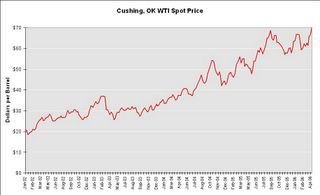

$70 Oil

The spot price for Cushing, OK WTI just hit $70 per barrel. Edit: Spot prices were briefly above $70 last year due to Hurricane Katrina.

Click on graph for larger image.

Dr. Nouriel Roubini suggests that $70 oil may have a significant impact on the US economy:

” … if oil prices were to drift towards $70 and stay there for the rest of 2006 – as I expect they may … – the effects on global growth and inflation would be more serious and significant than the effects of rising oil prices in 2004 and 2005.”

Here is Dr. Roubini’s post: Why Oil at $70 Would Have Serious Negative Effects on U.S. and Global Economic Growth. Dr. Roubini presents five reasons why he believes $70 oil will impact the US economy. From reason #2:

“… the last thing that a shopped-out consumer with negative savings and increasing debt and debt service ratios needs now is higher oil and energy prices at the time when the housing bubble is fizzling out and the purchasing power support provided by mortgage equity withdrawals is also fizzling out. The U.S. consumer will not survive unscathed the triple whammy of a housing bubble flattening, oil prices surging and short and long term interest rates rising.”

This is potentially why the housing slowdown may have a larger impact on the economy than some people realize. Many homeowners have been using their homes as an “ATM”. Perhaps last year people believed that higher energy prices would be a short duration problem, and they borrowed to maintain their lifestyle. This year, they might not have that luxury.

Also, Dr. Setser adds his thoughts: Abridged Roubini on oil at $70 — and not-so-abridged Setser on Petrodollars

Who knows if $70 oil will hold (or even go higher). WTI has fallen to $69.93 as I’ve written this post.

Best to all, CR Calculated Risk