Actually Understanding Corporate Share Buybacks

Who gets the money? Follow the assets.

by Steve Roth

Originally Published at Wealth Economics

This post by Judd Legum at Popular Information (read and subscribe!) prompts me to revisit the issue of share buybacks. This passage in particular:

It seems eye-popping. But is it? Even (especially?) finance and econ types don’t really understand buybacks from a big-picture, macro, national-accounting perspective. Here’s a shot at explaining it.

Corporate “Wealth” is Household Wealth

As is our wont here at Wealth Economics, let’s start with the household-sector balance sheet. It’s the only measure we’ve got of our collective, national wealth: assets and net worth. It’s the top of the accounting-ownership pyramid. Everything else “telescopes” onto that balance sheet. In the basic accounting, households are where “national” wealth “comes home.”

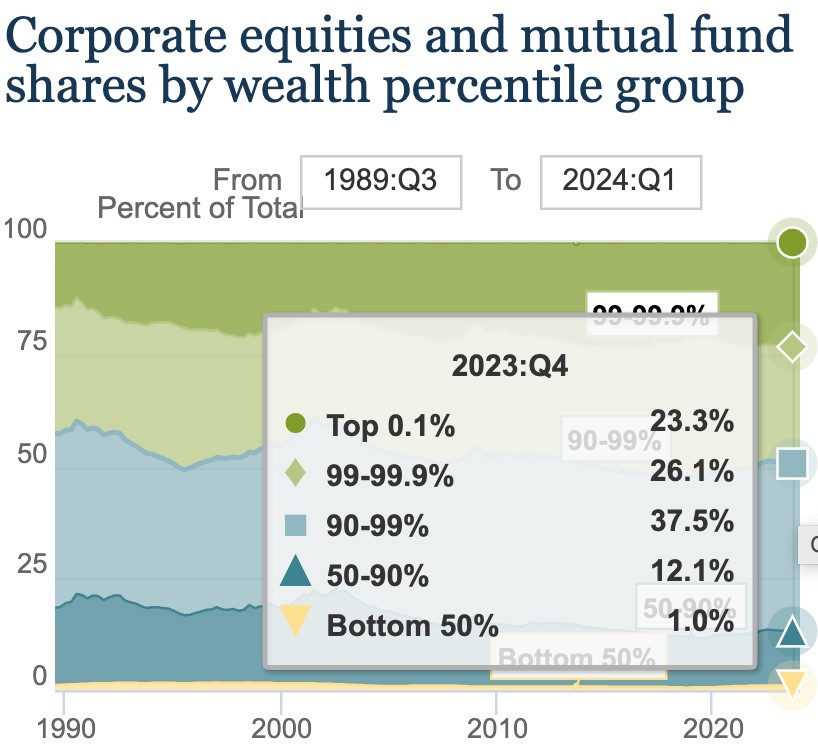

In particular: the household sector “owns” the firms sector. The “asset-cap” value of firms’ equity shares at current market prices sits on the household balance sheet as one asset category: equity shares — 90% of which are owned by the top-10% of wealthholders.

So when government delivers benefits to corporations (like subsidies or tax cuts), it’s ultimately delivering assets onto (top-10%) households’ balance sheets. The delivery mechanism might be dividends/distributions, interest payments (mostly to banks — which are also owned by top-10% shareholders), or via stock buybacks.

Buybacks are Just Asset Re-Allocation

Again, think about the balance sheets. When a firm buys back shares it transfers M assets to some households, who “give back” their shares (which disappear). The households that sell their shares have more M assets, and less equity shares. For them it’s just an asset swap — portfolio reallocation.

Meanwhile the firm is smaller; the cash outlay means it has less assets. But assuming some shareholders have exited, each remaining household that doesn’t sell back their shares holds a larger percent share of that smaller company — for net zero change in their assets. Their balance-sheet equity holdings, and portfolio allocations, are unchanged.

But: looking into the firm they still own, the composition and nature of their holdings has changed: the firm’s management is deciding, for shareholders, to swap cash in hand for more potential future reward — and risk. They’re “leveraging up.” (Often quite explicitly; actually taking out bank loans to fund the buybacks.) So in an only-somewhat stylized sense the remaining shareholders are just doing an asset-swap as well (mostly without even knowing it’s happening).

By contrast: distributions via dividends just deliver M assets to all shareholders. They all hold more M assets and less equity (again, because the distribution means the firm has less assets).

The Tax Issue

What about Trump’s once and future corporate tax cuts? First off (I’ve written about this before), buybacks are a massive tax-avoidance scheme. With dividends, all shareholders get income that they have to pay taxes on in full at the dividend/cap-gains rate (they’re currently the same). With a buyback, only the selling shareholders get cash, and they’re only taxed on the difference between their selling price and what they originally paid for the shares — their capital gains. Those de minimus taxes starve the beast — with the eternal right-wing goal of reducing government revenues so they can drown it in a bathtub.

So Judd Legum gets some excruciating details somewhat wrong, though the thrust is right. If firms get a tax cut, that straightforwardly benefits their (top-10%er) shareholders. The firms’ choice of distribution mechanism — dividends or buybacks — doesn’t change that. But with dividend distributions, at least more of that windfall government gift gets taxed back.

None of this addresses the other big issue with buybacks: price manipulation and “insider trading” by C-suiters. (Yet another big mechanism driving insane and increasingly concentrated wealth — The Great Satan.) I hope to come back to that issue in a future post.

Roth

I hope you do come back. I may be beginning to understand it the way you do.

But as for ” each remaining household that doesn’t sell back their shares holds a larger percent share of that smaller company — for net zero change in their assets.”…

i wonder…while this looks right from an accounting definitions aspect, that “smaller company” still has the same earning potential [actual earnings at least in the short run], and its prior cash assets were essentially dead money (?), so it looks to me like the remaining shareholders are effectively much “richer.”

>that “smaller company” still has the same earning potential… [so] the remaining shareholders are effectively much “richer.”

If the market agrees with that and bids up the company’s share prices, you are correct. A shareholder can’t sell “earnings potential” if they want to buy a new car or shift their portfolio to a different asset mix. They can only sell shares at current market prices.

Roth

i think the current market price includes an evaluation of earnings potential.

I don’t think corporate wealth is really household wealth if you consider where the money to pay for the buyback comes from and where the money goes.

Most households have very few shares of stock, but they contribute to corporate profits as workers and customers. When a company buys back its shares, it is using money that could have gone to higher wages, better benefits, research and development or lower prices. In fact, before corporate buyouts were legalized and when tax rates were much higher, that is often where the money would go.

Now, it mainly goes to a small group of shareholders who then have nowhere to invest it. Incomes aren’t rising except for a sliver of the population. Instead, the money is used to bid up asset prices. This works well for the few holding enough stock for it to make a difference and even better since the next buyout will be even more remunerative.

Most households just find themselves poorer since assets like housing have gotten more expensive and wages are depressed. It is also bad for the nation since it suppresses spending on meeting actual household needs and research and development for the future.

I retired back in the 1990s when I realized that the economic policies imposed in the 1980s eliminated investment opportunities. The proof was the rapid stock market recovery after the 1987 crash. People took their money out of the market, looked around for where to put it and then put it right back into the market. When there is nothing to invest in, people with money will buy stocks.

and still have nothing to invest in…mortgage backed securities anyone?

internet cat food?

>When a company buys back its shares, it is using money that could have gone to higher wages, better benefits, research and development or lower prices.

Sure. That is a possible (desirable!) counterfactual. Another is that they issue the money as dividends.

> mainly goes to a small group of shareholders who then have nowhere to invest it

Sure but that’s also true of dividend distributions. Levels of labor compensation and hence aggregate HH labor vs property income (about which you and I no doubt 90% agree) are really completely separate topic from they buyback-or-dividend conversation.

Putting aside price manipulation (as I do in this post), the big diff is that buyouts deny tax revenues to Treasury, so are pernicious in that much larger and more complex picture of how the pies (income and ultimately wealth from that) get divvied.

Understanding buybacks in a pre-Modigliani-Miller thinking: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4408581

Comments are most welcome!

Ben:

Welcome to Angry Bear. You are beyond my knowledge with your paper. I can see your points. Anyway, Steve may come by too.

Regards,

Thanks much, Itzhak. I’ve only read the abstract so far, but one Q right off:

“Managers” (how equivalent is that to “C-suiters”?) have (some) control over both the numerator and denominator of EPS: earnings, and # of shares outstanding. Does the paper offer (or do you yourself have) insights into the relative importance of those factors in managers’ decisions? I’ll try and get to your paper though it’s outside my normal realm, but any quick thoughts and insights would be welcome.