The hard Financial Lessons for Two Entities

The End of Easy Money: Bankruptcy Filings Pile Up at Fastest Rate since 2010, Wolf Street, Wolf Richter.

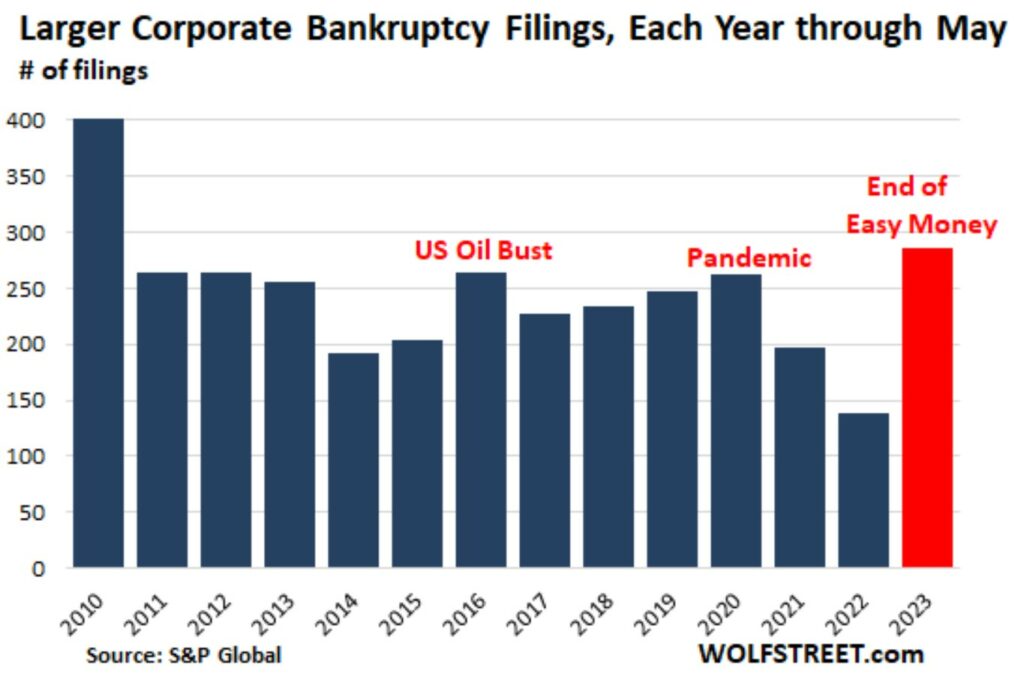

t’s turning into a banner year for corporate bankruptcy filings. Easy Money has caused all kinds of excesses, fueled by yield-chasing investors, in an environment where the Fed had repressed yields with all its might. Those yield-chasing investors kept even the most over-indebted zombies supplied with ever-more fresh money. But that era has ended. Interest rates are much higher, and investors are getting a little more prudent, and Easy Money is gone.

At the peak of the Fed’s yield repression in mid-2021, “BB”-rated companies – so these companies are “junk” rated – could borrow at around 3%. (My cheat sheet for corporate credit rating scales by ratings agency). Companies are junk rated because they have too much debt and inadequate cash flow to service that debt. In other words, investors risked life and limb to earn 3%, and now these investors are asked to surrender life and limb, so to speak. But that’s how it goes with yield-chasing.

These “BB” junk bond yields have risen to nearly 7%. This means these companies that had trouble producing enough cash flow to service their 3% or 5% debt, have to refinance this debt when it comes due, or add new debt, at 7%. That 7% may still be low, considering inflation running around near that neighborhood, but it puts a lot more strain on those companies.

So lots of overindebted junk-rated companies will restructure their debts in bankruptcy court at the expense of stockholders, bondholders, and holders of their leveraged loans. That’s how it’s supposed to work. That’s how the corporate-debt burden gets lifted off the economy. And it’s starting to work that way.

Bankruptcy filings will whittle down the corporate debt overhang. Many companies will emerge from bankruptcy with less debt, and they’ll be nimbler and more able to thrive. Others will be sold off in bits and pieces, making room for appropriately managed companies not encumbered by these issues.

There is a cleansing aspect to this part of the credit cycle that needs to be allowed to do its job to get rid of the excesses and the deadwood at the expense of investors. This cleansing process that has now just started is long overdue.

and then there is this fall out . . .

“Student debt has destroyed livelihoods for four generations,” The Washington Post.

Lisa Ansell writes for the Student Loan Justice Org. which has been featured at Angry Bear.

Regarding the June 3 news article: “After three years, borrowers prepare for student loan payments to resume”

Amid the partisan fault lines erroneously drawn around the topic of student debt cancellation, where is the bipartisan call to restore the constitutional right of bankruptcy back to student loan debt? One in 5 adults in this country — of all demographics and party affiliations — is burdened by crippling student loan debt.

Student debt has destroyed the lives and livelihoods of four generations. The removal of bankruptcy protections from federal student loan debt in 1998 and from private student loan debt in 2005 caused the crisis we face today. Moreover, the highly unethical lending practices borrowers experience are almost entirely because of a lack of consumer protections that every other type of loan possess.

The lending system is designed to keep borrowers trapped in a lifetime of indentured servitude with compounded interest and negative amortization that result in the borrower never being able to pay down the original principal.

With slightly more than half of all borrowers identifying as Republican or independent, this is not a crusade that the GOP should wage. The return of bankruptcy protections is a necessary step in allowing borrowers to reclaim their lives and have a fighting chance at saving for retirement. The sooner our elected officials recognize this is a crisis beyond partisan claims, the sooner we will come to a workable solution — bankruptcy — that offers a glimmer of hope.

Lisa Ansell, Los Angeles The writer is associate director of the University of Southern California’s Casden Institute.

~~~~~~~~

Congress does not bat an eye to this when there is a surge in business bankruptcy by 18-year olds. After all companies are risking life and limb.

This is the largest surge since 2010. Whittling down corporate debt “overhang” is what Wolf is calling it. Companies and students will emerge from bankruptcy with less debt, nimble, and more able to thrive. They will be ready to start the business gamble all over again. Which companies do . . .

There is a cleansing aspect to this part of the credit cycle. It needs to be allowed to do its job getting rid of the excesses. The deadwood is cleared at the expense of investors and schools and the gov. The long overdue cleansing process has just started.

Who would have thought? So magical, as there is always a way out for business which may do the same over and over again with little consequence, But 18-year-olds have far more wisdom than businessmen and should have known what they were doing when they sign on the dotted line to get educational funding which was sold to them as a way to succeed.

yes.

The inequity in preventing student borrowers from declaring bankruptcy on their student debt is obvious. The conservatives in this nation rail against students and student debtors as if they might be some sort of aliens plopped down on this planet who don’t deserve the same treatment as other citizens and residents of this nation trying to better their lives. If a person graduates from their general schooling and borrows, say, $50K to start a business and it fails, they get to declare bankruptcy. If a person graduates from their general schooling and borrows, say $50K, to study for a profession which demands they have that knowledge and those skills, they get blown off.

What’s the difference, other than the attitude by the so-called populists that studying hard and attending classes on a regular basis isn’t essentially a job itself. The arrogance of these people in deciding just what type of endeavor gets to be deemed real effort is just mind boggling — and they have the gall to call people who graduate from college and universities “elitists.” Every accusation they make is a confession of their own attitudes.

Praha:

I am not sure I would call them populists. These are the I walked uphill both ways to and from school. Many are just jealous. If adults mess up on debt, how is it an 18 year old be held responsible for debt? The former is forgiven and latter get a ball and chain for life. Thanks for your comment.