Claims of Student Loan Cancellation Benefiting the Wealthy are Still False

by Alan Collinge

Medium

A number of beltway “experts” are currently claiming that cancelling student loans would unduly benefit the wealthy. These claims are based upon blatantly flawed research, They have been used by very well-coordinated media/social media campaigns, designed to kill the push for student loan cancellation, and have flooded the zeitgeist in recent weeks.

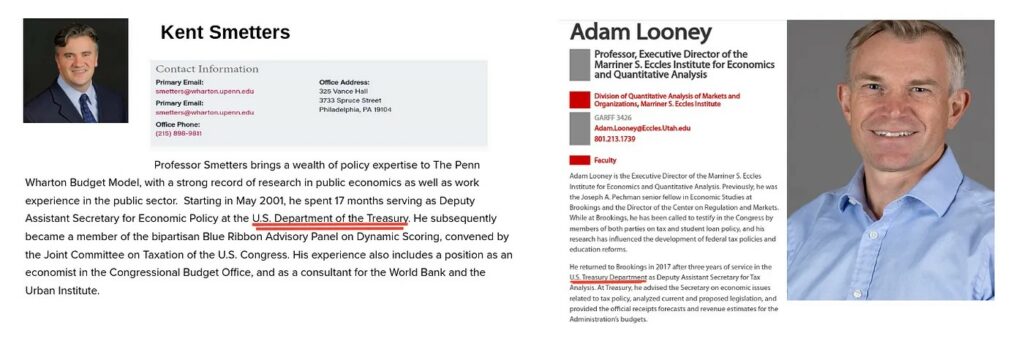

Most recently, Professor Kent Smetters (The Wharton School at the University of Pennsylvania) is making claims. Claims the beneficiaries of Biden’s new plan canceling interest for people in repayment for 20 or more years have on average, a household income of $312,000. Prof. Smetters also claims Biden’s current cancellation proposals will “cost” the taxpayers over $500 Billion (we will ignore that for now).

In 2022, Adam Looney (University of Utah), claimed a broad student loan cancellation would be regressive because student loan borrowers in the top 20% income bracket hold 30% of the debt. Looney also uses an example of a young, high-earning medical school graduate earning more than a young non-college graduate. He claims broadly cancelling loans would be unfair.

Very simple analysis of both of these claims, however, reveals that not only are they completely wrong, their analysis is deeply flawed, and badly misleading.

First the obvious:

- Wealthy people cannot get federal student loans. 100% of all borrowers had to prove financial neediness in order to get the loans.

- 40% of all borrowers never graduated.

- Tens of millions of borrowers went to trade schools and community colleges.

- Before the pandemic, 85% of all borrowers were either unable to make payments, or were paying but couldn’t pay enough to avoid an increasing loan balance. Furthermore, wealthy people don’t get behind on their debt.

- Today, 80% of all borrowers are unable to make payments. These, clearly, are not wealthy people.

Debunking Smetter’s Claim

Smetter’s claim the average household income of people in repayment of student loans for more than 20 years is $312,000 is not sourced. Wherever they may have pulled this assumption from, it flies in the face of the obvious:

People who were unable to pay down their student loans balance on student loans 20–25 years after leaving college clearly do not have incomes anywhere near $312,000. People with that level of income typically have no problems retiring their student debt. Typically, they do it in far less time than 20–25 years. They would not fall into the group of debtors that Smetters is pointing to.

Whatever earnings data Smetters might be cherry-picking to make this claim, it does not apply to student loan borrowers who have been underwater on their student loans for their entire adult lives. That he fails to source this income data is probably an indication he cannot support this claim.

We also dispel Stetter’s claim that Biden’s student loan cancellation proposals will cost the taxpayers hundreds of billions (or even trillions) of dollars here. In actuality, the true cost of these cancellations is essentially zero. Stetter is- unethically- conflating the cancellation of profit with true taxpayer cost.

Debunking Adam Looney’s Claim

Looney’s claim the student loan cancellation is “regressive” is similarly, and outrageously, false. By his own admission, the data he relied on, (voluntary survey data), was dicey at best. Adam’s own words:

“The sample is too small, 30 percent of aggregate student debt is missing and not accounted for, the value of debt is frequently missing and statistically imputed”.

Given financially distressed individuals (who tend to be lower-income) are far less likely than financially stable individuals (who tend to be higher-income) to fill out voluntary surveys. That 30% of the debt is unaccounted for raises a question of the accuracy of Looney’s top line claim the highest 20% of earners own 30% of the debt. It is dubious, at best.

But even accepting this suspicious claim implies directly that the bottom 80% of earners hold 70% of the debt. So by Looney’s own analysis, cancelling federal student loans will largely benefit the “un-wealthy”, and thus cannot be called regressive.

But what is far more important?

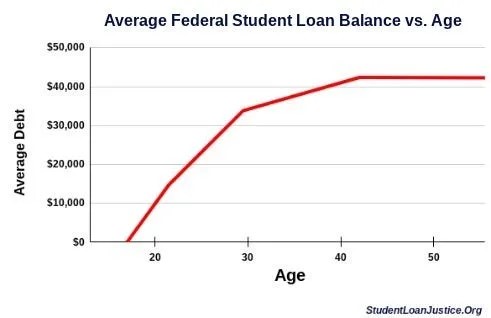

The highest balance student loan borrowers aren’t young people at all- they are older borrowers who, by and large, have been stuck with student loans for years or decades, and who now owe far more than younger people, despite having borrowed far less years or decades ago.

Statistically, this age group may have higher earnings. However, people with student loans who were unable to pay down (much less extinguish) their student loans over 20+ years clearly have an earnings deficiency. They earn nowhere near what both Smetters and Looney are claiming. People who do have earnings in line with these statistical averages typically are able to pay down/extinguish their loans in less than 20 years,. They have fallen out of this cohort of borrowers, leaving only lower income borrowers in the set.

Adam Looney is playing the same statistical trick as Smetters: Assuming- wrongly- that older, student loan borrowers who were unable to pay down their student loans over their adult lives have incomes consistent with the average for their age/Education (assuming that this is the sort of assumption they are making).

At best, this is academic laziness. At worst, it is ethical and moral bankruptcy and fraud. Whichever it is, the real harm these two men have caused with their research is unfathomably large, and ongoing:

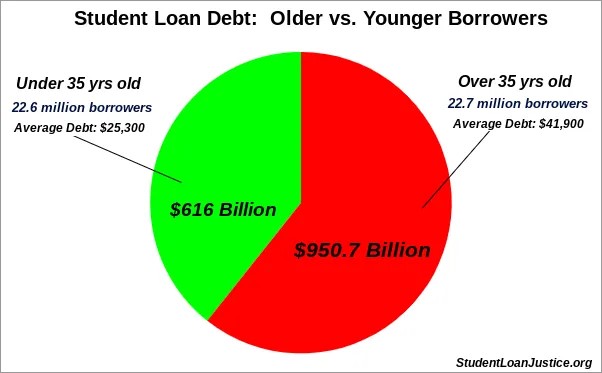

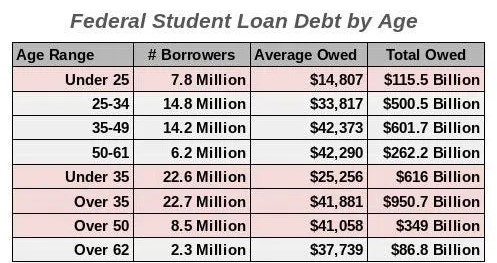

U.S. Department of Education (Q4 2020)

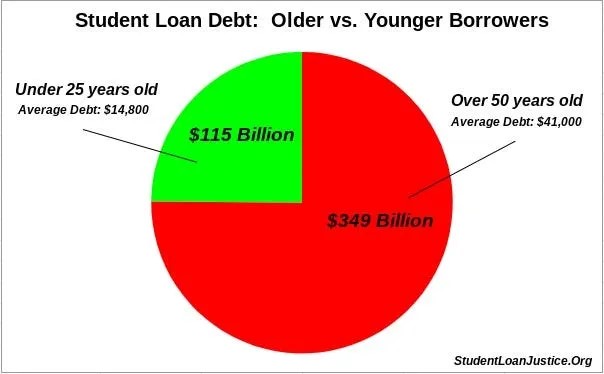

Interestingly, older borrowers now outnumber younger borrowers, both for the under/over 35 split, and the over 50/under 25 split. In both cases, the older borrowers owe far more than their younger counterparts, despite having borrowed far less.

U.S. Department of Education (Q4 2020)

U.S. Department of Education (Q4 2020)

U.S. Department of Education (Q4 2020)

Therefore, it is clear the “research” from both Adam Looney and Kent Smetters is flawed, unreliable, and misleading. That both of these men had careers at the U.S. Treasury Department is particularly disturbing. A bit of background on each author.

Why this is important?

The federal student loan system has failed by all rational metrics. Forty percent (40%) of all borrowers never graduated. Eighty percent (80%) were “underwater” on their loans even before the pandemic. During and before the pandemic, most student loan borrowers (64.3%) were not making payments at all. The default rate for 2004 students- who borrowed less than a third of what is borrowed today – is a whopping 40%. And Today? Eighty percent (80%) of all borrowers are unable to make payments on their student loans.

The lending system has failed, and no amount of beltway spin – even if/when orchestrated through the Treasury Department can make this not true.

The failure is a result of the wholesale removal of consumer protections from these loans. Bankruptcy protections and statutes of limitations have been stripped from federal student loans. The loans have also been stripped of Truth-in-Lending laws. They are not vulnerable to most Fair Debt Collection laws. Even state usury laws are not applicable to federal student laws. These losses of protection and a draconian collection regime serves to hyper-inflate loans with penalties, fees, etc. The results of which have pushed the loans and the lending system for them beyond the brink of legitimacy.

The Nation’s Founders called for uniform bankruptcy laws. This right must be immediately returned to all student loans. Biden should order the Department of Education to stop opposing student loan borrowers in bankruptcy court. Congress should immediately return bankruptcy to all student loans by passing both S.2598 and HR. 4907.

We believe Biden has the power to cancel all federally owned loans without congressional approval, appropriation, and without adding anything to the national debt. The President should exercise his loan cancellation authority and end this national threat of a lending program.

We can do better than this.

New Bankruptcy Process for Student Loans is Proving to be a Cruel, Dangerous Joke for Borrowers, Angry Bear, and Alan Collinge.

yes to the bankruptcy fix. this should have been unconstitutional from the onset.

and why would it be so hard to separate the wealthy…who presumably benefitted from their student loans….from the poor who did not, and may well have been victims of fraud as to the value of the “education” they were buying, as well as to the likelihood of their being able to pay it back?

and, if i read that right about some borrowers being in the demographic that has average incomes over 300k…the writers are committing statistical fraud and should have their educations revoked.

That’s what it’s all about these days, Dale, liars, damned liars, statisticians and lawyers: learn how to manipulate the system, break the law. No altruistic to it

If wealthy people getting loan cancellations is a problem, do what has been done for other benefits – determine what level of payment someone with that income should be able to make, and only cancel if their payments are above that. You could just reduce the debt to make their payment a reasonable amount for their income. Or you could just set a simple income threshold, no cancellation if you make more than X dollars. That is even a more common way to restrict benefits.

While you are at it, start clawing back money from wealthy people who got Covid relief. Just the ones who did not follow the rules would get some money back.