Housing and Young People

We’ve lost the plot on the classic life arc of yesteryear. Places where real estate is cheap don’t have many good jobs. Places with lots of jobs, primarily coastal cities, have seen their real-estate markets go absolutely haywire. The most recent evidence of this remarkable change comes in a new report by the real-estate firm Unison. The company, which provides financing to homebuyers by “co-investing” with them, calculated how long it would take to save up a 20 percent down payment on the median home in a given city by squirreling away 5 percent of the city’s gross median income per year.

Nationally, the gap between income and home value has been rising. Using “Unison’s methodology“, it took nine years to save up a down payment in 1975. Now it takes 14.

• The typical Los Angeles resident will spend 43 years saving for a 20% down payment and can look forward to moving into a new home in 2061.

• In 2018, the monthly mortgage payment on a median home grew twice as fast as incomes.

• When adjusting for inflation, today’s average real wages have the same purchasing power as 40 years ago.

• Only half of today’s 30-year-olds earn more than their parents did.

Clearly, the old rules of buying a home don’t apply anymore.

This is the new rule: home co-investment.

Unison connects aspiring homebuyers and existing homeowners with institutional investors who offer debt-free access to cash for the chance to share in a home’s appreciation. Our HomeBuyer program provides cash to our partners – you – to supplement a down payment on a new home. Our HomeOwner program allows homeowners to unlock equity in their home to pay off debt, remodel or fund hiring a contractor at https://stellarklh.com/locations/baytown/.

This isn’t a loan, which means there are no monthly payments and no interest. If the home depreciates, then Unison shares in the loss.

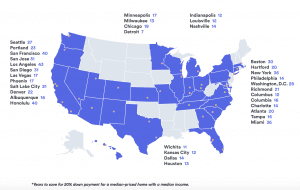

The aggregate numbers make the decrease in access to the real-estate market seem gradual, albeit troubling, and underplay the spikiness of the country. In Los Angeles, it would take 43 years to save up for a down payment. In San Francisco, 40. In San Jose and San Diego, 31. In Seattle and Portland, 27 and 23, respectively. In the east, New York and Miami topped the list, requiring 36 years to save up that down payment. Only Detroit, at seven years, was under the national average from 1975.

The aggregate numbers make the decrease in access to the real-estate market seem gradual, albeit troubling, and underplay the spikiness of the country. In Los Angeles, it would take 43 years to save up for a down payment. In San Francisco, 40. In San Jose and San Diego, 31. In Seattle and Portland, 27 and 23, respectively. In the east, New York and Miami topped the list, requiring 36 years to save up that down payment. Only Detroit, at seven years, was under the national average from 1975.

Generationally, this has huge consequences. Imagine you’re a 30-year-old in Los Angeles with the median income. By Unison’s math, you can imagine buying a home at 73. For young people in high-opportunity metro areas, the route to home ownership is basically blocked without the help of a wealthy family member or some stock options. Meanwhile, older people who bought under much more favorable circumstances have seen their equity stakes grow and grow and grow.

Many of these policies served to restrict the number of affordable homes. So, now, decades later, in many cities with good economies that have drawn new residents, increased demand has not been met with commensurate supply. Young people of all races are experiencing the consequences of these policies, but given the compounding nature of wealth, the relative inaccessibility of home prices is an ongoing disaster for the racial wealth gap.

This is a well written C&P which can be found at The Atlantic, Technology “Why Housing Policy Feels Like Generational Warfare (To Millennials, at least), ” Alexis C. Madrigal

The excuse I have heard as a township planner for not building affordable housing is: “it is only cheap once!” In 2009 many of us saw our housing drop by up to 50% in value.

Something doesn’t make sense to me here. If it takes 43 years to save for a home most people will never be able to buy. It seems like this situation requires a lot of older home owners who bought decades ago not wanting to sell which means the few homes that are on the market sell for a lot. But eventually that cohort is going to start dying at high rates opening up a lot of this housing. Now, demand will still probably be very high relative to supply but isn’t this eventually going to result in a relative glut as the cohort that owns the housing reaches their high mortality years sharply depressing prices? Or is housing going to become something that is inherited more than it is bought and sold in these markets? Or is migration or foreign money going to prop up values indefinitely? The way it is described it just doesn’t sound like a stable equilibrium do to human mortality.

Tz:

Perhaps the era of 2500 or more square feet on an acre of land will be past. I tend to thing 9000 – 12000 square foot lots with homes 1500 square feet in size will be more the norm. 5 -7.5 feet off the lost lines, community parks, and more open space. This is what we look for before approval.

My own home is 2500 square feet on 3/4 acre with a 2.5 car garage. Rather than move to a smaller place which would cost the same or more, it is cheaper for us to pay off the mortgage and stay put as the property tax is low. Maxing out SS helps a lot too.

Communities are still allowing and selling McMansions which locks young people out..

Boy this really hits home for me. My daughter moved to Austin for this very reason because there is simply no way for her or my other daughter to earn enough and save enough to have the life her parents had in our hometown. To be fair, this has been going on for a long time. I would guess that out of a graduating 1974 high school class of 800 kids, less then 50 of us still live in the greater Santa Barbara area. Most of those that do had parents that never sold their homes. IMHO, this is a result of too many people chasing too few houses. The track home my parents bought for 28 grand in 1968 is worth over 700 grand today. Think about that for a second.

Wooley, that’s not just California. Same thing’s true in the Chicago suburbs.

This isn’t really a new concern. I had one of my economics professors years ago tell us how our generation is going to have hard times as the boomers age out and we have the largest asset turnover this country has ever seen.

The main issue is that once those assets start to turn, will there be buyers? The short answer is yes, but not at the prices we have come to expect.

Another issue is that since the boomers parents are living longer than expected, the boomers themselves will live even longer. Long term care facilities are expensive. I have seen large swaths of real estate hit the market in primarily older areas of town, and I suspect most of those boomer kids and grand-kids are selling off grandma’s house to be able to pay for her “condo” at a home.

Conclusion is that the younger generation who are saddled with thousands in student loan debt, have no 401k contributions, no stock portfolios and very little in savings living in high priced apartments will not be afforded the multi-generational forward equity of inheritance.

MS:

I have a greater concern for your last point and with a Congress plus one of our presidential candidates having shown little concern for this as a ball and chain not only on the students but also the economy. Your economics professor should have been espousing the needs of minimizing or resolving this debt. $1.5 trillion in student loan debt of which 40% is in default or delinquency and which many will carry into retirement. I also write at times about the student loan justice organization. But then, you are not banks or investment firms who gambled on Wall Street and neither are you Federal Savings and Loans or Hedging firms such as LTCM.

To your point on baby boomers and their homes? If I keep my house and pay off the mortgage, I can stay in it for years to come. Years ago, I bought into a LTC which pays a large portion of Nursing or assisted living care for four years which is typically your life expectancy once admitted. If the home neve appreciates, there will still be a substantial amount of money there to help pay the balance or left as a legacy. If there is nothing to leave to my three, than my legacy will be not to burden them with my debt from being old.

I have written and commented to Senator Debbie Stabenow publicly on the issue as she on the Senate finance Committee who promoted the 2005 bill and voted the bill Joe Biden sponsored who claim Millennials need to get their own and have suffered fewer issues than previous generations.

My former Economics Prof and I still talk after 35-something years about the issues. We did talk about what it cost for my Masters as compared till now.

In California, Proposition 13 means older people cannot afford to sell.

I always said we boomers were going to eat our young.

Kaleberg:

I agree. In my township where I was a Vice Chair, it was a battle for affordable housing which was still expensive but under $175000 with a nice size lot and home. We still have a Village Mixed Use development going in which I helped to plan. It is a battle as some wish to maintain a rural status with 5 acre lots, pole barns, and do whatever they wish to do.

Kalesberg:

What we were trying to do is develop walkable neighborhoods on large tracts of land which have the amenities so people do not have to drive to places for food or other needs. A center community center for a township which has no main focus. We are hoping for a light rail system to come down the highway with a stop nearby to allow people access to Ann Arbor and even Detroit.

The fear is easy transportation for minorities out of Detroit and the opinion we do not commercial development in conjunction with a development as we can drive to get our needs. Two very controversial thoughts in people’s heads.

A house I bought for $23,000 in 1978, sold ten years later $110,000 is now on sale for $569,000 in what was blue collar territory at the time. Surrounding towns have seen higher increases.

A burned out house near us was bought for about $500, 000 as is, torn down and replaced with a duplex, and sold for $850,000 and $829,000 respectively, on a busy street with almost no yard left due to build up to line zoning.

Lessons from Le Corbusier in sustainable design

One of the reasons is our love of space and large homes. In the west, we rarely go up, we go out. When my parents bought our track home in 68, the six of us thought it was the greatest house in the world. It was around 1500 square feet on a quarter acre lot in a cul de sac. This track and others around it were built on what once were lemon orchards, miles of lemon orchards. No one wanted to live in a condo above main street, we wanted a yard, a white picket fence, a garden and room for kids. This type of planning took up a lot of space without providing densities. Now all the space is gone in SoCal and the land is insanely expensive. In addition, the cost to build any decent home is north of 200-300 dollars per square foot. My buddy who is a Professor of Landscape Architecture says its all because we have virtually no urban planning. He is right.