instead of interpreting that solid momentum as a sign that conditions are too hot, top economists are increasingly seeing it as evidence that America’s economy is resilient. It is capable of making it through rapidly changing conditions and higher Fed interest rates, allowing inflation to cool gradually without inflicting widespread job losses.

A soft economic landing is not guaranteed. The economy could still be in for a big slowdown as the full impact of the Fed’s higher borrowing costs is felt. But recent data have been encouraging, suggesting that consumers remain ready to spend and employers ready to hire at the same time as price increases for used cars, gas, groceries and a range of other products and services slow or stop altogether — a recipe for a gentle cool-down. …