Real retail sales decline again slightly

Real retail sales decline again slightly

– by New Deal democrat

Nominal retail sales for the month of June rose 1.0%, and May was revised up by 0.2% from -0.3% to -0.1%. But since inflation was 1.3% in June and 1.0% in May, this makes the combined downturn in real retail sales -1.4% for the two months:

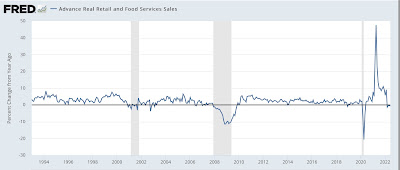

YoY real retail sales is down -0.5%. In the past 75 years, a decline in real retail sales YoY has frequently – but not always – indicated a recession. Here’s what the past 30 years look like:

To repeat what I said one month ago, not good news.

Next let’s turn to employment, because real retail sales are also a good short leading indicator for jobs.

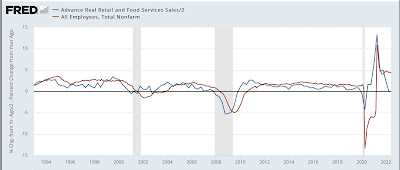

As I have written many times over the past 10+ years, real retail sales YoY/2 has a good record of leading jobs YoY with a lead time of about 3 to 6 months. That’s because demand for goods and services leads for the need to hire employees to fill that demand. The exceptions have been right after the 2001 and 2008 recessions, when it took jobs longer to catch up, as shown in the graph below (note: sales averaged quarterly to cut down on noise):

I have been writing for months that I have expected the blowout job numbers of about 500,000 per month to slow down to a range of about 100,000-300,000 per month by early autumn. The last 3 months have averaged 383,000, so the slowdown has begun, but there is almost certainly more to go.