Lowest new jobless claims in over half a century

Lowest new jobless claims in over half a century

The first two of four data releases this morning were corporate profits for Q3 and jobless claims for last week.

Corporate profits, a long leading indicator, increased slightly in Q3 over Q2, by 1.9% or 4.2% depending on whether you include various inventory adjustments. Deflated by unit labor costs, they either increased by 0.3% or decreased by -0.1%. While they haven’t decreased significantly in any accounting, the big post-lockdown and stimulus-fueled pandemic surge is over.

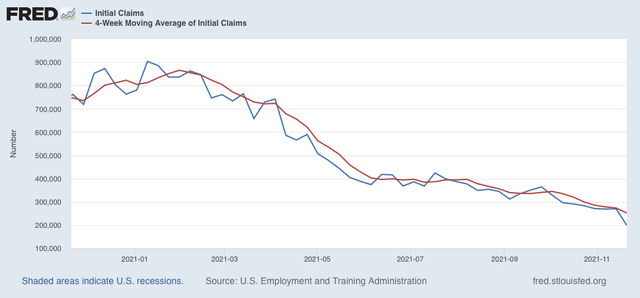

Initial claims declined a huge -71,000 this week to 199,000, its lowest reading since 1969 when the US population was half of what it is now! The 4-week average declined -21,000 to 252,250, the lowest since 1973 except for 2017 through February 2020:

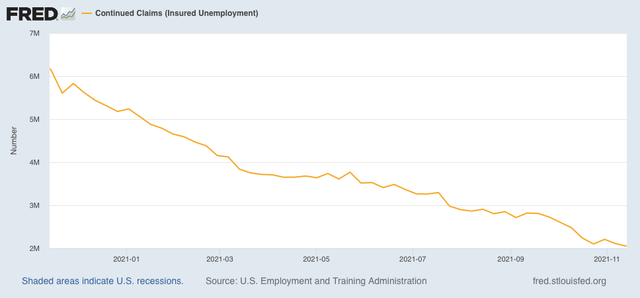

Continuing claims also declined -60,000 to a new pandemic low of 2,049,000:

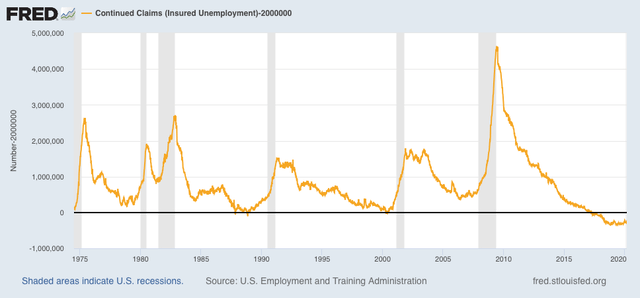

Only a few weeks in the late 1980s, plus 2 months in 1999, plus the last 4 years of the last expansion were below this number:

I am sure the super-low number of initial claims this week has a lot to do with Thanksgiving week seasonality, so I expect a rebound next week. Still, this is yet another sign of a Boom in labor strength that has not been seen since the late 1990s at least.

USA never ceases to amaze. Another drop in unemployment could be obtained by a shrinking M2 money stock. Disinflationary expectations encourages vendors to dump inventory by dropping the asking price, increases M2V, gets folks rehired, raises the multiplier effect.

good

luck

!