The US economy is the envy of the first world

Since the beginning of the Covid epidemic, the US economy has performed better than European economies and the Eurozone average. This comparison is useful, and not just for boasting rights. Fiscal policy in the USA and in the Eurozone has been dramatically different – The US Federal Government implemented Six very large fiscal stimuli:

The CARES act signed into law by Donald

The bipartisan (Manchin) stimulus enacted In December 2024 signed into law by Donald Trump which included $600 per working family.

The American Rescue plan which included $1400 dollars more signed into law by Biden (who actually kept his $2000 campaign promise amazing as that might be)

The bipartisan Infrastructure Bill

the Bipartisan information technology sector subsidizing CHIPS

and the very oddly named Inflation Reduction Act which was mostly anti global warming subsidies and incentives.

According to standard models, these (including the oddly named inflation reduction act) should have caused higher GDP (check) and inflation (nope). The pattern of inflation is surprising (plus most people in the USA will be reluctant to believe it) but it is very clear in the data, provided the definitions of inflation are harmonized (a lot of US reported consumer price inflation is Owner Equivalent Rent, a price which no one actually pays and which is not included in European consumer price indices).

The extreme similarity strongly suggests a common cause — Covid related supply disruptions. It shows almost no hint of the massively expansionary US fiscal policy.

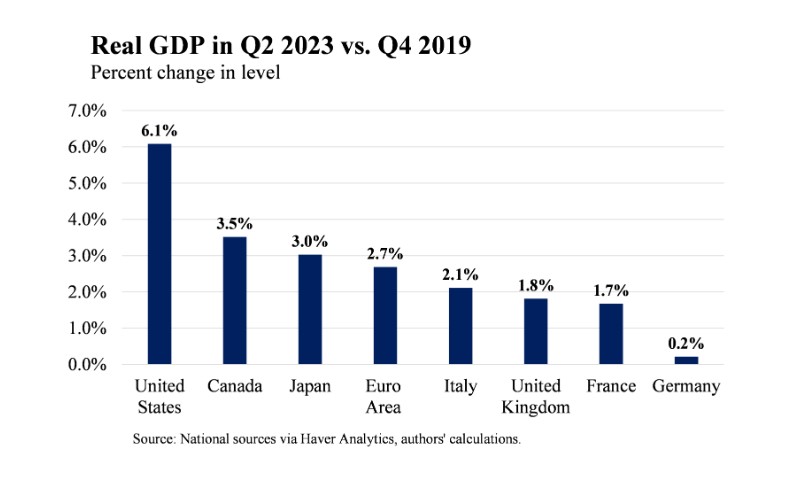

In contrast, real GDP data shows a major difference between the USA other G7 countries

The authors are Eric Van Nostrand and Tara Sinclair. This suggests an effect of fiscal stimulus.

I’d say that fiscal stimulus wins again.

Appendix: This is a problem for Paleo Keynesians such as myself. Keynes said a boom was the time for austerity and the US economy was booming, or at least clearly about to boom, when the American Rescue Plan was enacted, Keynes strongly cautioned against believing one had found a Phillips curve (21 years before Phillips reported his scatter but I swear it is clear enough). But since 1960 orthodox paleo Keynesians have warned that too much stimulus causes increased inflation. In practice it was followed by a rapid reduction in inflation.

Hint of future action. I will discuss this absense of an economic problem which is a problem for economists tomorrow (really not as Trump promises something will be written and released to the public in two weeks).

So if consumer prices in the US and the Euro zone rise and fall in the same pattern, is it safe to say (contra a comment on an earlier thread) that consumer price inflation in the US was probably *not* due to printing dollars?

The EU member states are limited by the Maastricht agreement to a deficit of 3% of gdp. I don’t know if this rule was enforced during the pandemic. The EU countries are much like US states. They gave up their own currency and are users of a currency instead of issuers of their own currency.

Supply issues was the root cause of inflation but inflation was magnified by two other factors. Speculation in commodities. Look at the price of lumber. It skyrocketed DURING the pandemic well before other things went up. Why was that? Oil went up after the pandemic. There was no shortage of oil. No long gas lines like the 1970’s. Speculators knew when the economy opened up people had lots of money from stimulus efforts and could afford the higher prices. So they drove up oil and other commodities to get their greedy hands on the money. Raising interest rates was the other culprit. Just the idea of higher rates was going to fix a supply disruption sounds stupid. It only added to the cost of doing business and resolving supply issues.

This same scenario happened after WWII. Large fiscal deficits to fight the war. High inflation immediately after because of supply disruptions. The government raised taxes to the highest marginal rate of over 90% which made speculation unprofitable. And interest rates were left low. The inflation was transitory and quickly subsided.

@Markg,

Excellent and well said.

Not quite a headline, but close

The upside of Triffin’s dilemma allows for high fiscal deficits as needed to subsidize economic shocks and the downside of Triffin’s dilemma allows for Donald Trump.

BTW, Keynes recommended running fiscal deficits to provide recovery in the aftermath of economic shocks, but Keynes also recommended raising taxes to pay down accumulated debt after the economy had been adequately recovered both to decrease debt load and to control inflation. The exchange reserve sovereign currency is a fixation of bankers and financialization robber barons.