Biden’s American Rescue Plan Act Improves the ACA for All Incomes

President Biden’s temporary ARPA Improves ACA Subsidies through 2022.

xpostfactoid: Will 60-64 year-olds have a choice between Medicare and Obamacare? What will that look like?, ARP puts more ‘affordable’ in the Affordable Care Act | healthinsurance.org and How the American Rescue Plan Act will boost marketplace premium subsidies | healthinsurance.org

If you have not been reading any of what is going on with the ACA and Medicare; it is time to update your knowledge. It gets a little complex. Thanks to blogger Andrew Sprung @ xpostfactoid, for explaining what is happening with the ACA and making it clearer. Also Washington 7th District Congresswoman Pramila Jayapal has introduced H.R 5165 which lowers the age for Medicare eligibility to 60. There is more to this topic than what I will put here and will go into it in a separate post.

American Rescue Plan Act Enhances Subsidy Income Levels

ACA – Biden’s American Rescue Plan Act is enhancing ACA marketplace coverage through 2022. The ARP Act came to be in March 2021. The Act insures more people during the pandemic. The plan establishes increasing subsidies for ACA insurance plans through 2022. The ARPA opens up another enrollment period for people who are not enrolled.

The ARP increases healthcare plan premium subsidies for all income levels sold in ACA marketplaces. The increased subsidies reduce the percentage of income enrollees have to pay for an ACA “benchmark” Silver plan, the 2nd tier and lowest cost Silver plan.

Key ACA Cost Benefits of the ARPA (H.R. 1319):

- The legislation help ~ 12 million current marketplace plan buyers, plus the newly enrolled.

- Under H.R. 1319, no one would pay more than 8.5% of their income for a Tier 2 Silver plan (includes enrollees with household income >400% FPL.

- In areas of the U.S., households well over 400% FPL may receive subsidies.

- Subsidy increases depend on location, income, and age of policyholders.

- The legislation’s adjustment to subsidy guidelines would be retroactive to January 2021, temporary, and extending only through 2022.

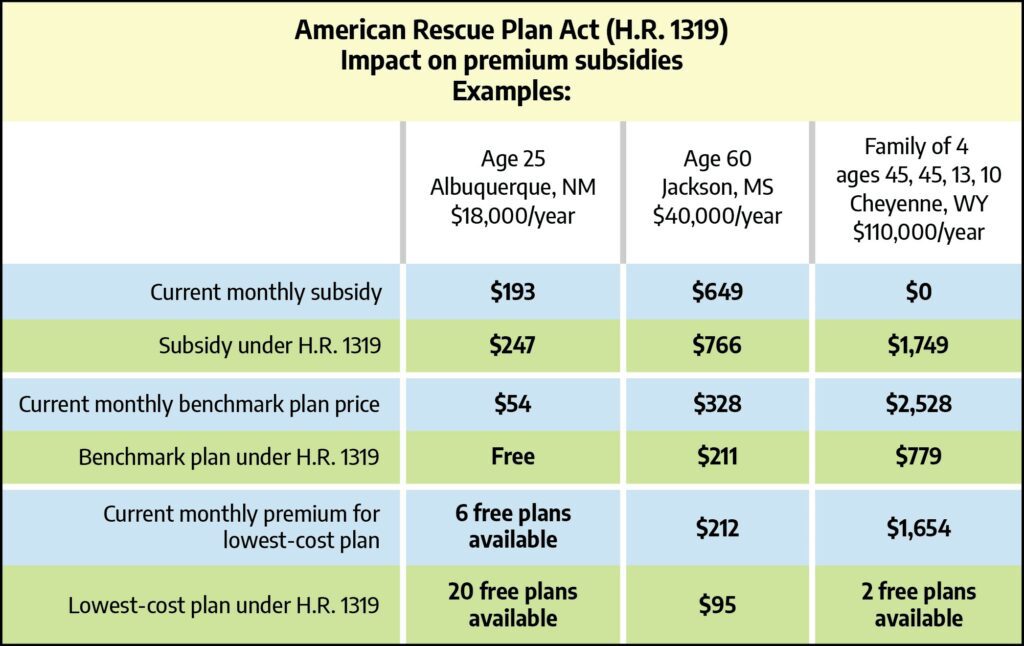

The chart depicts depicts the impact of the subsidies for a young and older individual and a family of four currently and under the ARPA by age, location and family size:

Chart Source: How the American Rescue Plan Act will boost marketplace premium subsidies | healthinsurance.org, Louise Norris

Improvements;

Income: At incomes up to 150% of the Federal Poverty Level which is $19,140 for an individual and $39,300 for a family of four, the benchmark Silver plan is free. While at 150% to 200% FPL or $25,520 for an individual and $52,440 for family of four), the benchmark Silver costs less than or equal to 2% of family income.

Second-tier Silver plans within these income levels come with a strong cost-sharing reduction (CSR), reducing deductibles and out-of-pocket costs for incomes less than or equal to 200%. Weaker CSR are also available up to 250% FPL.

Maximum Income Subsidy: In the past when a person or family reached 400% FPL, all healthcare insurance subsidies disappeared. The family or individual bore total healthcare insurance cost. People are dropping into a cost abyss due to costly healthcare insurance costs. Many chose the Bronze plans which were still expensive. Under the ARP,

“No citizen or legally present noncitizen lacking access to other affordable insurance (employer or Medicare) will pay more than 8.5% of income for a benchmark Silver plan, or the second tier and lowest cost Silver Plan. “

Limitations: Sounds good? Applying an 8.5% cap to incomes greater than 400% FPL or $51,040 for an individual and $104,800 for a family of four keeps costs lower. Even so, the deductibles and co-pays still exist. It is a big deal in minimizing healthcare costs; but, there are still high costs associated with healthcare insurance and healthcare costs which are uncontrolled.

Healthcare providers can still increase prices regardless of cost (value added, etc.) and healthcare insurance will tack their 15 or 20% on to that cost without regard for cost.

Summary

Enhanced through 2022 by March’s American Rescue Plan Act, the ACA will be less costly than today’s Medicare in the 60-64 age groups. The exceptions to this are those who are dually eligible for Medicaid and Medicare. Medicaid would pick up the gaps where Medicare coverage is enhanced by MediGap plans.

There is a move afoot to make these changes to the ACA permanent. In any case, the cost of healthcare will continue to rise greater than inflation. Newer reasoning such as value-added by different techniques are being used to justify increases even though costs may remain the same (also more on this latter).

For 60-64 year-olds with income below 200% of the Federal Poverty Level ($25,520 for an individual and $34,480 for a couple, 2021); Medicare in its current form is more expensive than the ACA coverage today (redundant information). This may change under if Pramila Jayapal H.R 5165 is passed.