June inflation almost non-existent except for the fictitious measures of shelter

June inflation almost non-existent except for the fictitious measures of shelter

– by New Deal democrat

The message of this morning’s consumer inflation report was the same for almost everything except for the fictitious measures of shelter: sharp deceleration everywhere.

Let’s take a look:

Headline CPI up 0.2% m/m and 3.1% YoY (lowest since March 2021)

Core CPI up 0.2% m/m and 4.9% YoY (lowest since October 2021):

CPI less shelter up +0.2% and 0.7% YoY (lowest since February 2021):

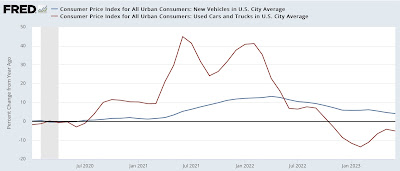

New and Used vehicles: 0.0% and down -0.5% respectively m/m, and up +4.1% and down -5.2% YoY respectively:

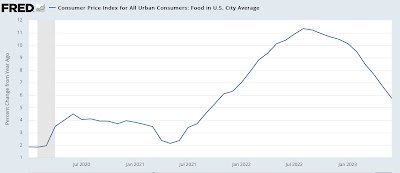

Food up 0.1% m/m and 5.7% YoY:

But food is only up 0.3% in the 4 months since February:

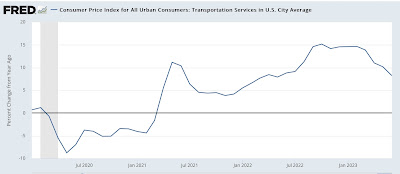

Transportation services (replacement parts, repairs etc.) has also been a hot spot, and has also decelerated, up 0.4% m/m and up 8.2% YoY (but down from a peak of 15.2% YoY last October:

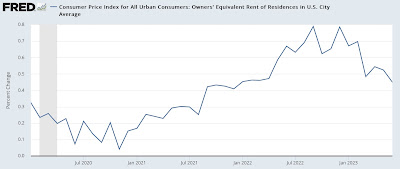

Finally, Owners Equivalent Rent up 0.4% m/m:

and 7.8% YoY (down from all time YoY high of 8.1% YoY in April):

Here’s what it looks like in comparison with house prices as measured by the Case Shiller national index YoY (/2.5 for scale):

Since the beginning of this year, monthly increases in OER have declined from 0.8% to 0.45%. YoY OER is probably going to be below 4.0% and maybe below 3.0% by the end of next winter.

To sum up: except for the fictitious measure of shelter, the only other remaining “hot spots” for inflation are new vehicles (but resolving as the supply chain issues have finally resolved) and transportation services. Food inflation has basically stopped in the past 4 months.

And if actual new rent increase and house prices were substituted for the fictitious OER measure and the 12 month average used for leases, headline inflatioin would only be up about 0.8% YoY, and core inflation up 3.0%.

But I’m sure there’s some sticky price blah blah blah somewhere that will justify the Fed’s continued hawkishness.

Inflation ex-shelter increasing at 1.0% annualized rate since last June; core inflation with actual house prices only up 3.0% YoY, Angry Bear, New Deal democrat.

probable typo?: monthly increases in OER have declined from 0.8% to 0.45%.

I am not sure you explained what you mean by “fictitious measure”

I have some problem with “owner equivalent rent” myself. but there was a report today (NYT?) that rents have increased greatly leaving very little (few?) rentals for low income families. i assume this is related to corporate takeover of the rental market and political resistance to building low income housing (not in my neighborhood, and not with my taxes).

I bought my low income house years ago so I am not directly affected by high rents. But my taxes have gone up a great deal due to the arrival of Californians with a lot of money who can pay a lot more for a house than people with Oregon incomes. Same for farmland, but I think this is due to corporate takeover of farmland…which has nothing (apparently) to do with inflation, but with cornering themarket for future profits.