New home sales and YoY prices change little; expect sideways trend to follow similar recent trend in mortgage rates

New home sales and YoY prices change little; expect sideways trend to follow similar recent trend in mortgage rates

– by New Deal democrat

This week we conclude January’s housing market data with repeat sales prices tomorrow, and new single family home sales, which were reported this morning.

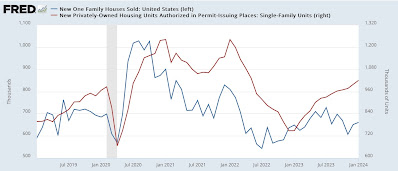

Per my usual caveat, while new home sales is that they are the most leading of the housing metrics, they are noisy and heavily revised. Which was the case this month, as last month’s number was revised downward by about 2%, or 13,000. January sales increased 10,000 from that revised number (blue in the graph below) to 661,000 annualized. The slightly less leading but much less noisy single family permits is also shown (red, right scale):

The likelihood is that single family permits will stall out at current levels and quite likely even decline in coming months, following the recent downward trend in sales.

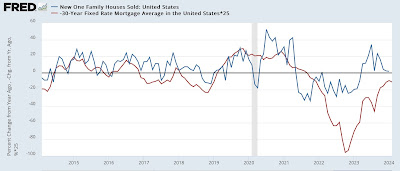

Now let’s compare sales with the even more leading metric of mortgage rates. Both are shown YoY (rates inverted, and *25 for scale):

We are unlikely to see much more YoY improvement in new home sales. Since one year ago they stood at 649,000, this suggests their current absolute level is about where they are likely to remain in the next few months.

Finally, here’s the YoY update on median prices, which are not seasonally adjusted (red), which lag sales (blue):

We will probably continue to see negative YoY comparisons in prices for some months to come before the situation abates.

Generally speaking I am not expecting much in the way of big moves in new home sales or prices until there is a significant change in mortgage rates.

New home sales: if you lower prices, they (buyers) will come, Angry Bear by New Deal democrat