Driven by the hurricane force disinflationary tailwind, real personal spending and income, and real sales, all increase nicely

Driven by the hurricane force disinflationary tailwind, real personal spending and income, and real sales, all increase nicely

– by New Deal democrat

In the current economy the personal spending and income report is just as important as the jobs report. That’s because, despite the downturn in manufacturing production and many parts of the housing market, consumer spending especially on services has continued to power the economy forward.

Today’s report was more good news in that regard, as every important metric was positive.

Let’s start with real personal income (red) and spending (blue), which in the below graph are normed to 100 as of the onset of the pandemic. Real income rose 0.1% in June, while real spending rose a solid 0.4%:

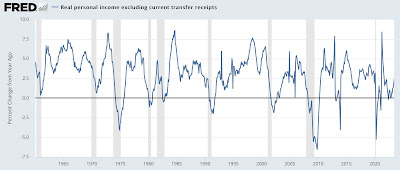

One of the 4 important coincident measures for the NBER, real personal income less government transfer receipts, also rose 0.2% to another new high. It is now up 2.4% (vs. only 1.3% two months ago) YoY:

As you can see, this is the kind of rebound you would expect to see coming out of a recession, not heading into one.

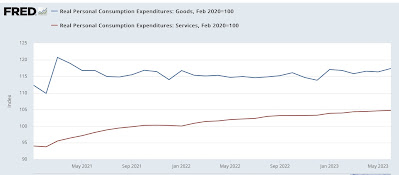

On the spending side, here’s how goods vs. services spending compare:

Real spending on services continued to rise at a steady clip (roughly 2.6% YoY), while real spending on goods, which had been flat, had a nice +0.9% pop. Outside of this past January, this is one of the strongest readings in 2 years.

Real spending on goods can be decomposed further into durable (red) vs. no durable (blue) goods, showing that the big increase was in durable goods:

We know that motor vehicle sales have recently finally increased to over 15 million annualized. My suspicion is that is what is reflected in the big increase in durable goods consumer spending in June.

The personal saving rate – income that isn’t spent – declined -0.1% for the month. Although it is still elevated compared to its 2.7% level at its low water mark last June:

Consumers tend to get cautious and save more in the advance of a recession. That has occurred in the past year, but this month was a small positive.

Additionally, the personal consumption deflator gets used in the calculation of real manufacturing and trade sales, which is another important coincident indicator monitored by the NBER. These rose 1.1% in May, but they are still below their recent January peak:

Finally, note that almost all of the good news reported above had to do with “real” i.e., inflation adjusted metrics. The good news was greatly assisted by the continuing decleleration in the personal consumption deflator, up only 0.2% in June, and is up 3.0% YoY:

This is a very sharp deceleration from its peak of 7.0% YoY twelve months ago. But as shown by the month over month % changes below:

There will be much more challenging YoY comparisons beginning with next month’s report.

To sum up: almost everything about this report was positive. If you are cheering on a “soft landing,” then this report is potent ammunition. And it is all-around good news for average American consumers.

On the other hand, as noted above, last June was an inflection point. Gas prices in particular, along with a host of other commodities, declined in price thereafter. If that tailwind is ending – and I suspect it is – what happens next?

But, if you poll the average voter, everything is in the shitter. So, J’Biden’s approval numbers suck.