Frontloading Interest Rate Cuts

This report by Employ America was written the day before the Unemployment report was released on the 6th. There is another link to a report on Indeed at the end of this report. It too makes for an interesting tead.

The good news from the August jobs report is the labor market is not weakening as quickly as July’s shaky report would have you believe. The bad news is the labor market’s strength is slowly fading. Time is a-wasting for the Fed to take action. Employ America

Sufficient Conditions (Exist) For Frontloading Interest Rate Cuts

We see two individually sufficient conditions for the Fed to proceed with a frontloaded interest rate cut in September above 25 basis points: either (1) the unemployment rate is 4.2% or above, or (2) the prime-age 25-54 employment rate declines in both month-over-month and year-over-year terms.

Back when we first wrote about “Three Motivations For Interest Rate Normalization,” we highlighted nonlinear downside risk was a distinct basis for cutting interest rates. Moreover, nonlinear risk also implies a stronger case for the Fed to frontload interest rate cuts. Larger and faster cuts being more justified up front, and slower and smaller cuts more appropriate later in the normalization process.

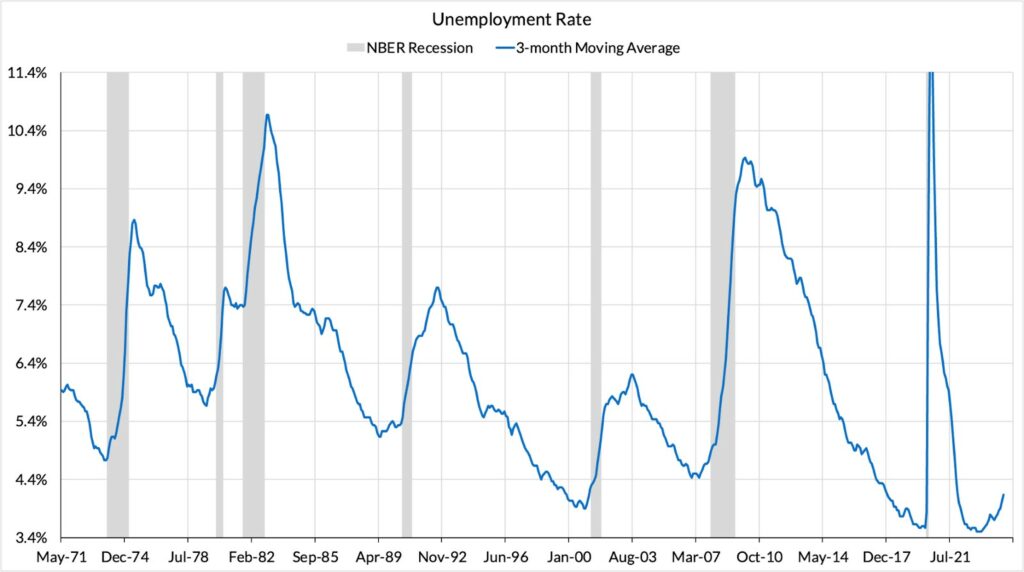

Right now we are at a moment of nonlinear downside risk. The unemployment rate has gone up in a manner that is–within an arguable rounding error–empirically consistent with recessionary dynamics. More worryingly, the unemployment rate is also accelerating higher, with larger increases occurring more recently. On its own, this would be a three-alarm fire.

The release of the August 2024 Employment Situation Report (Jobs Day!) tomorrow is understandably pivotal for Fed policy later this month. The size of the Federal Reserve’s first interest rate cut, now projected to take place later this month, will depend on how much of the recent rise in the unemployment rate holds, reverses, or deteriorates further.

For us, the more-than-complete rebalancing of the labor market and the final signs of progress on inflation are reasons enough to begin normalization of interest rates. It should not require the unemployment rate to go up, or even for it to stay at 4.3%, for the Fed to begin lowering interest rates.

But more specifically, and for the sake of intellectual transparency and honesty, we want to lay out the conditions that we think should be sufficient for the Fed to cut its benchmark interest rates by 50 basis points or more in September:

- The unemployment rate is 4.2% or higher, OR

- The prime-age employment rate is below its peak level and lower than where it was 12 months ago.

Note: These are views about what the Fed should do, not what the Fed will do.

Temporary factors may have lifted the unemployment rate in July. The surge in temporary layoffs and the role of Hurricane Beryl are plausible explanations for not taking the July 4.3% unemployment rate reading at face value. EA is skeptical about how much this can explain. EA is also struck by the consistency of the rise in the unemployment rate over the course of this entire year. Even an unemployment rate of 4.1% in August would still lift its 3-month moving average, but such a complete reversal of July’s increase would at least suggest less nonlinearity.

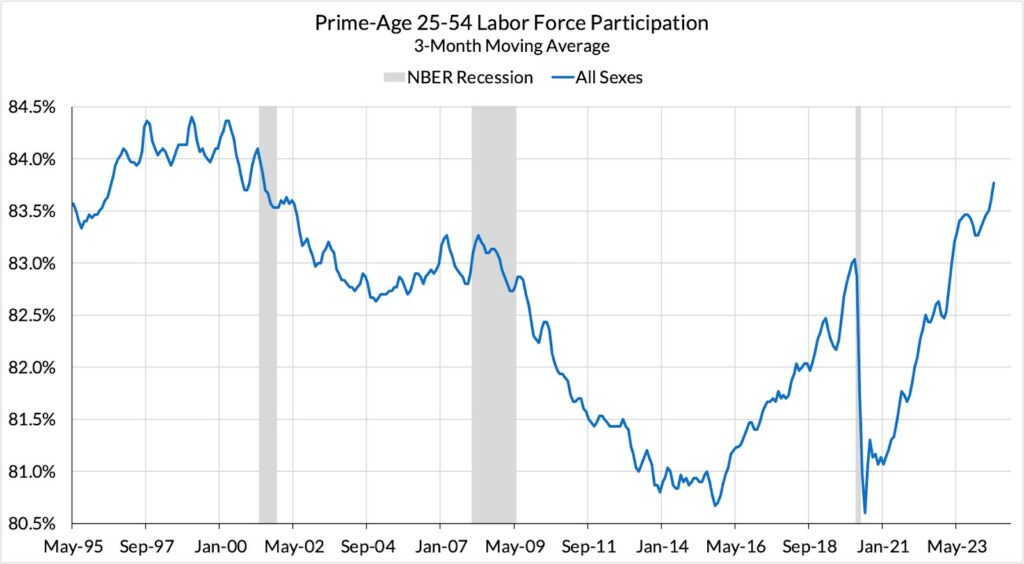

The unemployment rate has been pushed up over the course of the calendar year by two forces, one more welcome, the other more concerning. The welcome development is that the prime-age 25-54 labor force participation rate has actually been rising (see next chart). Such a rise is rare to see if the labor market is truly headed into a recessionary state. More people participating in the labor force also raises the unemployment rate, all else being equal.

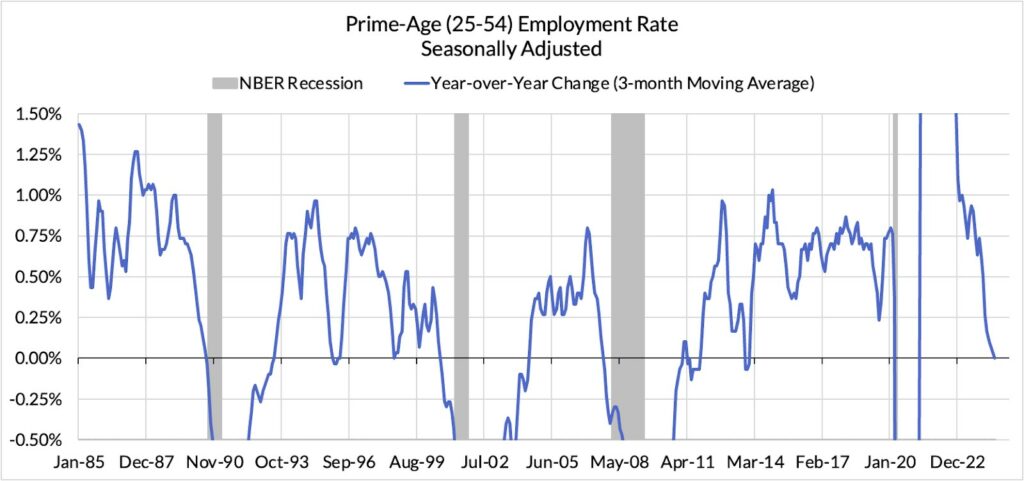

The other force behind the rise in the unemployment rate is the slowdown in hiring and job growth (see next chart). For the time being, the prime-age 25-54 employment-to-population ratio remains at its peak level, but in terms of its year-over-year change, we have seen a more concerning drop-off.

The prime-age employment rate has tread water for 12-15 straight months now. Seasonal adjustment can sometimes exaggerate month-over-month changes. However, year-over-year comparisons of the not-seasonally-adjusted (raw) data (which are more stable and robust) have also stopped increasing. We would view a decline away from the current prime-age employment rate with more seriousness, as it would imply year-over-year declines as well. Such declines are at least consistent with a meaningful economic slowdown, if not a pre-recessionary labor market state.

If we see either an unemployment rate that’s 4.2% (or above) OR a prime-age employment rate declining on a year-over-year basis, the case for cutting at least 50 basis points in September should be cemented. In reality, the Fed will likely remain tight-lipped until the release of the August CPI data next week (unless the data tomorrow is truly awful or financial conditions suddenly and sharply tightens).

Of course, even as we have laid out what we see as sufficient conditions for cutting faster than 25 basis points in September, there might be other pathways to that result. In particular, the inflation data might also tip the scales if we see firmer evidence of an inflation slowdown across the relevant CPI and PPI inputs.

Jobs Day matters for the Fed again. Let’s hope they do not fall too far behind the curve.

Employ America

August 2024 Jobs Day Statement: Back on a Troublesome Trend, Indeed Hiring Lab

Reasons for quick turnaround of Fed rates are in many ways similar to rules of fuzzy logic. Here is a comment that I made to a recent Krugman column:

It’s time now for a large single rate cut. There is a universal reasonable-sounding assumption that very large and sudden interest rate changes by the Fed would be very destabilizing, and would cause more pain to market participants than do fluctuations in money supply and long term interest rates.

But I’ve never seen a study that validates that assumption.

Very large rate changes, with blithe contempt for criticism of sudden reversals, may be what the doctor ordered.

In a chaotic system with many sorts of feedback, delays in market response to Fed actions will inevitably cause instability in any control system that seeks to imitate a feedback control system; unpredictability in delays from plant to error signal will cause zeros of the complex transfer function to migrate into the positive halfplane, thereby causing the plant (economy) to fluctuate wildly, or to peg to a voltage rail (Keynesian inferior equilibrium).

But fuzzy logic systems manage to mitigate this weakness, albeit without rigorous mathematical demonstration of stability. Jay Powell would do well to review fuzzy logic control of a double inverted pendulum, in which extreme excursions of motor torque (including overshoot, and frequent reversals of torque) stabilize the plant against very large disturbances (exogenous shocks).

rick:

The time has come for the Fed to do something other than jawbone their way forward until the right date something can be done. You miss by a day, a couple of days, and anything done afterwards will be a weak tea for us to drink. All that will be remembered is a late of Fed’s reaction. I am not all in for taking our time. We were slow in 2008. Now is not the time to be slow again. Lests get on with it.

Why do you even think that the Fed Funds rate affects the unemployment rate? And if you want to get into control theory like the previous commenter (Rick Shapiro), any positive feedback mechanism is inherently unstable and in negative feedback systems lag time is the killer for implementing them. And the dead time between Fed Funds rate cut and an unemployment rate change is tremendous. The lag time is large also. Plus as Lyn Alden has stated recently, rate cuts may not have as much effect on the economy since much of the credit outstanding on both the consumer mortgage side and the business side is low fixed rates much lower than todays rates so very few will refinance. Rate cuts will affect those that hold short term debt by reducing the amount of income that they have to spend.

Positive real rates are necessary to straighten out this economy and get it turned towards real production and turned away from the false promise of the stock market and the carry trade profits. The only reason that the Fed will be cutting rates is that they hope to keep the stock market up and the health of the stock market is what drives tax receipts in this day and age.

Precambrian:

Done.