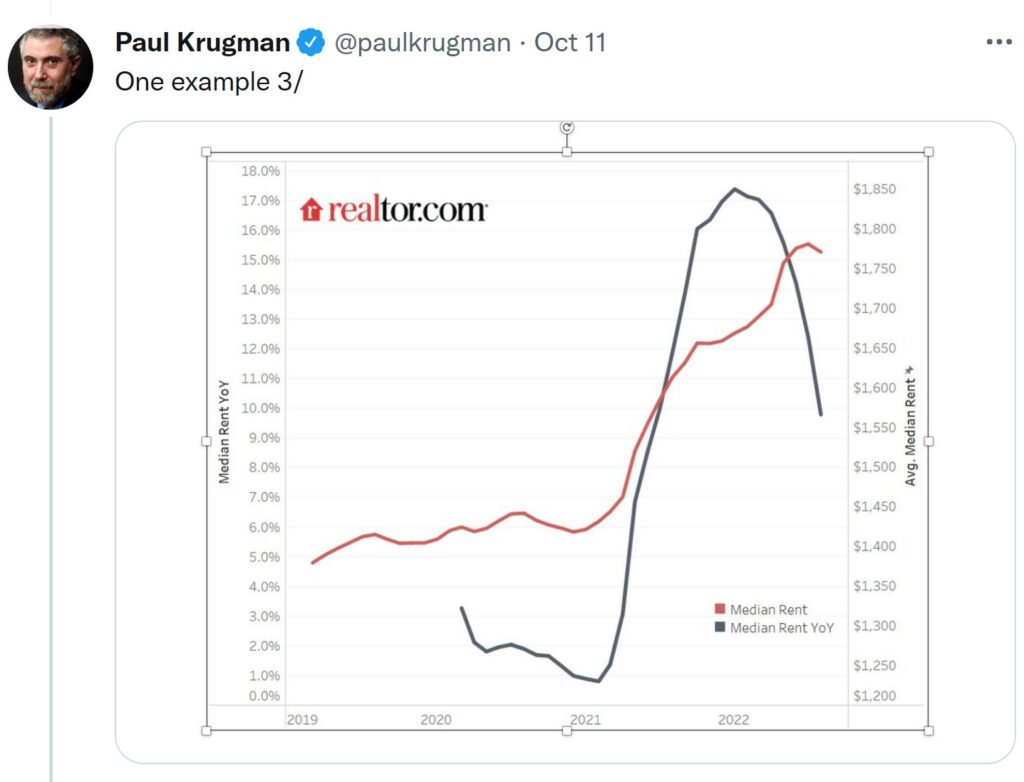

*Actual* rents and house prices lead the CPI measures by about a year

Two of the most knowledgeable economists discussing events leading up to this year’s high inflation and the resulting interest rates. Of course, the Fed is reacting to the high inflation rates. If we look out into the future, probably early next year for a recession.

OER should not be used by the Fed in setting policy. The Fed is currently chasing a phantom lagging menace.

“Actual* rents and house prices lead the CPI measures by about a year.” In our neck of the woods, home prices are dropping, sales are down, and mortgage rates are about 6%. Inflation remains high. Hat Tip to New Deal democrat for sending this conversation. Thanks NDd..

~~~~~~~~

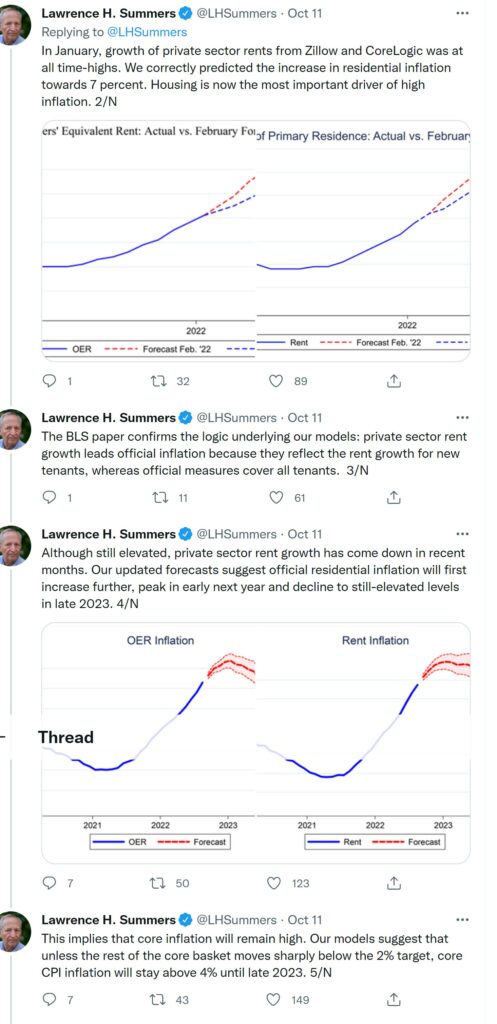

Larry Summers projects his thoughts on Inflation.

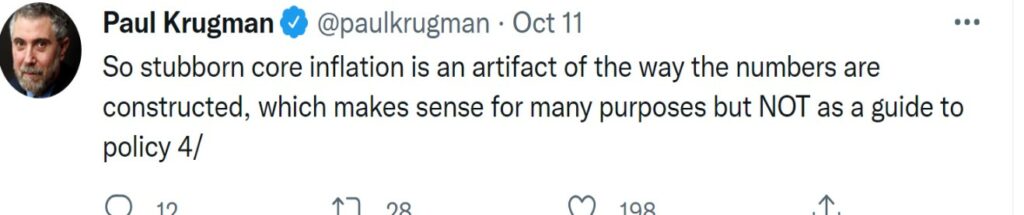

Paul Krugman Responds . . .

People can still find work. They do crab about gasoline prices.

“September consumer inflation; function of fictitious “owners’ equivalent rent + new cars” – Angry Bear

“Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace” – Angry Bear

Economics is already voodoo enough without adding wishful thinking about the future into the mix. The massive housing bubble was created by printing money and holding rates at stupid levels. This article seems to advocate pumping up massive bubbles and then holding them at a “permanently high plateau.” How will that work? And then you all will be whining about house prices being stable so you can’t flip your 19th condo for a profit. And then what? We pump up the market again just to move things higher still?

What is wrong with correcting inflation by allowing deflation? Deflation is hardly evil. The story of the Great Depression is not that it was created by deflation; it was created by inflation! So we get ten years of inflation followed by a month of deflation. That still makes prices double what they were ten years ago! Where does this end?

You don’t need monetary policy to create inflation when landlords are able to legally collude to keep rents-up.

The Property owners can use software product to coordinate rent increases. It’s not a monopolistic predation because we used a tool!