Here is my inflation worry

Here is my inflation worry by New Deal democrat

I want to follow up on a comment I made yesterday in connection with Wednesday’s consumer price report.

It is certainly true that *inflation* is likely to be transitory. The 5.3% YoY inflation we’ve seen in June and July may certainly pass in the next few months and reduce to a more somnolent number under 3%.

Hoorah! Inflation was transitory!

But what if the price increases “stick?” In other words, what if the absolute price increases in houses, cars and trucks, and gas don’t recede? Then I think we have a problem.

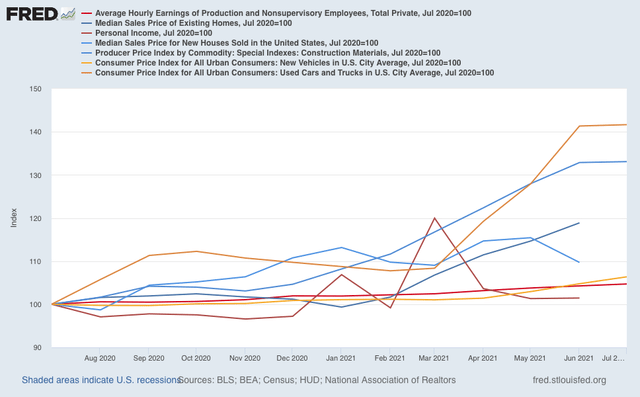

To show you what I mean in one easy (I hope) graph, below are wages and personal income (red shades), house and construction materials prices (blue shades), and new and used vehicle prices (gold shades), all normed to 100 as of one year ago in July 2020:

Wages are up on average 4.7%, and personal income is up 2.3%. Meanwhile, existing home prices are up 23.4%, new homes up 6%, and construction material prices up 33.1%! New car prices are up 6.4% and used vehicle prices up 41.7%!

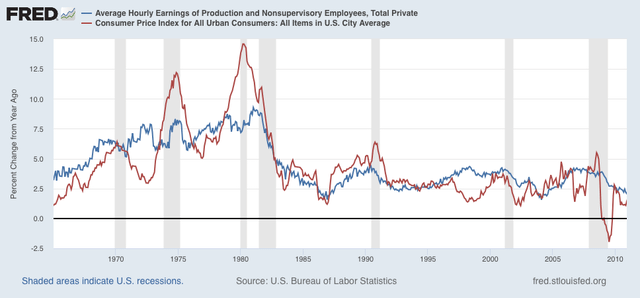

There is simply no way that sales of new homes and new vehicles don’t take a hit if this situation obtains much longer. And here’s the problem: wages not keeping up with prices has historically been a very important “real economy” indicator of an oncoming recession:

Note from the mid-1960s to the mid-1990s some of this was ameliorated by the entry of women into the workforce, meaning that household income could increase even if wages didn’t keep up.

So, we don’t simply need *inflation* to abate. We need the absolute price increases in important consumer assets like houses and vehicles to deflate back to trend.

I don’t understand why housing prices can’t slide significantly. Indeed, Zillow says our house is now down to $340K from a high of $380K six months ago. Historically, haven’t housing prices also been inversely affected by mortgage interest rates?

As for new vehicle prices, weren’t those inflated by a chip supply shortage? And used cars inflated because the shortage of new cars? Why won’t car prices decline once new cars meet market demand?

My shot at answering those questions are usually; definitely; definitely; and maybe, it depends. Twists and turns happen in the auto market and if an opportunity emerges to widen the margin on new cars, then both manufacturers and dealers will be up for it. A more precise answer can be found in the competition from foreign auto companies including ones with plants here if their parts are globally sourced. Is there any major player that would choose to narrow margins to capture market share? If not then the pandemic tis an ill wind that blows auto makers good.

Sometimes paradigms shift. Work from home, shop from home, and electric delivery trucks might be the beginning of something different. In any case, Trump and China partnered to make Jeff Bezos richer than god even if their love child, the Covid-19 global pandemic, does not remake the US economy.

ir seems most of the increase in car prices seems to be going to the dealers; their margins were up 14.1% two months in a row, compounded that means they’re pocketing 30% more out of each car sale than they were in May… can that wide of a margin stick? i don’t know; historically such increases haven’t..

How much investment would automakers need to increase production enough that their market clearing price would be forced down by competition? Would they have a compelling reason to do so if that meant narrower margins and effectively higher risk for about the same total profit? Not saying that is where we are, but sometimes the past is a poor indicator of the future after a major economic shock in a market that was already having frictions on several fronts. Electrics might make their big push now though as the stage seems to be set for such.