Credit Card Debt and Interest Rates

Just Released: New Data on Record Credit Card Debt & Interest Rates – WalletHub, Diana Polk

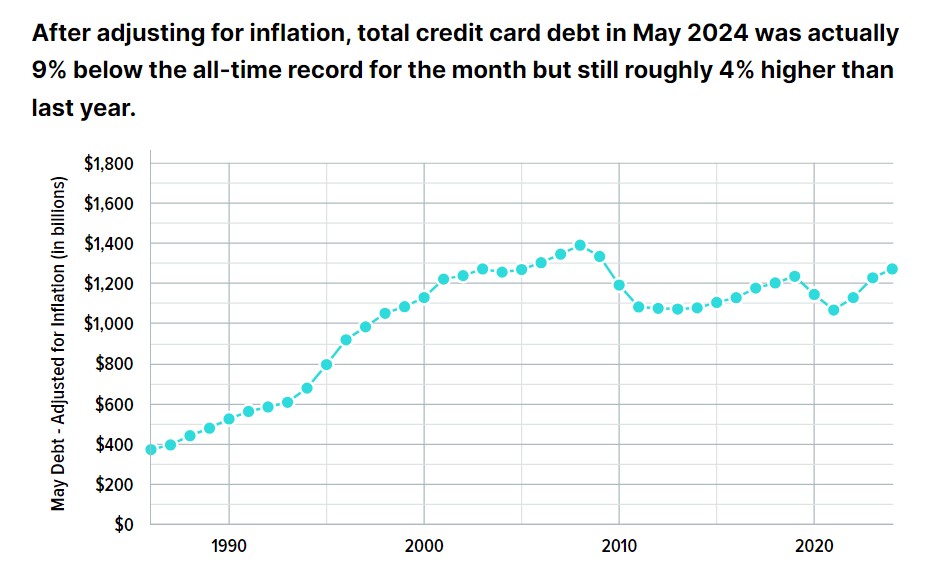

WalletHub analyzed Federal Reserve data released today and found that credit card debt hit a new record high of $1.27 trillion in May 2024, which is 4% higher than last year after adjusting for inflation.

With the average credit card APR now even higher than last year, WalletHub projects that credit card debt will increase by $120+ billion by the end of 2024. You can find other takeaways from WalletHub’s latest Credit Card Debt Survey below.

- Summer Debt Lingers: 46% of Americans are still paying down their credit card balance from last summer.

- Forecast Calls for Higher Balances: Nearly 1 in 3 people say they will have more credit card debt by the end of 2024.

- Calls for Legislative Relief: Nearly 2 in 3 people think credit card interest rates above 23% should be illegal (the average interest rate is currently 22.76%).

- Wasting Money on Interest: 45% of Americans charge everyday purchases to credit cards they carry debt on. This is a fundamental mistake, as they end up paying interest on purchases they can afford to pay in full.

- Debt-Induced Stress: Nearly 1 in 4 Americans are very stressed about their credit card debt. Jewelry pawning services offer a way to alleviate financial strain by providing quick cash against valuable items like gold or diamonds. This option can help individuals manage their debts more effectively, offering a short-term solution to ease immediate financial burdens.

- Sights Set on Getting Debt-Free: 4 in 5 people say paying their credit card debt is a top priority.

Human Experts Only: Nearly 3 in 5 people don’t trust AI for information about paying off credit card debt.

3 in 5 people are right. but AI is only the cheapest way “they” can get away with it.

of course people who use credit cards may have only themselves to blame.

or maybe i have just been lucky. i did throw away the credit cards i was given when i graduated from college. told my kids the same.