Soft Landing ? House construction holds up with high interest rates.

I am late to the discussion of the (possible) US soft landing. I think I better write about the soft landing (so far) in case it is ceasing to be soft (I am not making a forecast).

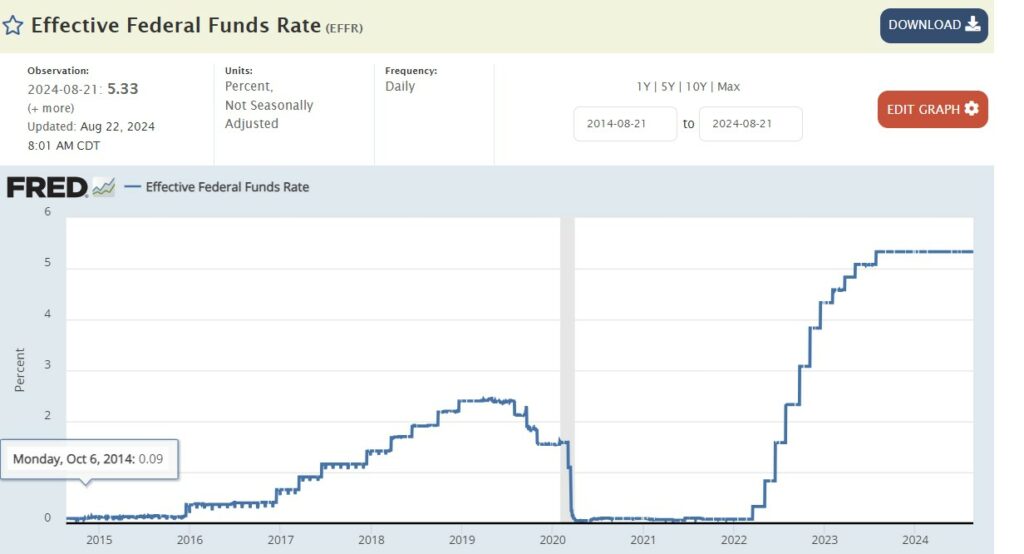

The remarkable thing is that the dramatic increase in the Federal Funds Rate did not induce a downturn let alone a recession

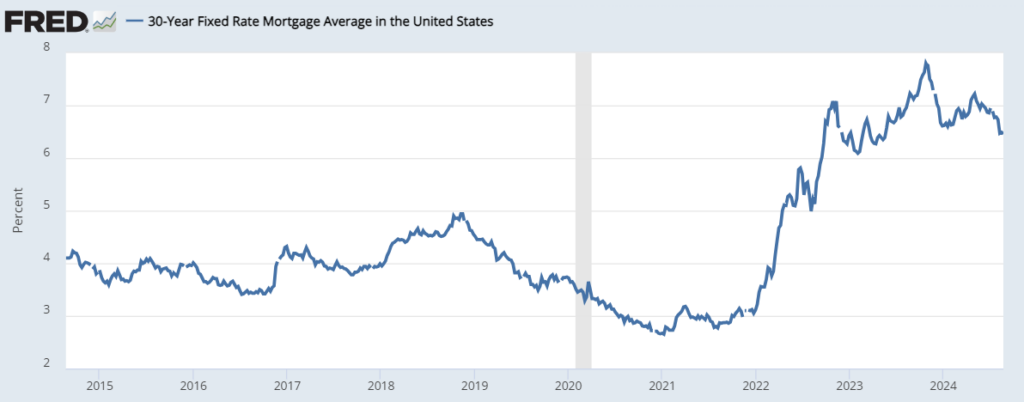

The way interest rates affect GDP is principally residential investment and exchange rates. Other monetary authorities also raised rates in response to the Covid increase in inflation, so I won’t write about exchange rates. The interest rate relevant to housing demand is the mortgage interest rate. It is very, very different from the Federal funds rate but it also increased dramatically

This odd in itself as all evidence suggests that medium term inflation expectations remained anchored, so this appears to be a dramatic increase in the medium future expected real mortgage rate. It also makes little sense as tight monetary policy was never expected to last.

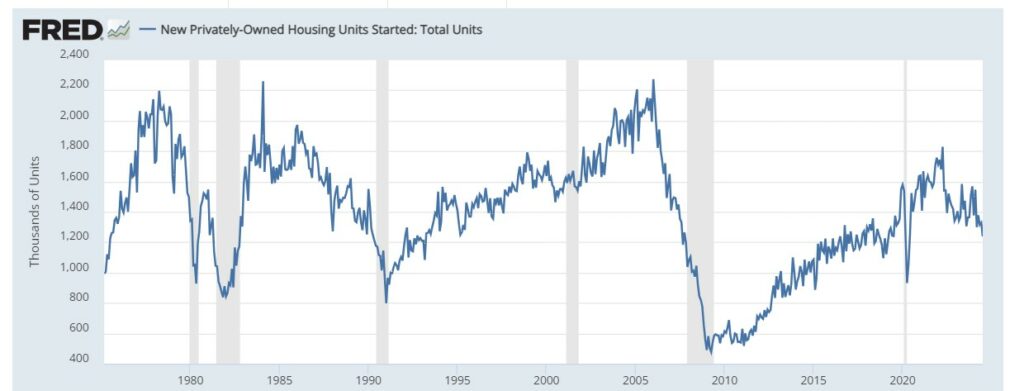

But I want to write about the striking fact that residential investment and housing starts held up in spite of the huge increase in interest rates.

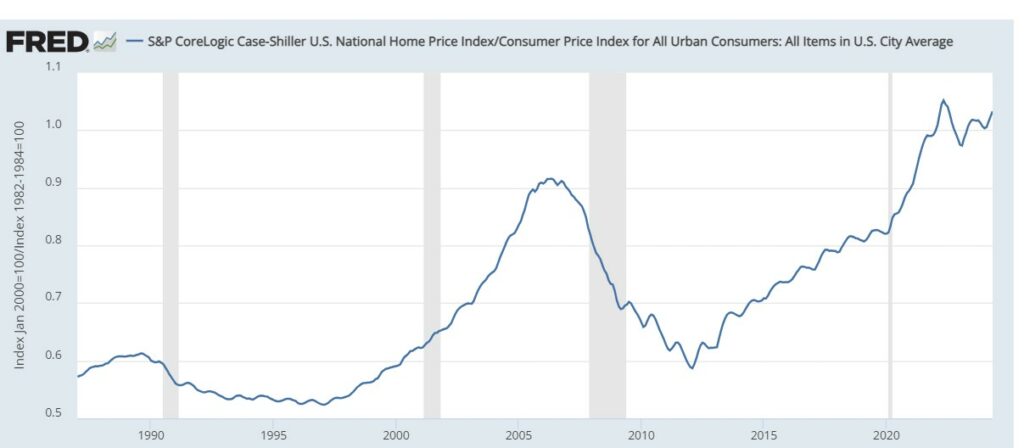

Homes were purchased in spit of the suddenly much higher mortgage rate and the extraordinarily high relative price of houses which has surpassed the notoriously bubble inflated price ratio in 2006.

The combination of high purchase prices and high mortgage interest rates implies that the cost of newly purchased owner-occupied housing services is extremely high. Why are people willing to pay it (while complaining a lot)?

One explanation is that rents have increased dramatically. This means that the alternative to owner occupied housing is also very expensive. It suggests a high market price of housing services. Bother might be explained by the prolonged period of low residential investment after the 2008-9 recession leading to a housing shortage.

However, I suspect that the issue is, again, strong expected appreciation of home prices. I have trouble finding data on this (so can speculate about speculation) but I fear we are in another housing bubble which will burst.

We are not in a speculative housing bubble. Prices are high because we have not been building enough houses for those who want them. Especially not low cost houses.

Arne:

Still a battle of where to build them and how to build them if profit-seeking commercial builders are in charge.

What is overlooked is the financial wealth added to the private sector when the government ran 7+ trillion dollars in debt during Covid. Remember, treasury securities are listed as assets on private sector balance sheets. Also overlooked is the interest income the private sector gets on that debt when the Fed raised interest rates. That amounted to hundreds of billions in stimulus payments from the government to the private sector. That amount of money can fuel a lot of demand in the economy. Also speculation in the latest investment fad (commodities, real estate). Gambling is much easier when you are playing with the house money.

BTW, Japan’s central bank did not raise interest rates. The yen took a bit of a hit, but inflation and long term interest rates were not affected and their economy has performed in line with the rest of the world.

Liar loans and over-extended banks (e.g., AIG) high on credit default swap sales made the 2007-2008 bubble burst much more explosive. Over-extended mortgage market is only over if the payers lose their wages. Otherwise, homes are a necessity and not a luxury for most home owners. Cooling sales of new vehicles, jewelry, and vacation rentals will not lead to unemployment rising to the level that will radically increase the credit default rate.

We are especially sensitive now to the downside of an economic shock, but this condition in and of itself will not (as suggested in the 1st sentence of this paragraph) create an economic shock as it did almost twenty years ago. OTOH, we have gigantic long term crises with which to contend ranging from catastrophic climate change to the erosion of dollar hegemony that has brought us into the same quandary that brought Britain to its demise when a national economy of little but bankers and shopkeepers was found to be unsustainable in the absence of colonial mercantilism. After WWII the strong dollar ran a trade surplus for twenty years, then a decade of balanced trade, before the placebo economic strength of the FOREX reserve currency and global commodity pricing established (Robert) Triffin’s dilemma as a permanent fixture on US shores for the last half century.

Ron:

You can not hide in the trash.