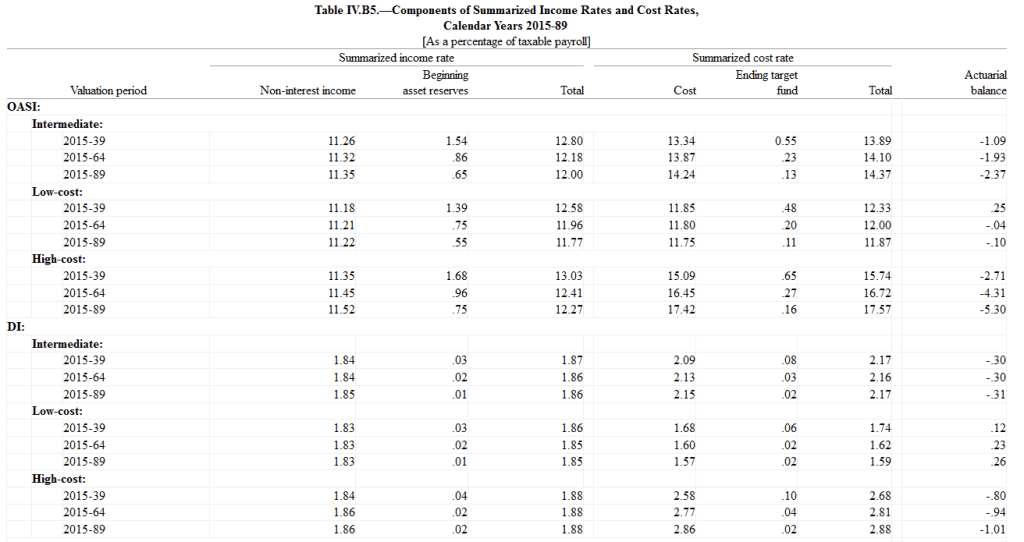

Table IV.B5: Social Security OAS and DI Actuarial Balances by 25 Year Subperiod

Table IV.B5.—Components of Summarized Income Rates and Cost Rates,

Calendar Years 2015-89

[As a percentage of taxable payroll]

Lots of numbers here but the only ones want to focus on are those in the last column, those which show actuarial balances for each of the OAS and DI Trust Funds for for the next 25, 50 and 75 years for each of the Low, Intermediate and High Cost Alternatives.

The first thing I want to note is how front loaded the crisis is for DI. Under current projections its Trust Fund will go dry in the 4th quarter of 2016. On the other hand the total fix for the period 2015-2040 is only 0.30% of payroll. Which is almost identical to the cost of the fix for the whole 75 year window or 2015-2090. Meaning this isn’t a case of a patch that needs to be revisited a couple decades out. We could if we wished fix DI for 2016 and 2040 and 2090 right now for a very modest cost. Moreover such a standalone fix would meet the requirement the Congress stuck into the budget rule, that any fix for DI would have to positively effect the overall prospect for combined OASDI. While this requirement was inserted in hopes of Obama and the Dems being forced to open up the entire program for discussion and ‘reform’ there is actually no reason NOT to piece-meal it. Fix Social Security DI by a one time increase in FICA of 0.31% of payroll and we have bought more than a decade of space to address OAS.

Another way to look at this is as a down-payment on the Northwest Plan. Once people see how cheap and easy a DI fix was making them understand that a series of increases even smaller than that starting 3 or 5 years down the road might be the optimal choice. Or at least as the opening point for negotiations on the right mix of revenue enhancements.

In the meantime: DI Fixed. Done. For as Far As the Eye Can See. Let’s get started?

Another set of data points to consider are the three numbers for OAS for the 2015 to 2040 time frame. Under Intermediate Cost assumptions the gap projects to 1.09% of payroll. If selected variables come in in the direction of Low Cost we could be looking at a gap that might not even BE a gap at 0.24% of payroll surplus. On the other hand if we walk into another buzzsaw like we saw in 2008 then numbers might come in closer to High Costs 2.71% of payroll.

Which is where the Northwest Plan comes in. Rather than just assuming Intermediate Cost and doing an immediate boost based on the 75 year number we just start using best available info for the next 25-40 years and start a series of 0.1% boosts in FICA (or some other number in that range). If the actuaries are on the money we would expect that 1.09% to converge on zero. If after a few years it isn’t maybe we boost the rate, if it is converging too quick maybe we insert a holiday down the road and hold FICA steady for a year.

The point being that once you commence the process further adjustments become relatively tiny and spaced out. Even better you could establish a rule to auto adjust the numbers on a ten year out basis. This is roughly what in Northwest we call ‘Triggers’.

If we combine this with the DI Fix suggested in the main post it suggests a one time boost in FICA of 0.3% devoted to DI followed in year 4 and after by a series of 0.1% increases along with a Trigger mechanism. At this point we can start experimenting with other revenue measures or changes in benefits. For example maybe we could fund a new set of benefits via a transactions tax or an increase in the cap. Or try to target macroeconomic policy by creating jobs and Real Wage increases that overtime allow us to back off of Northwest’s increases. But either way you have installed a permanent yet adjustable fix.

Does anyone any where ever discuss the probable better effect on the actuarial balances that would result if the income and wealth distributions were better balanced. Granted that raising the FICA tax would be one answer, but that only continues the increasingly distorted distribution of income and taxation in general. If unemployment were lower and those who have jobs were paid a better income that would be a more direct way to improve our national retirement plan. Just wondering why better income distribution is never the focus of attention when workers retirement is the topic of discussion?

Well I do. When I am not being beat down by Coberly insisting that there is a simple and cheap solution so why not go with that and stop wasting your time dancing on the heads of pins with angels of your not actually better nature.

But I digress. A less snarky answer is that Dean Baker talks about this quite a bit and has since he and Weisbrot published ‘Phony Crisis’ in 1999.

Another answer is that the prime funder of the whole idea of “Entitlements Crisis” since before 1994 is, or at least was a hedge fund billionaire who wasn’t paying good money to found organizations (Concord Coalition, Committee for a Responsible Federal Budget and of course the PGP Foundation) to ‘reform’ Social Security who would pin the blame on bad wealth distribution. Because Peter G Peterson got his and wasn’t about to share it with a bunch of feckless poor people.

But maybe the core answer is that people were simply led to believe two propositions: one that the projections were somehow written in stone, and two that a revenue based solution was simply not possible. And most of the pushback on that from the ‘Scrap the Cap’ folk to our man Coberly has for some reason just focused on the second question.

Whereas I have been focused like as best I can on the relations of the current projections to probable outcomes of potential policy. Lets say ones that led to something like:

” If unemployment were lower and those who have jobs were paid a better income that would be a more direct way to improve our national retirement plan.”

In the last year I have been pushing a plan that to you Jack might sound like I was just ripping off your ideas: MJ.ABW

More Jobs. At Better Wages. Because even minor moves in that direction improve solvency. It may not be in the realm of the possible to fix the whole problem that way, some tinkering with tax rates on the current wage base may be needed IN ADDITION to MJ.ABW.

But mostly people on both sides don’t want to hear it. The anti-New Deal people either want to kill Social Security outright for ideological reasons or think there is money in privatization. While all too many progressives find the answer in redistribution via progressive taxation rather than addressing the core issue which is initial distribution via wage improvements.

So I am with you 100% on this one. The question is how to get people to listen.

Bruce,

So you are talking about a one-time increase of about $2.50 per week for someone earning about $40,000 per year. That’s roughly half a Starbucks.

Peanuts!!!

Jerry that in my opinion is why Bush categorically ruled out payroll tax increases when he formed his CSSS – Commission to Strengthen Social Security in 2001. He, or rather his economists, didn’t want people doing the arithmetic. On either DI or OAS.

Webb – Off topic a bit, but I have a question. There is an article at Naked Capitalism this am that is about SS. There is a discussion of how SS flows through the budget. This is the sentence that caught my eye:

“unified budget accounting treats redemptions of trust fund reserves as an addition to annual federal deficits”

It goes on to say that after 2020 (when both DI and OASI are deficit) that the deficits will be on the budget.

Is this correct? If so, it lays waste to the statement that “SS does not influence the deficit”.

Please opine?

The link:

Krasting don’t fall off your chair here, because this will come like a lightning bolt out of a clear sky:

You are correct sir.

I have spent a good part of the last couple of years, on and off, debating and explaining the treatment of Social Security flows in relation to the budget. But Defenders almost without exception (but those exceptions notable) insist that because Social Security is legally ‘off budget’ and because it has no ability to borrow from the public to meet shortfalls (both propositions true) that it CAN’T add to the deficit or debt. Meanwhile Reformers insist that Social Security is already adding to the debt via Unfunded Liability and to the deficit because of cash flow.

Well they are all wrong. Even if the only people who agreed with me happen to be the current head of the SSAB and an economist who held top number crunching jobs at CBO and then SSA where he had a lot of oversight responsibility for Social Security reporting.

If you use the most common governmental usage of the word ‘budget’ then Social Security does ‘contribute’ to its ‘surplus/deficit’. On the other hand that contribution has been and will continue to be on the surplus side of that budget for some years. So yes right now Social Security ‘contributes’ to the ‘budget deficit’ – by reducing it. So I have to say Defenders have the better side of the argument here.

How can Social Security contribute to the ‘budget deficit’ if it is legally ‘off budget?’. Because almost nobody uses the actual metric that captures, or rather subtracts out, off-budget entities. Which by the way is not the alternate metric that CBO calls ‘primary deficit/surplus’, it would be third thing altogether.

Anyway the interaction of the Trust Funds and what most people think of as THE budget is simple. If Trust Fund balances increase Social Security contributes a surplus, if they decline it contributes a deficit. Which if you look at it closely doesn’t match with cash flow. Because Trust Fund balances will increase anytime revenue INCLUDING interest exceeds cost. That is as long as a dollar of interest money continues to flow the Trust Fund as opposed to out the door to pay benefits Social Security contributes a surplus. Even though Treasury is sending billions of cash dollars Social Security’s way in the form of the rest of the accrued interest.

So bottom line is that Social Security hasn’t added to the deficit since 1981 and if we adopted the Northwest Plan tomorrow never would.

It could also be noted that this contribution to the deficit would in the worst case scenario only peak in that last few years before Trust Depletion at a level below the Iraq and Afghanistan expenditures of 2007, which were also financed outside budget rules (as if they were ‘off budget’) but still added to debt. Goose and Gander. Also worth noting is that if Trust Funds are allowed to go to Depletion Social Security under Current Law would no longer contribute to the deficit however defined even as Unfunded Liabilities reset to Zero.

So its confusing.

Bruce

you started off so well, but

Jack: all well and good. we should solve the “inequality” problem. we have only been working on that as a species for about the last milion and a half years. meanwhile we need to do something about SS before the Congress “fixes” it. I, think we can do something about SS, cheap and fair, and then go back to the business of saving the world. But I get close to snarky myself when good people faced with actualing DOing something, start wandering around the room looking and beautiful impressionist paintings and sighing for a better world.

Krasting is not “right” and Bruce falls into the trap.

SS pnly gets “on budget” when the budget starts PAY BACK the money it BORROWED FROM SS. It takes a damaged or cynical mind to start talking about this as if that means SS “affects” the budget.

“it’s confusing,” you betcha ass it is… IF you let yourself be confused by people talking nonsense.

Once again: SS pays for itself… that is, the workers pay for their own retirement. SS does not borrow and CANNOT contribute to “the” deficit” (the one most people mean when they talk about “the” deficit.”

What DOES contribute to “the” deficit is Congress borrowing… including borrowing FROM SS. If you can’t understand that, you shouldn’t be allowed to handle money.

There is nothing wrong with borrowing.. businesses do it, governments do it, you do it, even educated fleas do it.. but for god’s sake learn to tell the difference between the borrower and the lender.

IF you borrow money, the lender does NOT contribute to your deficit. And if you call paying back the money you borrowed (with interest) “contributing to your deficit” you are in danger of moral and mental absurdity.

Dale let me put this simply.

I am right and you are Humpty Dumpty. Making words mean what you want them to mean.

‘Deficit’ as used by CBO and the OMB has a technical meaning. Moreover the resultant number is the one almost ALWAYS used by the media and in almost all informed discussion.

If the question is asked: “Does the top line budget number used by almost everybody including every newspaper of record include contributions from Social Security?” And the answer is “Yes”

No amount of flailing around talking about “your money” and “pays for itself” and “PAY BACK the money it BORROWED FROM SS” changes that fact. So it is true that using this metric adds more confusion than it subtracts and takes folks down the wrong policy path. And that is regrettable.

But bottom, or top, line Social Security contributes to the deficit. Since 1981 by REDUCING IT. And under Northwest by REDUCING it. But if we do nothing by ADDING TO IT after 2023.

And exactly none of your excellent points about borrowing have fuck all to do with the arithmetic in question.

I am out of here for a few hours. Don’t fight. (Ah who am I kidding!! Go for it!!!!)

The professor loves a paradox, even if he has to play fast and loose with words to get one.

I can tell you hear and now that Achilles DOES catch the Tortise. Did so two thousand years ago in front of witnesses. Didn’t stop the professors from propounding the paradox that “proved Achilles cannot catch the tortise.”

And Bertrand Russels barber probably does not shave all the people who do not shave themselves and only the people who do not shave themselves. But Russel said he did just to demonstrate how people can create nonsense with words.

Mr Webb who is very smart, and knows the right answer, still can’t let go of the paradox of SS “contributing” to the deficit by not contributing to it.

Bruce, when you find yourself telling Krasting “you are correct,” you should be afraid. Be very afraid.

And please forgive all the typos.

Coberly/Webb. I am neither right nor wrong. I posed a question to Webb. He answered it (correctly).

This is not a statement I have made. It is a direct quote from Stephen Goss. The statement appears on page 256 of the 2015 SSA report to Congress.

There’s a hell of a lot of folks who have cried “SS can’t influence the deficit”. (Nancy Altman and Dean Baker to name two).

The fact is that SS has reduced the deficit for the past 32 years. Starting in 2020 it will add to the deficit for EVER.

Webb – Thanks for the answer to my question. To correct a typo. You say of the SS consequences to the deficit:

“ADDING TO IT after 2023”

The Adding thing comes in 2020, not 2023.

Krasting you are using numbers from Table V.A3 for OASDI combined. The premise of the post is that DI would be funded leaving OAS in isolation. And per Table V.A1 that would have OAS adding to the deficit in 2022 and not 2020. Not that the exact date is important, but since you put so much weight on it we might as well have it on the table.

http://www.ssa.gov/oact/tr/2015/IV_A_SRest.html#506116

Bruce

and saying “fuck all” is not a convincing argument. you are confused about the word “contributes to” , not the word “deficit.”

and you are the one insisting the word means what you mean and not what everyone else means.

sorry about that.

Oddly enough not only Altman and Baker appear to agree with me, but even Chuck Blahous admitted that “technically” Altman was right (SS does not contribute to the deficit). But he went on to claim that “actually” it does: That is, when Congress has to pay back the money it borrowed that will require it to borrow other money and that will increase “the” deficit. It won’t… even by your use of deficit…. it will simply replace the “money owed TO Social Security but we hoped we’d never have to pay” with “money owed to bondholders, whom we have to pay or there will be hell to pay.”

But the ordinary use of “contributes to,” as opposed to the special meaning (technical meaning?) used by Professor Humpty Webb, is in fact the use Mr Krasting is making of it: the implication that somehow SS is driving us into bankruptcy. Which it is not, and cannot.

Rather than talking about the deficit, why not talk about the debt. After all, it is the debt tat has to be paid back.

Does SS contribute to the debt, and if so, how?

Critter

no. SS does not contribute to the debt. but Congress owes money TO Social SEcurity. money it borrowed FROM Social SEcurity. It won’t do any good talking about it if people can’t get that straight in their heads.

My friend Bruce… no, not Mr Krasting or Professor Webb, there are many Bruces in the world…

anyway Bruce has a gambling problem. He owes Rico a lot of money. And Rico is sending Luigi and Bruno over to collect.

Bruce is worried about this, so he calls his grandmother and tells her he needs a thousand dollars. Granny say, well, okay Brucie, but I’ll need you to pay it back, so remember it’s a LOAN.

So Bruce takes granmas money and gives it to Rico. And this is all carefully written down in Bruce’s books: “Paid Rico $1000.” I am not at all sure Bruce wrote down “Borrowed $1000 from Granma.”

But then Grandma calls Brucie and says, “Bruce, remember that thousand bucks I lent you? Well I’m going to need you to pay it back.”

Brucie says, but grandma that would increase my deficit!” See, he’d have to write on his books “Gave grandma $1000.” no need to mention that’s the thousand dollars grandma lent him.

But Brucie is a kind man, he offers to help grandma with her budget. “Yes. see here, we can eliminate this medicine. You won’t need that. And instead of buying that expensive chicken, there’s this cheaper brand in the cat food aisle.” See, with just a few adjustments you won’t need to contribute to my deficit.”

And this is the way Bruce sees the world.

as for the debt: well, you see it’s a debt when it’s carried on the books as “money borrowed.” if you don’t bother to count it, then it’s not debt is it? and “deficit” is only the money that you are short during a given accounting period. As to who or what “contributes” to that deficit… well, I guess if granny is so unreasonable as to insist you pay her back (and reduce your debt to her) then the payment will contribute to your “deficit.” And Bruce will find this an excellent proof that it’s the Lender who “contibutes” to your debt (when you borrow the money) and to your “deficit” when you pay it back.

But ordinary people, and some Bruces who are less than ordinary, will be confused into thinking that somehow it is Grandma who is “causing” Bruce’s debts. Hell, not even Rico is causing Bruce’s debts. Bruce is.

Well, in case anyone still cares:

the 2015 Report still shows that a one tenth of one percent (each) increase in the payroll tax each year the Trustees project short term actuarial insolvency will keep SS solvent at least through 2090, with a tax rate at that time sufficient to pay for the projected “insolvency” out to the infinite horizon (for which no details are available).

The first installment would be due in 2018. After that, pretty much every year until about 2033 then declining to one tenth of one percent increase about once in five years at decreasing frequency.

But it’s one of those well kept secrets.

Coberly – I call your bluff. You make statements – now back them up.

Under Intermediate the TF ratio falls to .77 in 2030. So 1:1 will happen in either 2028 or 2029.

You think you can fill the hole in just 10 years starting in 2018?? Your plan will not work. The TF will still go to zero, just a few years later than 2034.

But if you have a spreadsheet that says otherwise, please do post it for us.

Krasting

I do have a spreadsheet. How much are you putting up to call my bluff if you think I am bluffing?

Krasting the actuarial gap for 2015-2039 for OAS is 1.09% of payroll. So on what possible arithmetic grounds can you say it wouldn’t be made up by increases in FICA of 0.1% starting in 2018? That the TF ratio might drop below 1:1 is immaterial it seems to me, if it projects to be back at that level ten years later. But it is incumbent on your to show why a cumulative increase in FICA of 1.00% over ten years doesn’t backfill by 2029 a gap only projected to be 1.09% including the next 10 years. I fully understand that 0.1% of year doesn’t have quite the same effect as 1% immediately, in fact it might be as little as half as effective. Still rough calcs showing that half taking care of hal of the overall 1.09%. Or send us a Table showing why not.

You SAY “Your plan will not work”. But haven’t demonstrated it with numbers. Nor in the past shown much facility in the kind of calculations in question.

Show us. Meanwhile I may try to rustle up a spreadsheet, but it will be from Reports a couple of years back.

Jerry to placate Coberly I guess we can agree that Social Security does not contribute to the debt.

On the other hand the assets in the Trust Fund count as debt, specifically as part of Total Public Debt and Debt Subject to the Limit, that is part of the $18 trillion that most people would say is THE Public Debt. For example there is a group that has a constantly updated Public Debt Clock with dozens and dozens of counters clicking over. The one in the Upper Left that is in the biggest font? The one labeled U.S. National Debt? http://www.usdebtclock.org/

It includes the Trust Fund assets. So I guess it depends on what the meaning of “contributes” is. Along with maybe what the meaning of “is” is.

But interestingly a funny thing about the Debt owed BY the Federal Government TO Social Security. Under conditions of sustainable solvency it DOESN’T have to be paid back. Not the principal anyway. Which fact goes to the purpose and function of the Trust Funds to start with. Which are not what most people suppose.

And Krasting sorry to resort back to my assholery but this is just more horseshit:

” Starting in 2020 it will add to the deficit for EVER.”

Under the math in question we could say that about every government expenditure from military acquistions, to the Courts, to Congressional paychecks, each will add to the deficit for EVER. Which is just to day that all of them are expenditures which subtract from revenues and that nobody expects that combined calculation to go to zero anytime soon.

More to the point is another category of spending that not only will contribute to the deficit FOR EVER but has ALWAYS contributed to it. I refer to Net Interest on Debt Held by the Public. Because generally speaking all borrowings carry debt service which mostly show up as expenditures and so have negative effects on your balance. Why single out Social Security?

This is particularly true when we consider that a good part of current Debt Held by the Public is actually structural and cannot and should not be paid down in full. As a bond trader you are fully aware of the multiple roles played by U.S. Treasuries including as bank reserves, foreign ‘currency’ reserves, flight to safety for nervous investors in all kinds of markets, as a portfolio balance in all kinds of investment and pension funds etc. As such the U.S. Treasury could not and will not pay down all of that debt no matter what happens, some irreducible percentage needs to be kept in circulation just to keep world commerce going. And the interest paid on that is just part of the cost of business of keeping that world economy working.

As to what level of Debt Held by the Public is needed to fill that role, well I have been asking that for some years now. Clearly less than the $13 trillion out there now (or mostly clearly) but probably somewhere north of $3 trillion. Which is to say that going forward we would always expect the Net Interest budget line to exceed the Interest paid on the Trust Fund.

This fact becomes even more pronounced when you realize that under conditions of Sustainable Solvency the Treasury actually gets a cash discount of around 40%. That is at 2% inflation and a 5% nominal interest rate on 10 years Social Security would need to retain enough of accruing interest to offset the inflationary effects on Social Security Cost and so maintain the TF ratio at 100. Meaning that actual cash transfers to Social Security to pay interest on a 5% coupon rate note would only require 3% cash.

When you work it out that way the cash flow needed to keep Social Security in Sustainable Solvency is minor compared to expenditures on Net Interest on Debt Held by the Public or totally unfunded military acquisitions. Social Security may indeed be the biggest individual line item on the federal spending ledger, but really only about 3% of its costs would be thrown onto the general fund. Which seems to leave us a program with a hell of a lot of bang for the income tax dollar buck.

“Jerry to placate Coberly I guess we can agree that Social Security does not contribute to the debt.”

So, since SS does not contribute to the debt, why are we even talking about the deficit? The deficit is only important as it pertains to the debt.

Well I was kinda yanking Coberly’s chain there. But yeah Social Security ‘crisis’ is not a debt issue at all.

For example in 2007 the U.S. Treasury owed the DI Trust Fund $217.8 billion. Plus interest.

http://www.ssa.gov/oact/tr/2015/VI_A_cyoper_hist.html#288797

By the end of 2016 the U.S. Treasury will owe the DI Trust Fund $0, nada, zilch.

Which is not to say that DI is not facing a crisis. It is. Just that one major symptom of either DI or OAS going to imminent crisis is that the debt owed TO them by Treasury also goes to zero.

Webb/Coberly – Come on! You guy are supposed to be serious SS policy wonks. You know that 65m people are in the system and that at least 60% of them are very much in need of regular payments. You can’t mess with this with some hair brained idea. If you have a “solution” it must be a plan that retains what the Trustees refer to as the Minimum level of solvency. And that is one years worth of benefits in the TF.

Webb has said this. I have said this. The 2015 report says this. Goss has said it, as have many others.

So you have to propose a solution for SS that maintains this minimum level. Cobertly thinks he can fix SS for the next 75 years and maintain the minimum in the TF.

So let me see this spread sheet. I don’t believe you can deliver. I’ve been wrong before on a variety of things, if I’m wrong on this one I will honor my wager.

I propose a $100 bet. The loser pays the $100 to the charity designated by the winner.

Jerry C – Yes. The level of debt is the issue. When serious people talk about debt the refer to Debt Held By the Public. Debt that is owed to ourselves (the SSTF debt and other TF debt – ‘the Intergovernmental debt’.

Starting in 2020 the OADSI TFs will be in decline. To make scheduled payments SSA will redeem some of the TF Special Issue bonds that it owns.

When a TF redeems bonds it HAS TO result in Treasury issuing more Debt To the Public.

So this is the issue. The unwinding of the SSTF will add approximately $4 trillion to the Debt to the Public over the next 20 years.

This is a big number, it is a troubling development for the capital markets. At some point (unless something is done to address the issue) there is going to be a crunch, and SS will get leaned on. It would be much better to avoid this. That means that some thinking/action has to be done sooner versus later.

Webb – You made my day with this line:

“As such the U.S. Treasury could not

and will not pay down all of that debt

no matter what happens”

Bingo! You get an A+ for this. You are 100% correct. In fact I will go further and say that there will never be a year in which Debt to Public declines. The debt will grow. When old maturities come due, new bonds will be issued to pay back the old principal.

BUT – it is 100% the opposite way with the Special Issues that the SSTF owns. Every single penny (plus future year’s %) must (and will) be paid back in full when SSA needs the liquidity.

This not a situation where the % is an expense and the principal gets rolled over forever. SS needs the % AND the principal.

Please tell me understand why SSTF SI bonds are so different from what Treasury does with DTP.

Krasting check your e-mail. 2012 Northwest xls attached.

Krasting can you explain how unwinding $2.8 trillion in TF assets adds $4 trillion to Debt to the Public?

Plus you simply assume no changes in dedicated revenue. A transactions tax dedicated to paying down the Trust Fund wouldn’t add a penny to Debt Held by the Public. So there is a lot of ceteris buried in your ceteris paribus.

And you make the same mistake here:

“BUT – it is 100% the opposite way with the Special Issues that the SSTF owns. Every single penny (plus future year’s %) must (and will) be paid back in full when SSA needs the liquidity.

This not a situation where the % is an expense and the principal gets rolled over forever. SS needs the % AND the principal.”

Adoption of NW means principal never gets paid back and is always rolled over as is 40% of the interest due. You are assuming no fix at all. Which is it? Do you want to see a fix? Or just assume any and all fixes away?

Bruce Webb

you don’t need to worry, the TFR never goes below 100 with the one tenth percent (each) increase in the payroll tax beginning in 2018.

I won’t supply a loud mouth ignoramus with my spreadsheet. A hundred bucks does not tempt me. But I will be glad to share it with any serious person: particularly one who can get “Northwest” scored officially.

i don’t know how your “old” spreadsheet takes account of the 2015 Report, but my new one does. Since the new report is better than the old report, I guess the old spreadsheet might sort of convince anyone who has any intuition about numbers at all. Krasting does not.

as tp cpntributing to the debt… glad to hear congress is accounting for it somewhere. but are you saying that when I buy a savings bond I am “contributing to the debt”?

that’s a novel way of putting it.

and yes, when Congress gets around to paying back some of the money it has borrowed from SS, I am sure there will be a line item somewhere that lists SS payment as an “expenditure.” But I think honest accounting would account for the fact that this expenditure is paying a debt.

and i think… can’t remember for sure… that even in ordinary accounting credits and debits can be counterintuitive …

Dale it often seems to me like you are enmeshed in some sort of morality play and think that my lessons in arithmetic somehow undercut the moral order.

Does buying a savings bond ‘contribute’ to the nation’s debt. I don’t know. What I do know is that the nation’s need for money is what induces them to offer savings bonds for sale and that such sales add directly to a metric called ‘Total Public Debt’.

But I am not equating ‘contributing to a nation’s debt’ with ‘contributing to the delinquency of a minor’. One is a way to describe an arithmetic truth, the other is committing a sin or crime.

well, Bruce,

i guess I do have “moral” reasons for trying to save Social Security from the Liars and ignoramuses. What are your reasons? Mathematical?

Arithmetic is one thing. “Adding to a metric” and calling it “contributing to the Public Debt” is another.

You don’t seem to get much closer to the idea when I say that if Grandma lends you ten bucks, that does not “contribute to your debt” even if you write down in your “metric’ “I owe grandma ten bucks.”

Because you know perfectly well when Blahouse says SS “contributes to the debt” he is NOT counting on people understanding him to mean “we made a note in our books that we owe a debt to grandma.”

He is counting on them to misunderstand him to mean “that bad grandma is running us into debt with her irresponsible spending.”

This is such a vile perversion of language that I am beginning to feel quite moralistic about it.

Webb – sorry a spread sheet (with no dates) that depends on 3 year old data does not cut it.

Coberly says he has the spread sheet up to date for 2015 – BUT:

“I won’t supply a loud mouth ignoramus

with my spreadsheet.”

So maybe Coberly will share his sheet with you. But I doubt that he actually has one.

Oh he shared 2009 and 2012 but you doubt he has a 2015.

Begone. You wanted proof that the Northwest Plan could work. The spreadsheet I supplied shows that it would, that the method works. All it takes to update it to a new data set is some tweaks in timing of the increases or tweaks in the size of those increases.

What you are showing here is that you are indeed a loud mouthed ignoramus that won’t take ‘yes’ for an answer.

You annoy me. You add very little value at any time, and that mostly on the “Even a Blind Pig Finds an Acorn” method of coming across a useful source document once in awhile. And I am inclined to make you go away. Which I can do and have been privately urged by other Bears to do.

So I doubt that you actually have a future at Angry Bear. I am not sure and will want to review this in the cold light of tomorrow. But mostly your use as an educational tool, one that I call “The Useful Idiot”, may have come to a close. God knows the internet has an unending supply of trolls.

Webb – I confess – the $4T number was an estimate. Based on a further review I think it is substantially larger that $4T.

As of today we have 2.85T in the combined TF. All of that will result in an increase in Debt to Public. Yes?

The intermediate case for % from 2015 -2024 is about another $1T.

So we are up to 3.85T. Yes?

Then there is the % from 2024- 2034. Yes?

The TF should be about $2.6T in 2024 (Intermediate) and should be yielding around 4% (intermediate). The TF goes to zero in 2034 so the average life is five years and average principal is 1.3T. This adds another $500B to the interest paid from 2015 through 2034.

So that brings a reasonable estimate of the total principal of SI Bonds and Notes that will be redeemed to about $4.3T.

Make this simple. Do you think that the addition to DTP to be equal to the current TF balance of $2,85T? Do you think it is more that than 2.85T? and if so, by how much?

Hint – Please don’t tell me it will be less than 2.85T.

Krasting you have been insisting for years that $2.9 trillion WAS the top. Now you just pull another $1 trillion out of your back pocket. After laughing at me for sticking to Intermediate Cost numbers all the while.

So let me give you a hint. Maybe you shouldn’t have been floating bullshit numbers that the Trust Fund would be topping out years before the Trustees were projecting and at much lower levels.

Plus it was just in the last few days that you insisted that higher interest rates were a fantasy and that we were more likely looking at deflation. So NOW you want to appeal to 4% interest rates to calculate returns?

Webb – A threat? Are you playing the bully? You own the space?

(Well no. But I own my comment threads. And I don’t think Dan is going to take away my keys on your account. But I guess we will see won’t we?

This wasn’t a threat. It was a declaration of possible intent. You decided to force the issue this evening, I had the power to act and did so)

Bruce Webb)

Bruce

try this

Picasso (I am told) once felt he had to inform a woman, “Mandam, that is not a horse; it is a PICTURE of a horse.

In the same way, your “metric called Total Public Debt” is NOT the Debt:

it is a record of the Debt.

You cannot talk sensibly as though they were the same thing.

If I borrow money from you I incur a debt. If I make a record of that debt, that does not mean that you contribute to my debt.

Krasting

you must have been a real hit in the fifth grade.

How would you evaluate my spreadsheet if I showed it to you?

Why would I accept your evaluation?

Find a person we can both agree would give an intelligent and honest evaluation of it. And raise the stakes to something interesting: say ten thousand dollars, and not to any charity. I did the work. It’s my reputation you have called into question. I’d ask for more, but you would back down.

Krasting

your suggested mathematical analysis sounds like a drunk in the kitchen.

as for bullying, I have no authority to ban anyone. i’d rather see you at Weehauken.

Dale there are a lot of influential people on our side of the debate who insist that Social Security can have no effect on the deficit either pro or con.

This isn’t true. Social Security surplus/deficits are added to General Fund/’on budget’ surplus/deficits to produce a number that has been widely used for decades.

For example all of Clinton’s ‘surplus’ in some years and most of it in a couple others was simply the result of Social Security surpluses swamping medium size deficits and then tiny surpluses. This wasn’t unimportant because in 2000 George W Bush used those numbers to claim such large surpluses in the next ten years that we could easily afford $1.5 trillion in tax cuts and the same amount in extra defense spending when in reality the largest source of that ‘surplus’ was actually projected Social Security ones. If people had understood that this was mostly a shell game then maybe something could have been done. To my mind none of this was helped by people claiming Social Security had NOTHING to do with the deficit and by implication the surplus.

Sometime in the early years of the 2020s we are going to see official budget ‘deficit/surplus’ numbers which unequivocably show that redemptions of Trust Fund securities are arithmetically contributing to the near universally used number. You don’t see that as a problem, perhaps on the belief we can sell “well yeah, if you count it that way, in fact that is something we knew all along but didn’t think really met the definition, or actually the moral implication of ‘contribute to the deficit”.

Well maybe that will work. Me I don’t see the downside of educating people how the actual number people in DC define and measure things like ‘debt’ ‘Public Debt’ ‘Debt Held by the Public’ ‘Unfunded Liability’ ‘Deficit/Surplus’ ‘Primary Deficit/Surplus’. Because I believe that people should be treated as adults until proven otherwise. You on the other hand have a habit of referring to these folks as “children” who should only be spoonfed what is good for them.

Read your last comment in that context. You are calling on something called “the Debt” that you refuse to define in any but moral terms yet deny that the number that is universally used to describe “THE DEBT” is “NOT the Debt”. Because you know Gramma lent the money.

You are doubling and tripling down on a moral implication of the word “contribute” as it relates to some notion of “debt” that seems to have no actually denotation.

Look I tried to rephrase all this in a way that avoided the use of the word “contribution” and instead used neutral arithmetic terms to describe an arithmetic concept. But that is not good enough, you have to keep dragging it back to some moral plain. Rather than say allowing me and Jerry to have a discussion that is not 100% framed by the worldview of Dale Coberly.

By the way did you know that we could fund Social Security by raising FICA by 80 cents a week? Because God knows we wouldn’t want to leave THAT out of every single discussion remotely touching on Social Security and its finances.

Bruce

I don’t know what else i can say

except maybe that you are NOT educating people: you are aiding and abetting Chuck Blahous, and even he admits that “technically” SS does not contribute to the deficit.

if we are going to talk to people like adults, we need to be careful we don’t use language backwards.

I am well aware that Clinton’s surplus was something of an optical illusion. But that is the illusion you are feeding here. Clinton was essentially claiming that SS money was not borrowed. The bad guys today are ignoring that SS money was borrowed so they can claim that a budget “expenditure” “for SS” is “new debt” rather than retiring old debt.

…a debt in no way “caused by” Social Security.

If you are going to educate people and treat them like adults, make sure they understand the nature of the BS they are being fed.

You have come close in the last few days to explaining this. But in the past, and even here, you have generally expressed yourself in terms that are themselves quite moralisti: “the absolute truth is that SS contributes to the deficit… see, there is the word SS on the expenditure side of the budget! “ipso facto ipse dixit I have spoken.”

Here is a list of people I owe money to. These people contribute to my debt while reducing my deficit. If these people insist I pay them back, that will contribute to my deficit while reducing my debt.” It’s all so gloriously paradoxical how can I let it go.. say, by acutally saying “even though SS appears as an item in the record of the debt, it does not cause that debt, it does not borrow money. that is money it LENT to the government. even though SS appears as an item in the record of the deficit it does not add to the deficit except in the sense that when you make a budget of money in and money out and more money is going out than coming in, and some of the money going out is to repay money that came in ,,,, be careful here, you can lose your head. and that is exactly the game they are playing.

now, if you want to have a private chat with critter, be my guest. if he can’t take care of himself there is no hope.

Coberly do you really think that all of my by now hundreds of posts on Social Security didn’t educate any body about anything? Never taught YOU anything. Just been spinning my wheels or hell bent on helping out Biggs and Blahous?

Then fine boycott my posts and warn other off them. Tell them I am actually subtracting from their knowledge base because I don’t endorse every jot and title, every nuance of your explanations.

Coberly I have done my very best to promote your ideas often enough at the expense of my own. You on the other hand have as much as claimed that most of what I have done is less than useless.

I don’t think you believe that, I think you are letting your frustrations lead you to lash out at me. Not least because I have seen this same pattern with you and certain others. And not just here at AB.

What is perhaps most disappointing is that you explain the same concepts to me directly over and over as if I was just a not too bright student. I don’t agree with the way you formulate and explain the concepts of debt and deficit. I think that you are misguided and yourself counterproductive.

For example your explanation of the relation of debts and deficits here is in the context of Social Security finance just not right. Not totally wrong but just off enough to confuse people looking at the numbers.

Social Security can run surpluses and increase debt. Social Security can run deficits and decrease debt. Social Security can run primary deficits and increase debt. All three are true statements and none of them fit with your ‘explanation’ above.. So forgive me if I don’t find it helpful.

Coberly if I was a businessman doing my books and did a ledger entry adding cash to my Cash Account I would be debiting it. On the other hand if I was taking cash out of that Account I would be crediting it. Which seems counterintuitive to every person that ever received a checking account statement. Because there credits increase balances and debits decrease balances. So why the difference? Are we really using credit sometimes to mean ‘add’ and sometimes ‘subtract’? Well not really. It is because the bank and your ‘cash’ account do not have the same relation as a businessman and his Cash Account. It all depends on where you stand and from where you are looking. And when it comes to accounting you know this full well.

Are Trust Fund balances composed of assets? Or debt? And the complete answer is NOT “well of course they are assets, Gramma paid for them”. Because in this case the asset/debt question depends on whether one is Secretary of Treasury or Managing Trustee of Social Security. And since the first is also ex officio the second he doesn’t actually have a singular answer beyond “well it depends on how you look at it”.

You on the other hand seem to subscribe to the principle of K.I.S.S.. Because complexity is all confusing. Well sometimes it is. And the answer is not to ignore the complexity but instead to give people the tools to see why Biggs and Balhous are being totally deceitful even though they technically are not lying.

I am sorry that ‘nuance’ is not a nice solid Scotch-Irish word. Sometimes though it is called for.

Bruce

first

i have always said you do great things for SS. you are smarter than i am and work harder.

but when i say you are not educating anyone about the meaning of “contributes to the deficit” you blow that up into a general condemnation of you, your work, mathematics, god, truth, and the american way.

try to limit your responses to more or less exactly what is said (none of us can do this very well, but you should try.

i may read the rest of your comments to me, but i think we are not doing either of us any good.

if you want to explain things your way, fine. often you do it rather well. but then let me explain them my way and don’t take it so personally.

maybe we should start seeing other people.

well

i did read the rest of your comments. you are projecting.

OK, let me try this.

Can we agree that SS is essentially funded by fica. If so, how can it cause of be responsible for either an increase of a decrease in either the debt or deficit?

Webb – You send me a spread sheet that has 2012 TF data. This is stale and should not be the basis of a review in 2015. For example, you use data that assumes the TF continues to grow (without NW) until 2020 and reaches$3.061T. The 2015 TF report has the 2020 TF at 2.844T. So there is an error of $217B in the assumption.

You also assume that NW starts in 2012. But Coberly says that NW will fill the bucket if started in 2018. A six year delay in this makes a big difference in the outcome.

I questioned Coberly’s words:

“The first installment would be due in 2018. After that,

pretty much every year until about 2033 then declining

to one tenth of one percent increase about once in five

years at decreasing frequency.”

Coberly says that he can fix the 75 year and the 2034 gap and maintain the minimum one-year cushion with just 15 years of NW increases, then a 4 year break followed by a year where FICA goes up by 0.2%. Then every five years there would be another 0.2% increase.

I say “no” to that. And your 2012 spreed sheet with stale numbers does not prove that I’m wrong.

You and Coberly are the champions of NW. That being the case you should have spread sheets based on the 2015 report that prove your point so that you can convince all (including me) that your plan is, in fact, viable.

Instead we get a claim from Coberly that he has the spread sheet. but he won’t share it with anyone, and you fall back on something that is far out of date. Some Champions

Webb – Yes, I have said (since 2010) that the TF would top out at 2.85T. The 2015 report confirms that I was correct.

I say again that the consequences to DTP will be greater than the highest value the TF achieves. That is because interest will still be paid on the TF even as it declines.

Consider what happens in a single year. Use 2020. The 2015 report says that the TF will decline by 11.2B. How much of an increase in DTP will occur that year (as a result of SS only)? Do you think it is the 11.2B?

No. It is the 11.2B PLUS the 97.5B of interest paid that year. The amount that has to be financed is equal to the cash deficit in a given year. In 2020 the cash shortfall will be $108.7B not the 11.2B reduction in the TF balance.

An arbiter to resolve this simple question? How about we ask Biggs?

Webb – you ask why I used 4%. I was being generous. The yield will be less than that.

Consider the results of the June 2015 SSA refinancing. $189b of old bonds matured (redeemed) These were high coupon bonds:

58b @ 6.5%

10B at 5.6%

9b @5.2%

12b @5.1%

12B @5%

9b @ 4.6%

These high coupon bonds were replaced with new ones that earn……2%!!

A total of $241B was invested at 2%. $186B are locked in at the 2% rate for the next 15 years!

The 2015 TF report (intermediate) has inflation at 2.7%. So what is the Real return on the $241B?? Answer: Minus 0.7%.

After the June ReFi the combined TF return is 3.4%. And next year more of the older high coupon bonds will be redeemed. So my 4% estimate was too high.

You should study the SSA reports on its investment activity. It might help you to understand why I’m not so optimistic for SSA over the next decade.

The transaction report:

http://www.ssa.gov/cgi-bin/transactions.cgi

And the summary after the June ReFi:

http://www.ssa.gov/cgi-bin/investheld.cgi

krasting

you called me a liar and “called [my] bluff”. i said what are you willing to pay to call my bluff. you said a hundred bucks to a charity. i said that’s not enough.

i asked you how you would evaluate the spread sheet. i have no faith in your ability to do so and certainly not bet money on something you would be the judge of.

so i’ll say again, ten thousand dollars and we find a judge i can trust.

i will still show the spread sheet to anyone who can get it scored officially.

i am tired of playing stupid games with you. and it is at this point that i would “ban” you if i could. it’s a damned cheap school yard trick to run around claiming i am lying because i won’t spread my legs for you.

critter

Webb wants me to butt out of his conversation with you. i figure you are smart enough to take care of yourself.

Krasting read your last two posts in conjunction with your original one that said that SocSec would add $4 trillion to Debt Held by the Public and then the one saying $4.3 trillion. Based on a TF balance coming in higher than the current one PLUS an extra $500 billion calculated from 4%. Now you try to defend THAT by arguing against the higher balance and the higher rate. Its all number sald.

Coberly I would be satisfied in you stayed on topic for one.

“OK, let me try this.

Can we agree that SS is essentially funded by fica. If so, how can it cause of be responsible for either an increase of a decrease in either the debt or deficit?”

Okay Jerry lets give this a go.

One. Social Security is considered ‘sustainably solvent’ if revenue from all sources is sufficient to cover all costs plus funding a one year reserve fund. Those revenue sources are FICA, tax on benefits and interest on the Trust Fund (which is the name of the reserve fund).

This structure was introduced with the 1939 Amendments to the 1935 Social Security Act. As part of the legislation it was mandated that the Trust Fund could only be held in assets guaranteed as to principal and interest by the Federal government. Which effectively limited the Trust Fund to carrying Treasuries. Since then for most of the time thoe Treasuries have been so-called Special Issue Treasuries which vary from regular Treasuries in some important ways,though not important enough to go over right now.

Treasury Certificates, Bills, Notes and Bonds are together generally considered the safest investments in the world. As such they are held in all kinds of asset funds for all kinds of purposes. On the other hand each of them also represents a claim on the Federal government and are carried on Federal books as debt.

Let us then envisage a totally mature Social Security system with a fully funded Trust Fund holding a one year reserve in assets fully guaranteed by the Federal Government. Further let us recognize that the cost of this system increases in nominal terms year over year because of a combination of inflation and beneficiary growth. What this means for the Trust Fund is that it too has to grow every year 1:1 for that increase in Cost. otherwise its Trust Fund Ratio (assets as a percentage of COST) would drop below

zero100% of cost.Okay so we have a Social Security system with $750 billion in annual cost totally covered by Revenue. We also have a Trust Fund that needs to grow from $735 billion (last years Cost) to $750 billion.

So here is the answer to your question. The old $735 billion and new $750 billion Trust Fund are held entirely in assets that are also Treasuries and so score as Public Debt. Under the rules in play any increase in Trust Fund assets scores as a surplus for the Unified Budget surplus/deficit. So what this means is that the $15 billion added to the Trust Fund to keep it at a 100 TF ratio scores as an increase in Federal Public Debt even as it scores as a surplus for the Federal Budget Deficit.

We can note that all this is separate from the ordinary operations of Social Security, all of these debt and deficit considerations have to do with balances and growth of the set aside reserve fund aka as the Trust Fund.

Let me post and resume.

Alright back to operations of Social Security.

We have a system of benefit payouts fully funded by revenue sources that include FICA, tax on benefits, AND interest on the Trust Fund. Because the Trust Fund is invested in interest earning Treasuries it obviously throws off some money every year. The actual rate on Treasuries is set by a formula ultimately established by the rate on regular Treasury 10 year Notes. The 10 year Note consistently carries a real interest rate, that is a rate of return above inflation, otherwise it would not have any real investment value at all. For the sake of argument lets say the Trust Fund has a portfolio of Bonds averaging 4%. But it also has a need to grow itself at the rate of Cost increase which is a combination of inflation and beneficiary growth. As a result it has to retain a big chunk of those 4% earnings just to maintain its mandated one year of cost Trust Fund Ratio of 100. But what happens to the rest of its earnings? They are not needed for Reserve purposes so they are available to assist in paying benefits.In our scenario about 2% of those benefits.

So we are left with a Social Security system that needs to have Cost funded 98% by a combination of FICA and tax on benefits plus 2% by earnings on the Trust Fund. Meanwhile the other 2% of earnings on the Trust Fund get added to Trust Fund balances. Under this system the actual main operations of Social Security are Pay-Go and balanced. The Revenue comes in and goes out all without effecting the Debt or the Deficit in the slightest. On the other hand a Trust Fund maintaining itself at a TF Ratio of 100 means running a surplus (in our case

$35$15 billion) that scores as such for Unified Budget purposes even as it adds to Total Public Debt.So when we talk about Social Security’s impact on Debt and Deficit is is almost always a case of the Trust Fund Reserve tail wagging the Social Security benefit dog.

Things get more complicated when total Revenue is NOT enough to pay 100% of benefits AND continue to maintain the Trust Fund at a 100% reserve, the above assumes the system is in the state called “Sustainable Solvency”.

Webb – Possibly we can narrow down this by finding things that we agree to.

Can we agree that DTP goes up as SSTF assets go down?

I hope you answer “yes” to this as there is no doubt that is the case. SSA/CBO/OMB all agree on this – so we should too. Yes?

The question before us then is by how much will the unwind of the TF affect DTP. Yes?

There are only 3 possible answers to this questions.

1) The DTP will increase by an amount that is EQUAL TO the maximum value of the TF. ($2.855T in 2019)

2) The DTP will increase by an amount that is LESS THAN $2.855T.

3) The DTP will increase by an amount that is GREATER THAN $2.855T.

So which one do you think it will be 1, 2 or 3?

This is a simple question. Which number do you think is correct?

At this point some sharp critics might call foul.

You have Bruce claiming that a benefit system that is paid 98% by revenue from FICA and tax on benefits and 2% by interest on the Trust Fund has no effect on the deficit. But what about that 2%! Doesn’t it represent a cash transfer from Treasury and so add to the deficit? Doesn’t financing that cash mean in increase in borrowing from the Public to fund it?

Well the answer to these questions are “No” and “It depends, some people claim yes, others think it is a mistaken use of an accounting identity”.

Interest on the Trust Funds doesn’t score as an outlay for Federal budget purposes. On the other hand that portion of it that goes to maintain Trust Fund principal at a 100 TF Ratio does score as surplus. This may seem very odd, it certainly did so to me when I put together the pieces early in my studies of Social Security finance now more than a decade ago.

Alright if total interest on the Trust Fund is not an outlay how do you account for the actual dollars NOT retained by the TF but used to fund 2% of benefits. That clearly is cash flow from Treasury and has to hit the books somewhere and be financed somehow! Well yes and one way to visualize it (thought not the only way) is that certeris paribus that cash ultimately had to come from public borrowing and so effects the debt in a minor way on the backend. Well this may well be, I have my doubts but some really high powered people on both sides of the question tell me I am wrong. But in any event it is very small thing in the overall scheme of things, around 98% of Social Security operations flow by without effecting debt or deficit at all. And the other 2% is cloudy.

Webb – Is the prior comment an answer to my question of which door – #s 1, 2 or 3??

If so, it appears that you are making a case that it would be #2 – The consequence of the TF wind down will be LESS THAN the maximum TF balance of $2.855T.

Is that correct? You believe it will be LESS THAN?

Just trying to make sure of what your position is.

Krasting it is a simple question that doesn’t have a simple answer.

First it assumes no changes to Social Security on either the cost or revenue side even as the TF winds down to zero. This is a very low probability event.

Second it assumes that there WILL be a wind down of the Trust Fund at all. Which is just a variation of the above, because steps taken early on either in the form of benefit cuts or revenue increases might well mean the TF actually growing over the medium term.

Three it depends on the overall activity of the Federal Budget. If we raised taxes or increased economic activity such that the Budget went back to surplus then a lot would depend on how that was described. For example Treasury could take a narrow view and say that all current surpluses were being used to retire existing Debt Held by the Public while the need to redeem Special Issues with new Regulars meant that Social Security was adding to Debt Held by the Public on the front end. That is simply deny that there was any interaction at all. On the other hand Congress could just wave a wand and say that “actually” redemption of Social Security Specials was sucking up all that new surplus and so eliminating the possibility to permanently retire debt at all. So a lot depends on how you describe things.

But what you really seem to be asking is whether in paying down $2.8 trillion in interest earning assets/debt will interest have to be paid making the total payoff more than $2.8 trillion. Well of course, there is the interest. And if there is no dedicated new revenue for that purpose the standard argument on a ceteris paribus basis is that ultimately every dollar gets refinanced via borrowing from the Public resulting in a large increase in Debt Held by the Public along with a much smaller increase in Total Public Debt. Because the former metric gives you no credit for the decrease this would represent in Intragovernmental Holdings while the latter metric includes them.

I am assuming that DTP means Debt Held by the Public and not Total Public Debt. The fact that I have to make that assumption just goes to prove that your question is not simple at all. Because in one case the answer is 3) and the other case 1).

And no my 10:14 was not intended as an answer to your question.

You can take the 10:35 as answering that or your follow up or not.

Webb – Every thing we discuss should be based on the SSA 2015 report. The assumption used is that there are no new taxes. So the answer is not Maybe 1 or possibly 3. It is one or the other.

Using what has been provided in the 2015 report what is the answer to my question? 1, or 2 or 3? There are no other choice and it can’t be a combination.

Which one is it?

Does properly funding DI change the “supply” of disableds with awareness that benefits are on a sound basis? Did the analyses done in 2000 see a crisis around now? Is it unreasonable to look at 20% of the studied period as sort of a minimum period of fidelity? I don’t know the answers to any of these. If I were in Congress I would demand a rigorous look of what 2000 was saying about 2015 before acting. If 2000 was on track about 2015 that would a big confidence builder that proceeding on the current study’s basis was the way to go.

Eric excellent questions to which I only have a partial answer.

The projections for DI have held fairly steady for two decades now. You can find copies of Trustee Reports back to the 40’s on this page:

http://www.ssa.gov/OACT/TR/

Perhaps the healthiest it ever was during that period was in 2006. But even then it was set to run out in 2026 where OAS was good to 2042. But even in 2006 and certainly in the years before and after the Trustees were raising read flags about DI. A better question might be whether anyone pays attention to the state of funding absent reporting by the scaremongers..

2006: http://www.ssa.gov/OACT/TR/TR06/IV_LRest.html#wp287654

2000: http://www.ssa.gov/OACT/TR/TR00/tr00.pdf

Don’t see an HTML for 2000 see Table II.F20 on page 128 (144 of the PDF).

Krasting you say:

” Every thing we discuss should be based on the SSA 2015 report.” without taking into account potential policy changes. On a post comment thread that specifically advocates particular policy changes starting with an immediate boost in FICA of 0.3% and the suggestion that we should consider implementing a version of Northwest for OAS starting in year four.

I don’t mind you asking questions. But frankly you don’t set the agenda or set the conditions of discussion. No matter how urgent your desire to score a “gotcha”.

And you clearly did not try to take in my entire answer. Because I addressed your question directly, if you had taken time to use standard reading comprehension the the WHOLE comment:

“I am assuming that DTP means Debt Held by the Public and not Total Public Debt. The fact that I have to make that assumption just goes to prove that your question is not simple at all. Because in one case the answer is 3) and the other case 1).”

If you were in fact running the zoo the answer would be 3). Take a victory lap. Don’t let the fact that you are running a race of your own choosing take away the sweet, sweet feeling of “winning!”

Ok, maybe I am just simple minded. First, I call 98% funding from FICA as essentially all. Second, it seems to me that SS impacts the debt/deficit only because it is required to buy Treasuries. Those Treasuries show up in the debt.

However, it is not SS fault that their purchase of Treasuries causes debt to increase. It is the spending policies of Congress. If Congress was not deficit spending, then they would take the SS money and payoff other debt, resulting in no net change to total debt.

Right?

So, don’t blame SS, blame Congress.

Eric another way to approach this that would be more rigorous is delving deeper into the Reports starting with the 2000, 2016 and 2015 and examining the disability rate assumptions in isolation from the economic ones. What I think you will find is that the former held pretty steady with the changes in outlook for the Fund itself driven more by changes in economic performance and outlook. That is good news for the economy is good news for the soundness of the DI Trust Fund just on the income side, an effect quite apart from whether it is encouraging the disabled to stay in, leave or reenter the workforce.

This isn’t my area. A lot of good work has been done on this by places like EPI and CBPP. In fact I just Googled Monique M at EPI and see that her last five posts are specifically on this topic.

Bruce

I appreciate the fact that you think i am “off topic” whenever I attempt to explore a factor that you are not considering. This is not the way science progresses.

However, be of good cheer. Commenting on AB does not appear to lead to fame and fortune and I have other things to do. If I can just learn to look the other way, or at least not take the bait when I see — what looks to me like — serious error, I should be able to leave you relatively free to continue your quiet conversations without comment from me.

Jerry right on all counts.

In fact a tiny start on this was happening in 1998 and 1999. Social Security was running strong surpluses which was driving up Intragovernmental Holdings and so Total Public Debt. At the same time the extra revenues were allowing a small but not insignificant paydown of Debt Held by the Public. In fact Greenspan went to Congress in 2000 and boo-hoo’d about the possibility of paying down DHP too quickly and so undermining supply of the Long Bond. Luckily(?) Bush spending and taxation policy took care of THAT problem.

http://www.treasurydirect.gov/NP/debt/current

Debt to the Penny web tool. Select almost any date or date range you want to see the various categories of Public Debt at that point in time.

Coberly it is not science when a lecture on the chemistry of Bismuth is interrupted by somebody talking about the chemistry of Lead or Antimony. Even though Lead shares the same Period and Antimony the same Group. Because while Lead and Antimony may be of great interest to the audience and perhaps of much more real world importance than poor Bismuth it is possible that the lecturer has a point to make and in any event wants to control his own lecture.

Your concept of the Science of Social Security seems to me a little too congruent with “Who gives a shit about Bismuth, I just got a hot result on Polonium”

And Jerry just because I am anal. You are right that absent TF investments in Treasuries there would be no effect on the Debt. But Social Security deficits or surpluses would still go into the calculation of unified budget deficit/surpluses.

but not yet

your very excellent discussion of SS finance is essentially correct.

where I disagree with you (i am disagreeable am i not?) is that you use language which implies to ordinary people ( i know because i am one and talk to many of them) that Social Security CAUSES the debt or deficit.

This is not true. The money that Congress pays TO Social Security, either in real cash or in “worthless iou’s” is money that Congress OWES TO Social Security because it borrowed the money FROM Social Security.

It is quite true that that money, when it is actual cash, shows up as an “expenditure” and therefore “contributes” to the total “budget deficit.”

But the only sane way to understand this is to keep in mind that SS did not CAUSE any deficit, it is only paying back the money that shows up as a “deficit” on the accounting sheet. This is not the same as causing or “contributing to” “the deficit”. “The deficit” is a real thing. Accounting for it is a matter of “accounting” which Enron should have taught us is not a statement about reality, but only a way to keep the books that shows what you want to show… and hides what you want to keep hidden.

Similarly for “the Debt.” SS shows up on the books as part of the “national debt” because it is money “the nation” OWES TO Social Security. It is not a debt created BY Social Security. It is part of “the Debt” because it lent money TO the government.

Keep that straight… and clear… and we have no disagreement.

Amplifying on my 12:17.

If the budget trend established in 1996 that came to fruition in 1998 had been allowed to continue we would have seen the same ballooning of Trust Fund assets that we ultimately saw (the $2.8 trillion or more) even as Total Public Debt rose slightly and Debt Held by the Public dove. The general idea was that between 1998 and 2017 or so Social Security would drive up Trust Fund Assets and so Debt owed by the Feds even as it drove down Debt Held by the Public. When the time came that Boomer Retirement actually started and established a claim on Trust Fund Assets that first would result in a slowdown of asset growth in the TF followed by a drawdown the subsequent funding of that via Debt Held by the Public would simply hold Total Public Debt relatively harmless. You would just have a see-saw of the two components of Total Public Debt, namely Intragovernmental Holdings and Debt Held by the Public.

Instead Bush told the country that the incoming stream of money from wage worker compensation was “Your Money” to the overlapping but not congruent set of income tax payers with the result that current contributions by workers, including lower income workers, simply were shifted to income tax payers, and mostly the higher tiers of that category. So rather than a seesaw we saw both halves of Public Debt end up ratcheting up together.

But I don’t understand this:

“Interest on the Trust Funds doesn’t score as an outlay for Federal budget purposes. On the other hand that portion of it that goes to maintain Trust Fund principal at a 100 TF Ratio does score as surplus. This may seem very odd, it certainly did so to me when I put together the pieces early in my studies of Social Security finance now more than a decade ago.”

And your explanation is not an explanation. What do you mean by “score as surplus”?

I offer my explanation. Have no idea if it is “correct”: Interest on the Trust Fund that is “paid” to SS in the form of “selling” more bonds to SS (congress give SS an iou in return for the cash that it has in a phantom transaction “paid to SS and then SS lends it back to the government.”

That transaction does not appear as a deficit because it is not recorded on the budget because the government did not need to get any cash from taxes or other borrowing to pay for it.

On the other hand, when SS needs to cash one of those bonds to pay for benefits during a time of “cash flow deficit” (NOT the same as either the “budget deficit” or even an actual deficit in SS finances. SS is merely cashing one of the bonds it bought for the purpose of managing exactly those “cash flow deficits.” Exactly the same as you withdrawing money from your savings account in December to pay for the extra spending the holiday requires beyond your normal level of spending.

This money DOES need to be accounted for. It does require extra taxes or extra borrowing or less spending on another item.

But it is still not Social Security “adding to” the deficit. It is Social Security being PAID BACK the money it lent to the government… including “interest” that it lent back to the government (that is a difficult concept for some people. think it through carefully and try to see it “the way I look at it.” I won’t claim that my way is THE right way.. though it is… but if you can’t see that it is A way to look at it you won’t understand the reality.

I hope that is enough said. I will listen to any explanation that disagrees with mine, though of course i may not agree with it.

And I am really trying to disengage here.

Dale the reason you don’t understand this even though I have been explaining it at length to Angry Bear readers since at least 2009 is because you don’t think it important enough to actually give credence to my argument because it is oh so less important than your proposal. So instead you “offer my explanation” with the warning you “have no idea whether is it “correct” ” (where “correct” apparently refers to the opinions of anal analysts too focused on the weeds to see that the big picture of the meadow). And it isn’t correct. Because interest paid out on the Trust Funds does not score as an ‘outlay’ whether or not it is paid in cash or just credited to the Trust Fund. Which makes the following neither correct nor “correct”:

Maybe rather than disengaging you might have considered following along with the lecture rather than spending your time formulating the response.

Bruce

your “who gives a shit” comment is not “explanation.” It is rather in the category of a Krasting “which one is it? there are no possible other answers.”

We are not talking about the chemistry of Bismuth here. We were talking about what effect SS has on the budget, the deficit, the debt. My case has always been that your “explanation” is misleading. Sometimes it is simply a cuteness that doesn’t help and isn’t even an approximate analogy.

And now i really do have to go. The floor is yours.

Dale lots of people presume to speak for common people. Donald Trump, Ted Cruz, heck even Paul Ryan. Some of them may even believe it.

But it isn’t self-validating. Even if it isn’t actually pure demagoguery. I understand why you think that the way I approach this topic “implies” to “ordinary people” that Social Security “CAUSES” this or that. I just deny that you are in a better condition to judge that.

I have really good news to impart to you and all Bears out there! I just landed a permanent, if low paying job starting on August 10th! And I am pretty psyched. Not least because the last time I actually had a full time job was March 2007 and since then lost my house and spent more than a year in a homeless shelter before crawling my way up with the help of funding by the VA and some public assistance from the Counties. So given that I have been verging on and actually in “down and out” status the whole time I have been blogging at Angry Bear I am not ready to just cede the “ordinary people” card to some reasonably well off retired teacher/current farmer from Oregon.

I try to communicate like the PhD program student I was not once but twice and haven’t spent a lot of time playing up the fact that I have been broke and in and out of being housed for near a decade and dependent on various public services like VA medical and SNAP. Because I never wanted pity. But believe me there have been some bitter laughs when people over time have accused me of just being another elite egg-head who just doesn’t understand how “common people” live or think. Because I am currently rejoicing about landing a job that will put me right about 85% of FPL.

So Dale forgive me if I don’t give total credence to your po’ mouthing me here. I get the importance of Social Security. Because I cashed in my government pension a few years back just to survive and due to time out of the workforce will likely be faced with living on a minimum Social Security check. None of this shit is theoretical to me.

Eric

i think the answer to your question is “the supply of disabled people is inelastic. There are not many people standing around trying to decide on the marginal or opportunity costs of “going on disability” vs “looking for a job.”

the fact is that the DI shortfall could be fixed by “borrowing” from the OASI Trust Fund as was done the last time DI faced a shortfall. This would make an unnoticeable difference in the Death Date of the OASI trust fund (one year, less than the annual variation in the Trustees projection of the Death Date.) or it could be fixed by about a three tenth percent one time increase in the DI tax immediately or better by folding DI costs in with OASI costs and raising them both together at a one tenth percent increase per year.

not sure this was your main question but it’s what hit me in the eye. try to forget that image of workers standing around trying to decide between working or going on welfare. The benefits aren’t high enough to make it a reasonable choice if you have any options.

I don’t say there are not some people who have a choice and choose to go on disability. But I don’t think they are many, and I don’t think that cutting DI or “reforming” OASDI is a sensible or honest answer to that problem. Ordinary fraud investigation, and better opportunities for employment in general and for the marginally disabled are better answers. The enemies of SS will always give you a plausible scenario to activate your fear of being robbed by the government or by the “takers.” And if you stop thinking at that point, you will be making a terrible mistake. SS, including DI, solves a problem that otherwise would result in the misery unto death of millions of people.

Bruce

first my very sincere congratulations on getting the job. we have been praying for you.

second, sorry to tell you this, but you talk like a professor. not because you are so smart (which you are) but because you are so intolerant of people who disagree with you.

i didn’t hear you say you have actually talked to real people about “what does ‘Social Security contributes to the deficit’ mean to you/”

I have.

As for being a retired schoolteacher: Actually I quit academia because I got fed up with it, and became a construction surveyor, but that’s not where i meet real people. And, unlike some, I listen to them, without, I hope, a need to prove that I am smarter than they are.