New Home Sales Fall Sharply . . .

New home sales continue to fall sharply, while prices for both new and existing homes continues to increase sharply

New home sales declined further in June to 590,000 annualized and May was revised sharply lower as well:

This was the lowest number since the pandemic lockdown month of April 2020, and before that since December 2018. It is also over 40% lower than the peak reading of 1.036 sales annualized in August 2020. This is absolutely recessionary, as is easily seen in the above graph.

The median price of a new home increased 1.7% in June (not seasonally adjusted), and remained sharply higher YoY at 15.1%:

The FHFA and Case Shiller house price indexes were also released this morning. The also showed that house prices continued to increase sharply in May

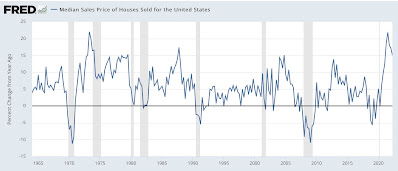

The Case Shiller national index rose 1.0% for the month and 19.7% YoY, below last March’s 20.5%, which was the biggest YoY% gain ever. Meanwhile, the FHFA purchase only index rose 1.4% for the month, and 18.3 YoY, below its peaks of 19.3% in February, and 19.4% last July. The YoY% changes for both for the past 5 years are shown below:

While both are decelerating somewhat from their YoY peaks, they remain historically high.

Here is a longer term view, demonstrating that the current surge in house prices is the biggest in the past 30 years, surpassing even the housing bubble:

Owners’ Equivalent Rent (x2 for scale, black) is also shown above. As I have pointed out many times, OER follows house price indexes with roughly a 12-18 month lag. OER has also risen to a 30 year record YoY high, and can be expected to accelerate further for several more months at least.

We saw last week that the median price of an existing home sold in June also increased 13.4% YoY, indicating that sharp increases in those prices had not yet abated. For new homeowners, they can contact professionals like Edmonton movers edmonton to ease out on their moving costs. And when new homeowners like you are ready to move, these professional packers and movers here are top-rated packers and movers, so you can rest easy knowing that they will be meticulously packed for safe transport.

As I have frequently pointed out, sales lead prices. Prices can continue to rise for even a year after prices peak. But with this kind of sales decline, I fully expect outright price declines to follow, and soon.

Additionally, since OER plus rents contribute a full 1/3rd of the entire value of the CPI, and can be expected to accelerate further, I see very little reason to believe that, absent the Fed creating a recession, consumer inflation (outside of gas prices) is going to abate meaningfully anytime soon.

High home prices plus higher interest rates equal lower sales. Amazing.

To me, a 5.something mortgage rate is still very low. My dad had a 5.75% mortgage on our home bought in the mid-60’s. The price then was $15,900. The houses going up behind us right now are priced starting at $414,900. Generously an extra 600SF on the house itself, but less than half the lot size. Not a good value from my perspective, but that is very comparable to the more recent construction in our area. That is California for you.

Jane

As you know and I am sure you know. The monthly payment on a home at 5.75% and $100,000 and the same interest rate at 414,000 is vastly different. Where I live, the same holds true for my home at $320,000 at 2.65% last year and $370,000 and 6% this year. Young people are balking at paying an extra $600/month now and the builders do not understand why!

Back in the 90’s we bought with an adjustable rate mortgage, because stupid I guess. I had run the mortgage calculators and knew what the payment would be after the teaser expired. What I had not done is interpret some of the fine print in the contract the same way as the lender, and what I thought was an annual cap was apparently not really. That made us angry enough to take money out of savings to pay it off. Very few people would have had that option.

I do not know where people today get the money, even with two people earning pretty decent wages.

They used to call it “house poor”, putting every cent into the mortgage. Been there, done that, really feel sorry for young families who will have to do that again. I don’t see how they can avoid it and still live here.

JaneE

I agree on house poor, This time our payments are more than usual. I just planned to have the mortgage payment each month, in the bank, before it is due and before we receive any checks. So far it is working. We also have a reserve set aside to fill the gaps. We are on a fixed income which is adequate and our expenses are mostly fixed. This year SS will increase by at least 5% (and probably more), which just adds to our funds. Not rich, just careful.

i have a different interpretation on what the new home sales report says about home sales prices…

Census estimated that the median sales price of new houses sold in June was $402,400, down from the median sale price of $444,500 in May, but up from the median price of $374,700 in June of last year, while the average June new home sales price was at $456,800, down from the revised $514,000 average in May and down 19.8% from the record $569,300 average sales price in April, but still up from the average sales price of $431,900 in June a year ago….

i’m looking at the first table here: https://www.census.gov/construction/nrs/pdf/newressales.pdf

of course, you can interpret those figures any way you choose..

We Need to Keep Building Houses, Even if No One Wants to Buy

NY Times – July 23